By Jess Jones

The so-called Magnificent Seven technology companies, Microsoft, Meta, Amazon, Nvidia, Apple, Google owner Alphabet and Tesla are all worth over a trillion dollars. And combined, they are worth more than $14 trillion, making up around 30 per cent of the S&P 500’s market cap.

In the first quarter of the year, five of the seven beat the market.

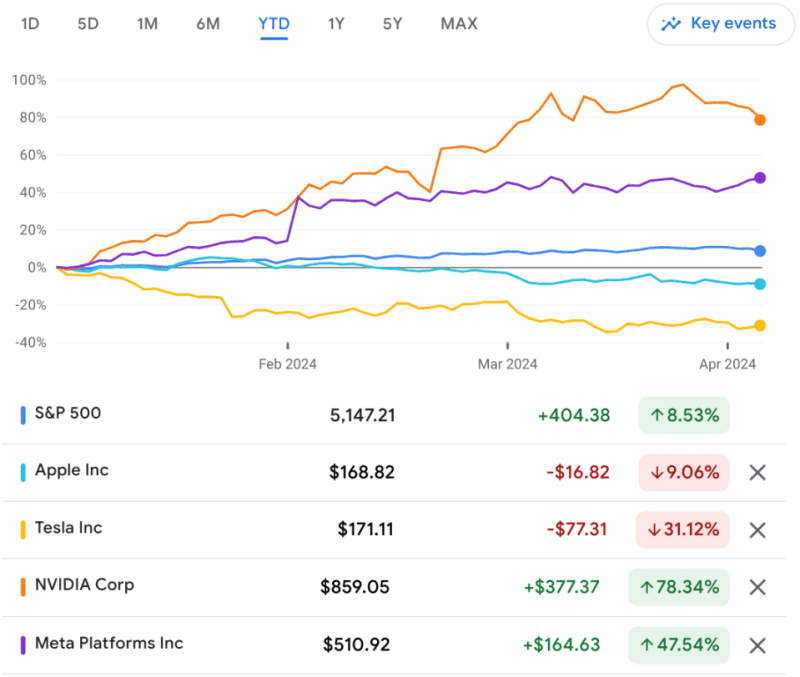

The S&P 500, which tracks the stock performance of 500 of the largest companies listed on US exchanges, has risen over nine per cent since the start of the year.

Compared to this, Nvidia has climbed about 82 per cent, Meta 50 per cent, Amazon 23 per cent, Microsoft 14 per cent and Alphabet, which owns Google, 10 per cent.

But Apple is down roughly nine per cent since year to date, while Tesla has tanked over 30 per cent.

This graph shows how the two best performing and two worst performing Magnificent Seven stocks compare to the S&P 500 since the start of January 2024:

Why have Tesla and Apple stooped into the red?

Unlike their rivals, Tesla and Apple have fallen so far this year. Both have failed to meet analyst forecasts and have suffered at the hands of Chinese and Korean competitors.

Earlier this week, Elon Musk’s electric car company posted a drop in quarterly sales, missing the consensus Wall Street estimate of 449,080 deliveries by more than 62,000, its largest margin to date.

Investors will be aware that Tesla has fallen short of revenue forecasts in five out of the last six quarters. The company got off on a bad food in January when Chinese automotive firm BYD overtook it as the world’s most popular electric vehicle (EV) manufacturer. To compete with BYD’s aggressive pricing strategy, Tesla cut its average selling prices but this may have worsened investor jitters.

Since then it has just got worse for the firm, which is also struggling with supply chain issues for its Cybertruck that is yet to turn a profit. On Wednesday, hedge fund manager Per Lekander, who has been shorting Tesla since 2020, told CNBC the stock could tumble to $14 and the company “go bust”.

Apple similarly limped into 2024 with concerns over weak iPhone sales leading totwo downgrades in just one week, sending the stock to an eight week low.

In February, the Cupertino-headquartered tech giant forecast a $6bn revenue decline due to lower than expectedsales in China, which led to a bearish outlook from analysts and has further dampened investor sentiment. Smartphone manufacturer Huawei is gaining ground on Apple amid a Chinese government crackdown on foreign-made devices.

Apple is also facing investor anger over its lack of transparency around artificial intelligence (AI). While Meta and Alphabet have been particularly talkative about the technology, Apple has shied away the topic despite two major shareholders trying to squeeze information out of them.