By Coinrule

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

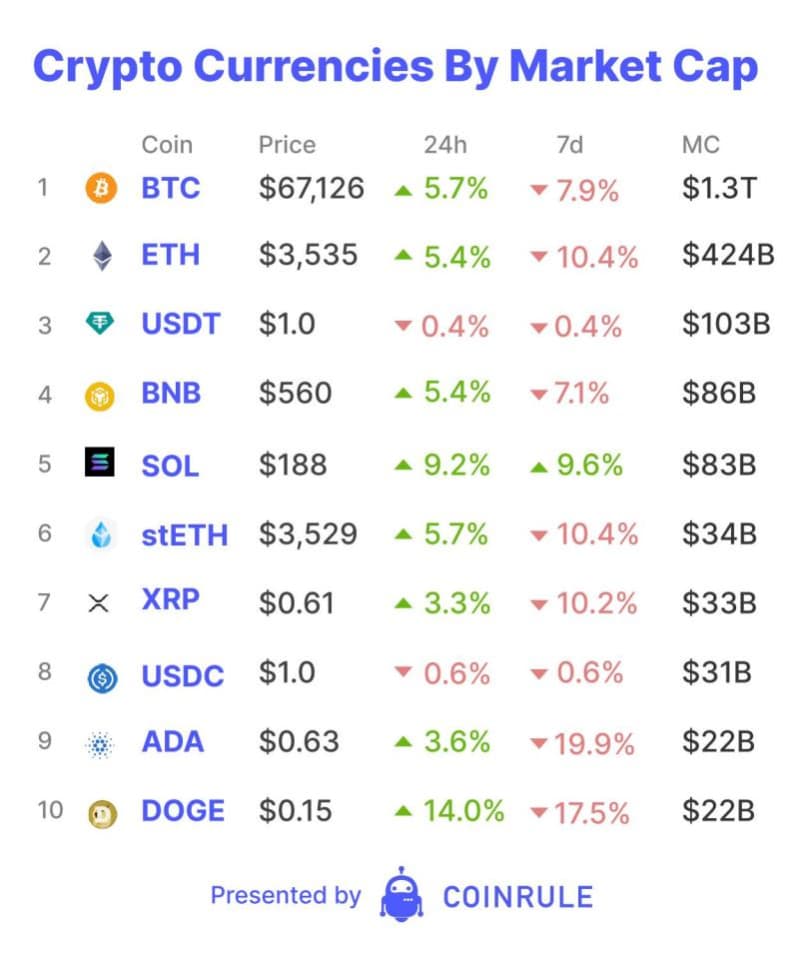

On Wednesday, the market made a strong reversal, as the Federal Reserve maintained interest rates at 5.25%-5.50%. However, ETF investors were not convinced. Net outflows for Wednesday stood at $261 million – the third day in a row of outflows. BlackRock’s IBIT maintained its undefeated inflow streak but experienced its second lowest daily inflows of $49.2 million. Even with this week’s outflows, the market showed it does not have to rely on the ETF flows to have a good time.

Last week, we saw the introduction of Ethereum’s Dencun upgrade. This reduced transaction costs on Ethereum’s Layer 2s, namely Arbitrum, Optimism and Base. Throughout the correction, one of these chains showed no sign of giving in to the market’s direction with volumes and total value locked (TVL) reaching record highs. That chain was Base. According to DeFiLlama, over the past week, only two chains within the 11 highest TVL had positive growth. Unsurprisingly, the first is Solana with just over 9%. The second was Base, also over 9% growth, leading to a new TVL high of $770 million. On Wednesday, Base’s volume was the sixth highest out of all chains, reaching a new high of over $370 million.

Base still has a mountain to climb to reach Solana’s $4+ billion of TVL and $2+ billion of volume. However, Base may have a card up its sleeve. Coinbase has been developing their “Smart Wallet” and will make it available for all decentralised applications (dApps) that implement it. It will allow Coinbase’s 100 million registered users to operate on-chain without having to deal with the responsibility of seed phrases that often scare away new participants. With passkeys, users will be able to connect to dApps and use their Coinbase account balances to fund their on-chain activities. This could see a new wave of Coinbase users come on-chain, with Base potentially being their first stop. But first, Base needs to expand its dApp offering.

The recent volume surges in Base and Solana have acted as stress-tests. Both chains have experienced congestion with transactions failing and gas fees increasing. On Wednesday, transactions on Coinbase and Coinbase wallet were also failing due to the increased usage on Base. If Coinbase wants Base to rival the likes of Solana, scaling solutions within Coinbase will be required to prevent further issues. Even if onboarding is easier, failing transactions are a big barrier to 100 million users coming on-chain. However, if anyone can pull it off, it is likely Coinbase.