Financial giants have made a conspicuous bearish move on ConocoPhillips. Our analysis of options history for ConocoPhillips (NYSE:COP) revealed 12 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 75% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $366,960, and 10 were calls, valued at $690,142.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $135.0 for ConocoPhillips over the last 3 months.

Volume & Open Interest Trends

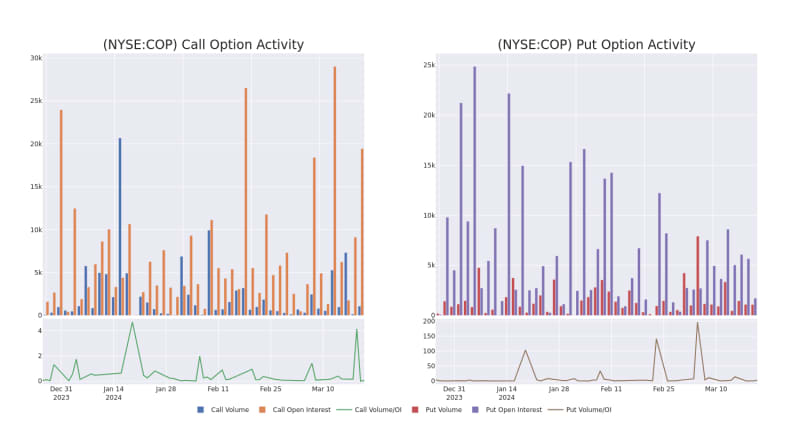

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ConocoPhillips's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ConocoPhillips's significant trades, within a strike price range of $90.0 to $135.0, over the past month.

ConocoPhillips Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

About ConocoPhillips

ConocoPhillips is a U.S.-based independent exploration and production firm. In 2022, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2022 were 6.6 billion barrels of oil equivalent.

Having examined the options trading patterns of ConocoPhillips, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of ConocoPhillips

- With a trading volume of 4,924,198, the price of COP is down by -0.39%, reaching $123.03.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 41 days from now.

Professional Analyst Ratings for ConocoPhillips

2 market experts have recently issued ratings for this stock, with a consensus target price of $136.0.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for ConocoPhillips, targeting a price of $133.

- An analyst from Mizuho has revised its rating downward to Neutral, adjusting the price target to $139.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ConocoPhillips options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.