Washington (AFP) - US private sector hiring came in well above expectations last month, payroll firm ADP said Wednesday, with construction, financial services and manufacturing all contributing to the increase.

Private sector employment rose by 184,000 in March, ADP said in a statement. This was sharply above market predictions of 150,000 new jobs, according to Briefing.com.

ADP also revised up the February jobs data, from 140,000 to 155,000.

The hot jobs data will be well-received by the Biden administration as it seeks to talk up the president's economic record ahead of November's presidential election.

But it also signals to the Federal Reserve -- which is locked in a years-long battle against high inflation -- that the labor market remains in a good place, reducing the likelihood of an early start to interest rate cuts.

"March was surprising not just for the pay gains, but the sectors that recorded them," ADP chief economist Nela Richardson said in a statement.

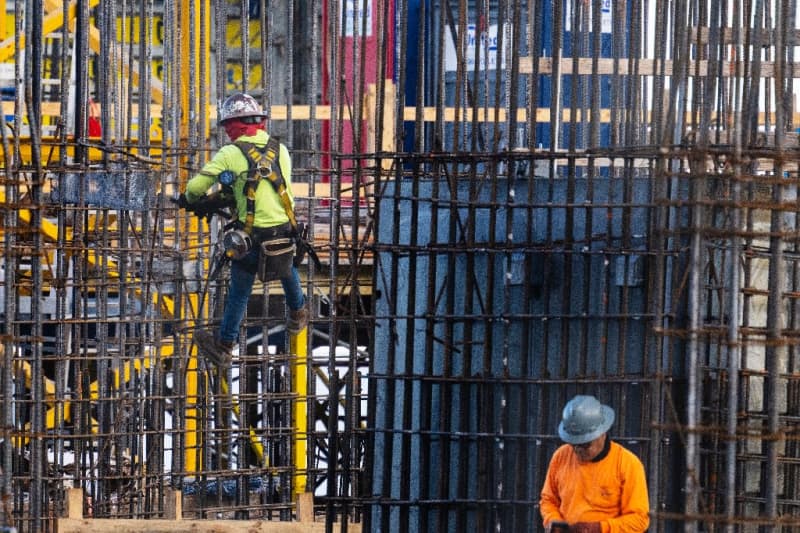

"The three biggest increases for job-changers were in construction, financial services, and manufacturing," she added.

The construction sector created 33,000 new jobs, buoyed by recent industrial policies like the 2022 Inflation Reduction Act, while the financial services sector added 17,000 new positions, and manufacturing was responsible for 1,000 jobs.

Other sectors that created large numbers of new positions included the leisure and hospitality sector, the trade, transportation and utilities.

ADP's data showed that pay was up 5.1 percent year-over-year for those who remained in their jobs, and by 10.0 percent for those who switched.

"Inflation has been cooling, but our data shows pay is heating up in both goods and services," Richardson said.

ADP's figures come two days ahead of US government data on US hiring, which will help to paint a clearer picture of the health of the overall labor market.

"Our base case remains that the labor market is likely to loosen on the effects of restrictive monetary policy," High Frequency Economics chief US economist Rubeela Farooqi wrote in a note to clients after the ADP data were published.

"But we expect job growth to remain positive and expect the unemployment rate to remain low, as monetary conditions become less tight on Fed rate cuts this year," she added.