In a mid-January 2024 Barchart article on grains, I wrote:

After falling from the 2022 highs, grain prices could rally over the coming months as uncertainty over the 2024 crop year’s output peaks in spring. Now could be the perfect time to begin building long positions. However, the trend is always your best friend in any market, and it remains bearish for most agricultural commodities. Therefore, leave plenty of room to add on further declines as prices tend to fall to levels that defy rational, logical, and reasonable levels during bearish trends.

The ongoing war in Ukraine and the uncertainty over the 2024 crop are compelling reasons to add grains and oilseeds to your portfolio. Based on the price action over the past years, the current price levels could limit downside risks, with the potential for explosive gains.

Grain prices have moved primarily lower since January 15, which allowed for building long positions going into the 2024 crop year. In early April, farmers are planting the seeds that will feed and increasingly power the world after the fall harvest. The grain composite declined 7.56% in Q1 2024.

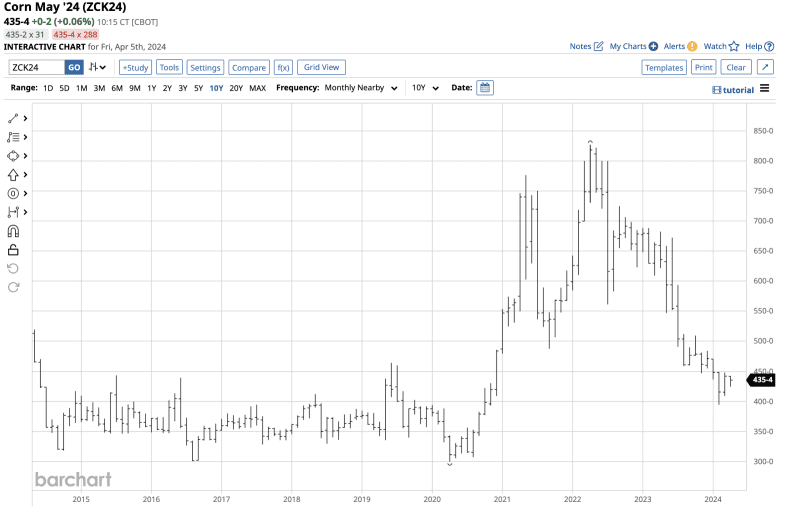

Corn declines

After a 30.55% decline in 2023, the continuous CBOT corn futures contract dropped another 6.21% in Q1 2024.

As the monthly chart highlights, corn futures settled at $4.42 per bushel on March 29, 2024, and were at the $4.3550 level on April 5 as the selling continued in early Q2.

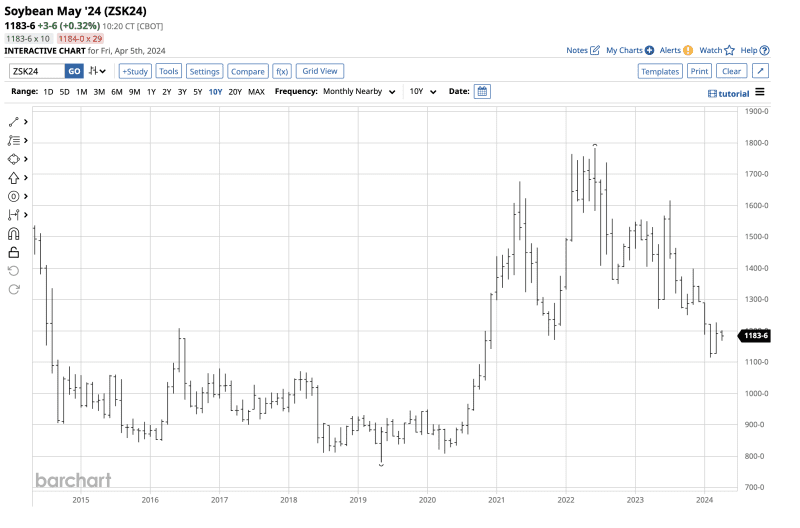

Soybeans fall- Meal declines, while oil edges marginally higher

After a 14.86% decline in 2023, the continuous CBOT soybean futures contract fell another 7.89% in Q1 2024.

