Artificial intelligence (AI) stocks have dominated the investment space over the past years, and the outsized share price surges of industry frontrunners like Nvidia Corp (NVDA) have recently started to prompt cautious sentiment among some market observers. However, according to Goldman Sachs (GS) analysts, the AI industry is still poised for significant growth and evolution. While Nvidia is leading the first wave, Goldman says there are three additional stages yet to come, with each offering unique investment opportunities.

AI software is revolutionizing industries worldwide with cognitive abilities, such as learning, reasoning, and problem-solving. Rapid technological advancements and widespread adoption across diverse industries set the stage for significant growth within the AI software market, which is projected to reach $1.09 trillion by 2032, registering a 23% compound annual growth rate (CAGR).

Goldman Sachs believes software companies - such as Autodesk, Inc. (ADSK) \- fit the criteria for what it considers “Phase 3” of the AI trade. This phase centers around companies that can benefit from integrating AI into their products, and includes a number of software and services names.

About Autodesk Stock

Based in San Francisco, Autodesk (ADSK) offers global 3D design, engineering, and entertainment technology solutions. As such, AI advancements hold the potential to enhance the utility of its software and expand market opportunities for the graphic software company through accelerated workflows. Its market cap currently stands at $55.9 billion.

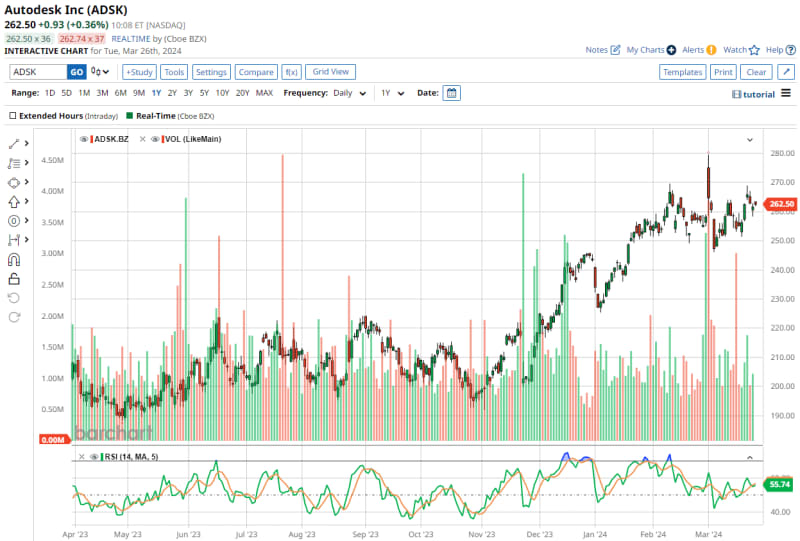

Autodesk stock has gained 7.7% on a year-to-date basis, and is up just over 30% in the past 52 weeks. ADSK is lagging the S&P 500 Index ($SPX) slightly over both time frames, which supports the idea that the stock still has room for multiple expansion as it capitalizes on AI advancements.

The stock is currently priced at 49.47 times forward earnings and 9.26 times forward sales. These premiums are relatively high compared to rival software stocks like Adobe (ADBE) and Trimble (TRMB), but both metrics represent a discount to ADSK’s own five-year average valuation multiples.

Analysts anticipate a 23.7% rise in the company's EPS this fiscal year, followed by approximately 17% growth in fiscal 2026.

Autodesk's Q4 Revenue and Earnings Beat Wall Street Estimates

Autodesk shares jumped in late February following the company’s Q4 results, with revenue of $1.47 billion and adjusted earnings of $2.09 per share both exceeding analysts' estimates. Sales of AutoCAD and AutoCAD LT, the company’s flagship software design product, rose by 7% on a constant currency basis.

More specifically, investors were encouraged by the company’s upbeat revenue guidance. Autodesk forecasts revenue between $1.38 billion and $1.40 billion for fiscal Q1, while fiscal 2025 sales are projected between $5.99 billion and $6.09 billion. The full-year forecast edged past Wall Street’s consensus.

On the earnings call, CEO Andrew Anagnost explained, “it's our intent to be the market leader in generative AI, just like we were in generative design over 10 years ago… we've been delivering AI in our products for several years now -- we just released drawing automation into Fusion, which allows people to automate manufacturing drawing stacks, which is a very labor-intensive effort, and it's a high productivity driver for our customers.”

How High Do Wall Street Analysts Expect Autodesk Stock to Rally?

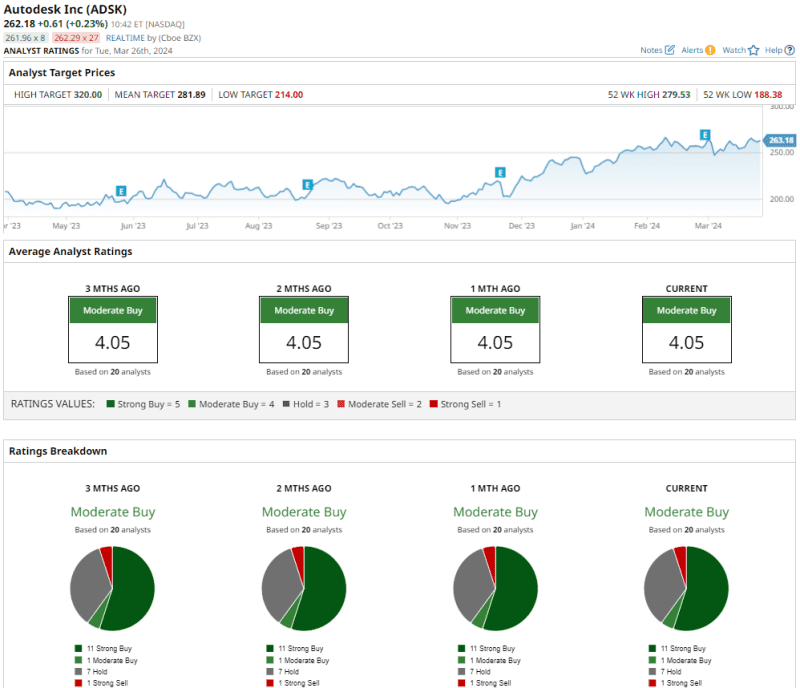

Following its Q4 results, the stocky received a number of bullish reiterations from Wall Street analysts. Overall, Autodesk stock has a consensus "Moderate Buy" rating. Out of the 20 analysts offering recommendations for the stock, 11 rate it a "Strong Buy," one advises a "Moderate Buy," seven say it’s a "Hold," and one suggests a "Strong Sell."

The average analyst price target for Autodesk is $281.89, indicating a potential upside of 7.4%. However, the Street-high price target of $320 - shared by analysts at KeyBanc and RBC - suggests the stock could rally as much as 21.8% from current levels.

The Bottom Line on ADSK Stock

Autodesk is poised for substantial growth in the burgeoning AI market, as it leverages AI to boost customers' work efficiency. However, Autodesk must cautiously leverage AI's potential to maintain market leadership and investor trust, while guarding against losing clientele to AI-powered alternatives.

That said, the recent pullback off the stock's YTD highs presents an enticing investment opportunity for investors seeking out AI stocks to buy right now.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.