Investors with a lot of money to spend have taken a bearish stance on Cytokinetics (NASDAQ:CYTK).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CYTK, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 26 uncommon options trades for Cytokinetics.

This isn't normal.

The overall sentiment of these big-money traders is split between 23% bullish and 76%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $318,520, and 21 are calls, for a total amount of $2,537,633.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $115.0 for Cytokinetics over the recent three months.

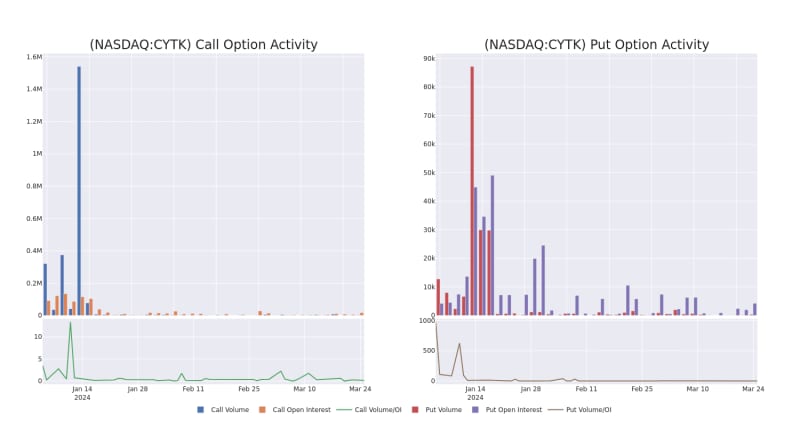

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Cytokinetics's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cytokinetics's whale activity within a strike price range from $60.0 to $115.0 in the last 30 days.

Cytokinetics Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

About Cytokinetics

Cytokinetics Inc is a biotechnology company that develops muscle biology-driven treatments for diseases characterized by reduced muscle function, muscle weakness, and fatigue. The company develops treatments for diseases such as amyotrophic lateral sclerosis, heart failure, spinal muscular atrophy, and chronic obstructive pulmonary diseases. The treatment is based on small molecules specifically engineered to increase muscle function and contractility. The company is developing muscle-directed investigational medicines that may potentially improve the health span of people with devastating cardiovascular and neuromuscular diseases of impaired muscle function.

In light of the recent options history for Cytokinetics, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Cytokinetics Standing Right Now?

- With a trading volume of 3,998,600, the price of CYTK is up by 3.52%, reaching $71.15.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 37 days from now.

Expert Opinions on Cytokinetics

5 market experts have recently issued ratings for this stock, with a consensus target price of $97.0.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $108.

- An analyst from Mizuho has decided to maintain their Buy rating on Cytokinetics, which currently sits at a price target of $99.

- An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $94.

- An analyst from JP Morgan persists with their Overweight rating on Cytokinetics, maintaining a target price of $77.

- Reflecting concerns, an analyst from Oppenheimer lowers its rating to Outperform with a new price target of $107.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cytokinetics with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.