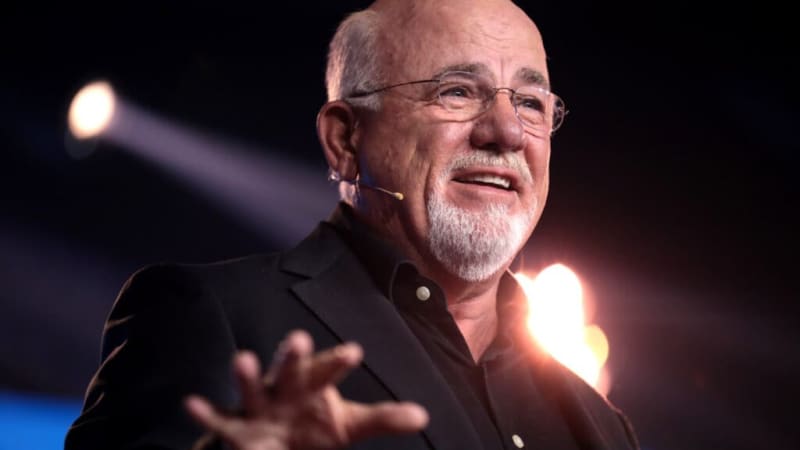

For many people, having a 401(k) savings plan means having access to money in the event of emergencies or unplanned big expenses. However, finance guru Dave Ramsey warns people to resist the temptation of cashing out their 401(k)s, and here's why.

Because a 401(k) retirement lets you invest a portion of your paycheck before taxes, by the time most people retire, there will be a decent amount of money for them to retire on if they haven't cashed out that money before then.

Don't Miss:

- The average American couple has saved this much money for retirement —How do you compare?

- Can you guess how many Americans successfully retire with $1,000,000 saved?The percentage may shock you.

Ramsey advises against the temptation of withdrawing funds from your 401(k) retirement plan to fund your kitchen remodel, student loans or your child's dream wedding. He said that dipping into your retirement money can have negative effects like "taxes and withdrawal penalties, but you'll also miss out on the long-term benefit of compound growth."

According to a Bankrate survey, 51% of Americans who have retirement plans have withdrawn money early.

Generally, most 401(k) plans allow account holders to withdraw up to 50% of the account value up to $50,000, making it tempting to pay for big things like weddings or college tuition. The most common reason people withdraw money early from their 401(k)s is to fund life events like college funds, medical expenses, wedding expenses and paying off debt.

Ramsey strongly advises against using a 401(k) plan as a consolidation loan because 88% of people who take out these loans have their debt return. You'll also miss out on contributing to your 401(k) while you're busy paying back the loan, leaving you back at square one and putting your retirement fund at risk.

Trending: If the United States had access totoday’s high-yield savings accounts rates in 2015, it wouldn’t need to save another penny.

Many people think that it's OK to withdraw a small amount from their 401(k), but Ramsey warns against doing this, saying, "The truth is that even a small cash-out can have a huge impact on your retirement savings."

This is because of taxes and withdrawal penalties. Withdrawing early from your retirement savings before you have reached age 59 ½ can trigger additional penalties and taxes.

Typically, the IRS will issue a 10% tax on early withdrawals on top of any income tax payable on that amount. So, you could find yourself paying the government 10% of a $10,000 withdrawal.

The IRS will waive the 10% penalty in some situations, including a divorce when the 401(k) must be split, you have rolled the account over to another retirement plan within 60 days or you chose to receive substantially equal periodic payments. Funds can be withdrawn penalty-free through specified annual distributions over five years before age 59 ½ years. This process can be confusing, with lots of rules, so it's best to chat with your financial adviser first.

Another way the 10% withdrawal penalty can be avoided is through a hardship withdrawal. The amount of money that can be withdrawn is usually limited to meet an immediate and heavy financial need. This includes medical bills, funeral expenses and money used to avoid eviction or foreclosure. While doing this may help you avoid early withdrawal penalties, you'll still be subject to paying income tax on the amount withdrawn, which will cause you to miss out on the long-term benefits of compound growth.

Trending: Americans got swindled out of $24.6 billion in the last 3 years —Which high profile ponzi scheme was endorsed by millionaires?

Ramsey explained what this looks like in real life. If you had to take out $4,500 from your 401(k) to pay for expenses after leaving your job, realistically, you'd only get $2,925. Why? Because 25% goes toward income taxes, and another 10% is paid as an early withdrawal penalty. Not only that but by not moving your 401(k) into an individual retirement account (IRA) after leaving your job, you could miss out on growing that account to over $200,000 over the next 40 years.

So, how do you avoid dipping into your 401(k)?

Ramsey advises that before you start investing in your 401(k), you should have started an emergency fund with at least three to six months of expenses saved. Having this emergency fund ready for unexpected expenses can remove the temptation of touching the money in your 401(k) until retirement.

But sometimes you have no choice but to cash out your 401(k) early if you need to avoid life-altering situations like bankruptcy, foreclosure and eviction. If you are in a position where you need to make a withdrawal from your 401(k), it is a good idea to consult with a financial adviser so you are aware of the results of withdrawing early from your 401(k) and how it will affect your future wealth.

Read Next:

- 82% of Americans aren’t usingthis government secured 5% passive income stream, are you one of them?

- Are you rich? Here’s what Americans think you need to be considered wealthy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.