Investing in quality growth stocks is a popular strategy on Wall Street. Typically, growth stocks tend to deliver outsized gains during bull markets, but they're just as likely to pull back significantly when sentiment turns bearish. So, if you are an investor with a higher risk appetite who has the ability to weather some higher-than-normal volatility, here are three “strong buy”-rated growth stocks to scoop up right now.

1. Viking Therapeutics Stock

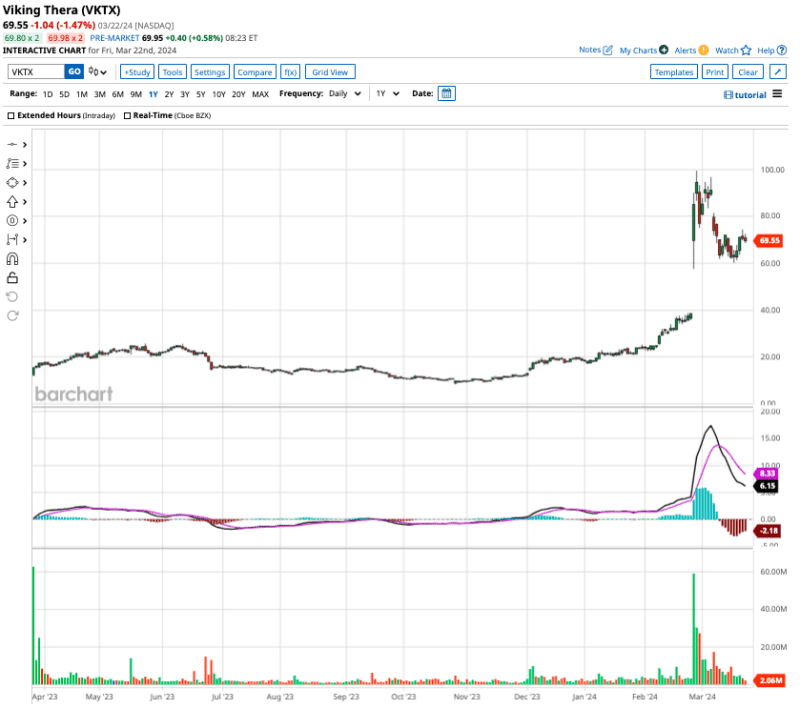

Valued at $7.5 billion by market cap, Viking Therapeutics (VKTX) has surged close to 700% in the last year. The primary reason for its stellar returns is speculation around the company’s upcoming weight-loss drug, which is in the clinical trial stage.

As a pre-revenue company, Viking Therapeutics does not have any approved products right now, which makes it a high-risk investment. However, the trial results for its weight loss drug, VK2735, have been encouraging so far. Data from its Phase 2 trial showed patients taking the drug lost roughly 15% of their body weight after 13 weeks of treatment.

Despite its enviable returns, VKTX stock trades at a massive discount to consensus price target estimates. Out of the 10 analysts covering VKTX stock, nine recommend “strong buy,” and one recommends “moderate buy.” The average target price for the stock is $106.22, indicating an upside potential of over 52% from current levels.

2. Cipher Mining Stock

A bitcoin mining company, Cipher Mining (CIFR) stock has more than doubled in the past year due to rising BTC prices. Similar to other BTC miners, Cipher Mining’s share price is tied to bitcoin (BTCUSD). The digital asset has gained significant momentum due to the launch of multiple spot BTC exchange-traded funds, which is viewed as a key driver of retail investor adoption in the U.S.

Valued at $1.37 billion by market cap, Cipher Mining reported adjusted earnings of $27.8 million and revenue of $126.8 million in 2023. It increased its hash rate to 7.4 EH/s (exahashes per second) in Q1 of 2024, and is on track to end the year with 9.3 EH/s.

Out of the seven analysts covering CIFR stock, five recommend “strong buy,” one recommends “moderate buy,” and one recommends “hold.” The stock has rallied sharply today to trade above its average target price of $5, though it's got room to climb about 13.4% to the Street-high price target of $6.00.

3. Zscaler Stock

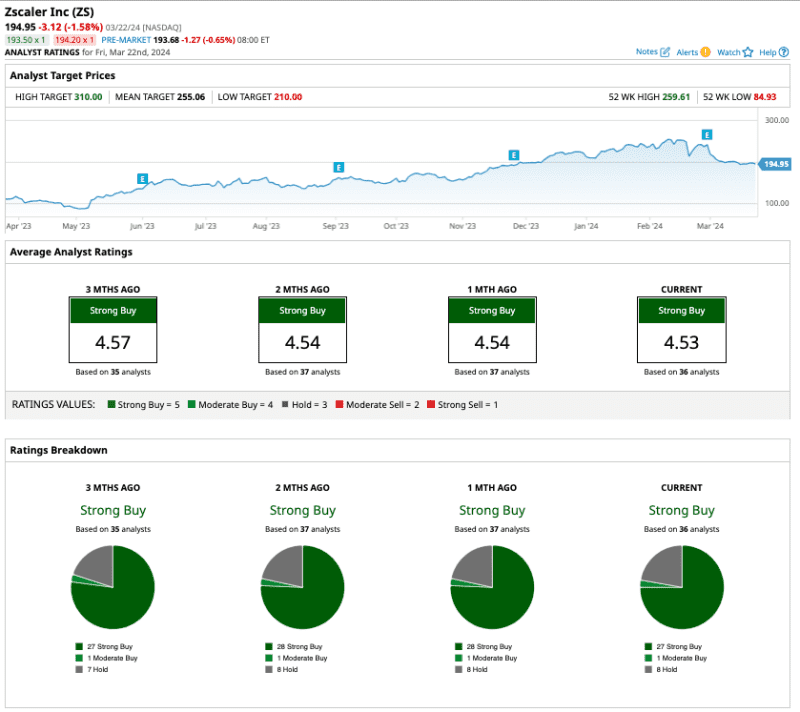

The final growth stock on my list is Zscaler (ZS), a cloud-based internet security platform valued at a market cap of $29 billion. Zscaler is among the leading developers of zero-trust technology, which prevents hackers from accessing corporate networks.

While several tech stocks are trading near all-time highs, Zscaler is down over 48% from record levels, allowing you to buy the dip.

In fiscal Q2 of 2024 (ended in January), Zscaler said its customer base has grown to 7,700 which includes 40% of Fortune 500 companies. Further, around 2,820 customers spent at least $100,000 annually on the Zscaler platform, an increase of 21% year over year. The number of customers spending over $1 million also grew by 31% in Q2.

A higher customer engagement rate allowed Zscaler to report revenue of $525 million in fiscal Q2, an increase of 35% year over year. Its net losses also narrowed by 50% to $28.5 million.

Out of the 36 analysts covering ZS stock, 27 recommend “strong buy” and one recommends “moderate buy,” while eight recommend “hold.” The average target price for the stock is $255.06, about 31.5% higher than current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.