By Chris Dorrell

June is looking an increasingly likely date for the Bank of England to start cutting interest rates, but one thing which could force the Bank to wait a little longer is the coming increase in the minimum wage.

From April, the minimum wage will rise from £10.42 per hour to £11.40, an increase of 9.4 per cent. While this is a big increase, it follows a previous increase of 9.7 per cent in April last year.

There are fears that this hike could keep wage growth at elevated levels, just as the Bank prepares to ease the cost of borrowing. Higher wage growth could in turn prompt another round of price increases, particularly if firms are less able to absorb the extra costs than last year.

Rain Newton-Smith, director general of the Confederation of British Industry (CBI), has warned that “more members than ever are telling us they’re worried about the increase next month”.

“We’ve heard from a lot of businesses that they’re really challenged by this because its two years in a row,” Neil Carberry, chief executive of the Recruitment and Employment Confederation (REC), told City A.M.

“We’re being told there’s no margin left to squeeze here,” he added.

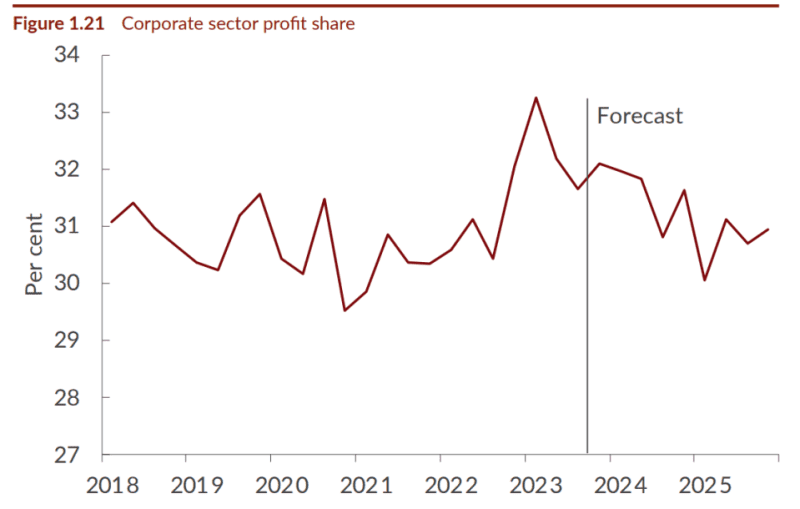

According to the National Institute for Economic and Social Research (NIESR), in the first quarter of 2023 corporate profit margins hit their highest level in almost a decade. However, there was a “significant erosion” of margins in the second half of last year as workers bargained for higher wages.

This means firms may be “less able to absorb the increased costs,” economists at the think tank said.

According to a March survey from the Office for National Statistics, 21.5 per cent of businesses that are considering raising prices said that labour costs was the primary reason, the highest of any factors.

It’s not just that wages will go up for people earning the minimum wage. While only five per cent of workers are paid at or below the new level of minimum wage, a further 12 per cent of workers are paid up to £1 above it, according to the Low Pay Commission.

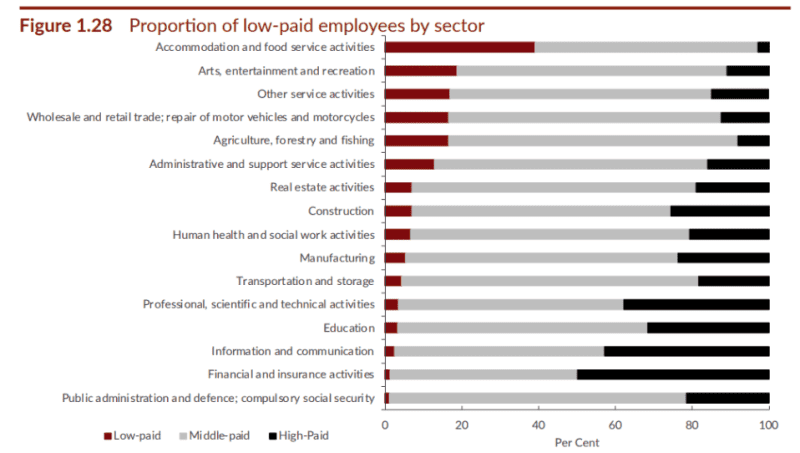

Surveys suggests businesses will also have to increase pay further up the ladder to maintain pay differentials. Businesses, particularly in consumer facing firms in the service sector, will come under pressure to give all of these workers a pay hike too.

“CBI members tell us that the forthcoming rise is spurring demands for equivalent pay rises from other areas of their businesses and is pushing them to up wages along the pay scale to ensure that higher responsibilities are appropriately rewarded,” Anna Leach, deputy chief economist at the CBI, told City A.M.

“CBI members tell us that the forthcoming rise is spurring demands for equivalent pay rises from other areas of their businesses and is pushing them to up wages along the pay scale to ensure that higher responsibilities are appropriately rewarded.”

So the minimum wage increase will definitely put up costs for firms, particularly in the accommodation and retail sector. But on an economy-wide level, the impact looks like it will be manageable.

Analysis by the Bank suggests that the April increase in the minimum wage, could push up aggregate pay growth by around 0.3 percentage points. Capital Economics expect it will add twice as much, but still think the inflationary impact will be limited.

This is because firms could respond to higher costs in a range of different ways. The Bank of England’s agents survey suggests businesses will manage the increase by “eroding differentials and/or reducing headcount or hours” as much as by passing on higher costs to consumers.

Even when costs were passed onto consumers, the survey noted that this was “usually only partially”.

Rather than raise prices, Tina McKenzie, policy chair at the Federation of Small Businesses, said firms will likely cut staff and scale back expansion plans.

“We’ve seen 16 per cent of small firms predict they’ll have to make redundancies, while 35 per cent anticipate cancelling or scaling down plans for investing and expanding in their business – highlighting a culture of caution,” McKenzie told City A.M.

None of these are necessarily desirable, but it will at least limit the inflationary impact.

While the exact impact of the minimum wage hike will only become clear further down the line, the inflationary risk it presents poses at least one potential challenge to the Bank as it looks to bring inflation back down to target.