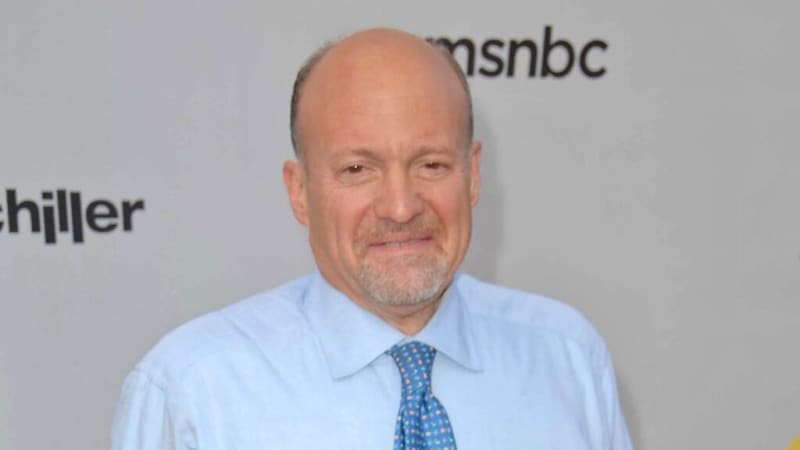

On CNBC's “Mad Money Lightning Round,” Jim Cramer said GigaCloud Technology (NASDAQ:GCT) is an e-commerce play that he just doesn't know enough about. He needs to do more work on that one.

On March 15, GigaCloud Technology reported better-than-expected fourth-quarter FY 2023 earnings and issued 2024 guidance. Revenue rose 94.8% Y/Y to $244.7 million, beating the consensus of $224.2 million, led by higher market demand for large parcel merchandise.

“It never really does anything. I think its stuff is kind of overpriced, but you do get that yield,” Cramer said when asked about Movado Group (NYSE:MOV). “I feel it's neither here nor there at that price.”

On March 26, Movado reported fourth-quarter adjusted earnings per share of 55 cents, beating the analyst consensus of 39 cents. Quarterly revenue of $179.62 million beat the street view of $174.80 million. The company generated a gross margin of 53.9% as compared to 56.2% in the fourth quarter of fiscal 2023.

When asked about NuScale Power (NYSE:SMR), Cramer said go buy GE Vernova Inc. (NYSE:GEV). “I don't want you to lose any money,” he added.

NuScale Power is scheduled to host a conference call to review first-quarter results on Thursday, May 9. Analysts expect the company to report a quarterly loss at 13 cents per share on revenue of $8.26 million.

Price Action:

- Movado shares rose 0.4% to settle at $26.30 on Thursday.

- GigaCloud Technology shares gained 1.3% to settle at $36.36 during Thursday's session.

- NuScale Power shares climbed 7.1% to close at $5.89 on Thursday.

Read Next: Top 3 Financial Stocks That Could Sink Your Portfolio This Quarter

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.