In the latest quarter, 4 analysts provided ratings for Fluor (NYSE:FLR), showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

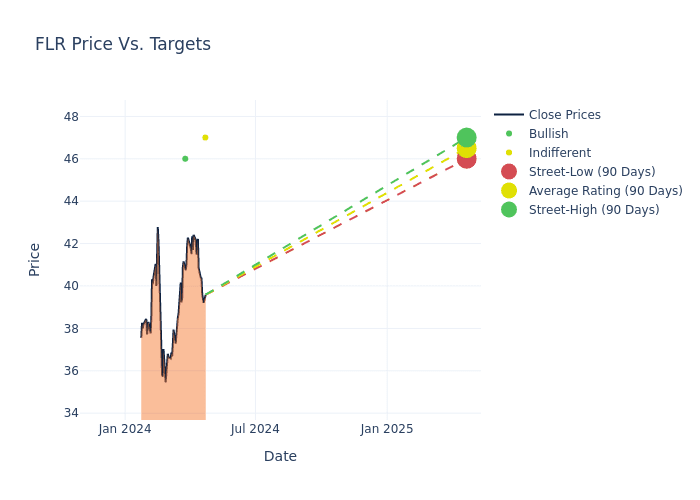

Analysts have recently evaluated Fluor and provided 12-month price targets. The average target is $46.0, accompanied by a high estimate of $47.00 and a low estimate of $45.00. This upward trend is evident, with the current average reflecting a 3.37% increase from the previous average price target of $44.50.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive Fluor. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Fluor. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Fluor compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Fluor's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Fluor's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Fluor analyst ratings.

Get to Know Fluor Better

Fluor is one of the largest global providers of engineering, procurement, construction, fabrication, operations, and maintenance services. The firm serves a wide range of end markets including oil and gas, chemicals, mining, metals, and transportation. The company's business is organized into three core segments: urban solutions, mission solutions, and energy solutions. Fluor generated $15.5 billion in revenue in 2023.

Key Indicators: Fluor's Financial Health

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Fluor's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 2.96%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Fluor's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -0.58%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Fluor's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -1.15%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Fluor's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -0.31%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.6.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for FLR

View More Analyst Ratings for FLR

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.