The monthly chart illustrates that nearby soybeans futures settled at $11.9150 at the end of March 2024 and were below the $11.8375 level on April 5.

Soybean products, meal, and oil were 19.33% and 25.03% lower, respectively, in 2023. In Q1, meal fell another 12.51%, while the oil was only 0.23% higher. The slight gain in the oil was due to a 3.71% gain in heating oil futures. Soybean oil is a primary ingredient in biodiesel, an alternative distillate fuel.

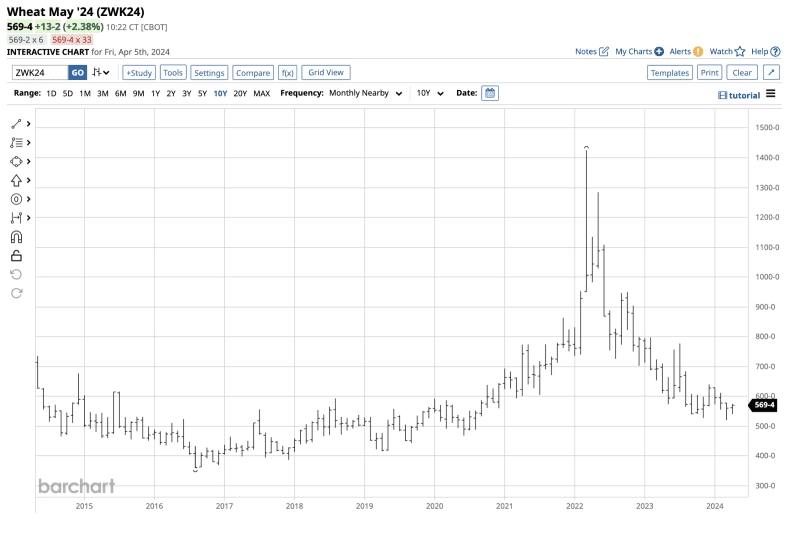

Wheat prices drop

CBOT soft red winter wheat futures fell 20.71% in 2023 and experienced another 10.79% decline in Q1 2024.

As the monthly chart shows, CBOT wheat futures settled at $5.6025 per bushel on March 29, 2024, and were slightly higher at the $5.6950 level on April 5.

Meanwhile, KCBT hard red winter wheat fell 27.70% in 2023 and was 8.84% lower in Q1, settling at $5.8525 at the end of March. MGE spring wheat futures fell 22.96% in 2023, and moved 10.82% lower in Q1, with the price at $6.45 per bushel on March 29. KCBT and MGE wheat prices were steady compared to the Q1 2024 closing level on April 5.

Lower prices for oats and rice

Nearby oat futures bucked the trend in grains last year with a 5.04% gain. However, oats fell 7.45% in Q1, settling at the $3.57 per bushel level. Oat futures were lower in early April.

Illiquid rough rice futures, which trade by appointment, fell 4.13% in 2023 and dropped another 5.46% in Q1, settling at the $16.36 per hundredweight level. Rough rice futures were lower on April 5, just under the $16.20 level.

Q2- Mother Nature is now in charge- Europe’s breadbasket remains a lurking bullish factor

As the grains and oilseed futures market moves into Q2 2024, northern hemisphere farmers are planting the crops that will grow into the agricultural products that feed and power the world. While the trends remain bearish in early April, the weather across the fertile northern hemisphere plains will determine the path of least resistance of prices.

The ongoing war in Europe’s breadbasket will continue to be a significant factor for worldwide supplies and prices. Growing regions in Russia and Ukraine remain battlefields, and the critical logistical Black Sea ports are still a warzone in early April. Prices have dropped to attractive levels, as geopolitics and the uncertainty of weather conditions could mean the downsides are limited, and there is plenty of room for price recoveries in Q2.

While the most direct route for exposure is the futures arena, Teucrium’s CORN, WEAT, and SOYB ETF products track a portfolio of the CBOT corn, wheat, soybean, and futures contracts.

More Grain News from Barchart

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.