Snowflake Ltd. (SNOW) is a data-cloud company. It provides useful insights, designs consolidated data, builds data applications, and aids in data sharing. Formerly known as Snowflake Computing Inc. it changed its name to Snowflake Inc. in 2019. It is based in Montana, America, and serves more than 3,000 customers in the Asia-Pacific, EMEA regions, and the Americas.

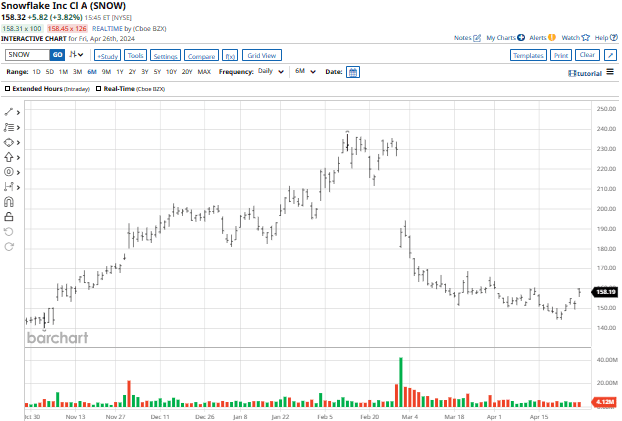

Snowflake’s stock has been down 16.23% YTD despite setting its 52-week high of $237.72 in February this year.

Snowflake reported its 4Q results in February end of this year posting revenue of $774.7 million beating analyst’s estimated $759.6 million and showing a growth rate of 32% YoY. Non-GAAP EPS came in at $0.35 against the analyst’s $0.18 prediction and gross margin increased from 65.1% to 68.8%.

On the full-year front, Snowflake’s revenue stood at $2.67 billion representing a 38% increase YoY while EPS came at $0.98 from $0.25 last year. On the other hand, its revenue outlook came to $745 million to $750 million for 1Q 2025, signifying and growth rate of 26% to 27% which is slower than the current growth rate. For comparison, its revenue growth was 33% in Q4 and 38% in 2024.

Surprisingly, the company also announced the retirement of CEO Frank Slootman who will be succeeded by their senior vice-president of AI Sridhar Ramaswamy.

As a result, the stock plunged 18% on the day of results and has fallen more than 30% till now.

Unveils New Open AI Model

Snowflake has unveiled its new Open AI model dubbed “Snowflake Arctic”. It is an enterprise-grade large language model designed to handle complex workloads while excelling in several industry SQL coding benchmarks. Snowflake will deliver the model with an Apache 2.0 license making it usable for personal as well as commercial use.

"This is a watershed moment for Snowflake, with our AI research team innovating at the forefront of AI," said Snowflake's CEO Sridhar Ramaswamy.

The model is set to be available on Amazon (AMZN) Web Services, NVIDIA (NVDA) API catalog, Microsoft (MSFT) Azure, Lamini, Perplexity, Hugging Face, etc. For the time being Arctic is available for use in Snowflake Cortex.

Insider Purchase

Snowflake CEO Sridhar purchased about 31,542 shares of SNOW on March 25, at an average price of $158.52 per share. The total value of the stake is over $5 million taking his overall stake in the company to 0.0777%.

In the beginning of March, Mark McLaughlin, one of its board members purchased more than 3,000 shares worth $501,314. He also purchased $300,000 worth of stock back in May 2023 which was right after being appointed to the board.

Should you Buy SNOW?

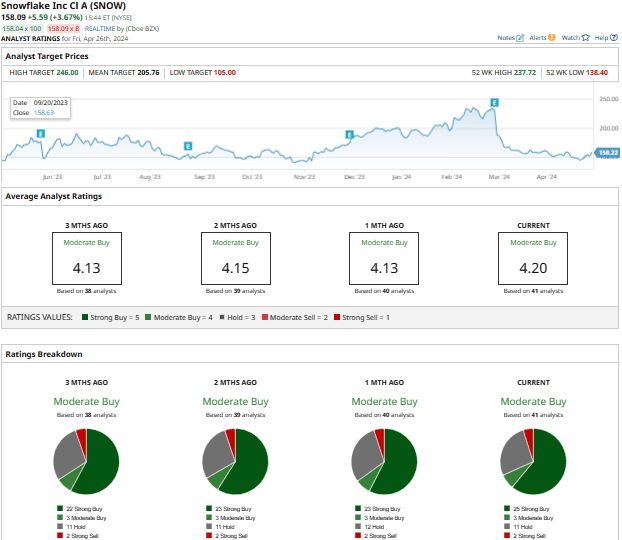

Snowflake has a consensus “Moderate Buy” rating from analysts with a mean price target of $205.76 translating to a 30% upside potential from the current level. At present 41 analysts are covering the stock, of which 25 have a “Strong Buy” rating, 3 have a “Moderate Buy” rating, 11 have a “Hold” rating, and 2 have a “Strong Sell” rating for Snowflake.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.