In a February 27, 2024, Barchart article on lumber demand, as the market moved toward spring 2024, I wrote:

I believe the current environment limits lumber’s downside. At the same time, the price action over the past years suggests the upside could become explosive when the Fed finally cuts rates, increasing the addressable market for home buyers.

On February 27, nearby physical lumber prices were at the $564 per 1,000 board feet level. There has not been a spring lumber rally, wood prices have steadily declined over the past weeks.

A bearish trend in physical lumber futures

The July CME physical lumber contract reached a $632 per 1,000 board feet high on March 12 when it ran out of upside steam.

The six-month chart highlights the decline that took 19% lower wood futures to $511 on April 24. In early May, lumber futures remain in a mostly bearish trend.

Liquidity remains problematic, but open interest is trending higher

Liquidity, or the low volume and open interest levels in the lumber futures arena, has always been an issue. The CME replaced the random-length lumber futures with the physical contract in 2023. The physical lumber futures offer smaller contracts with more flexible delivery locations and grades to encourage hedging and other activities. While the random-length contract contained 110,000 board feet, the physical contract contains one-quarter of the lumber at 27,500 board feet. Therefore, open interest, the total number of open long and short positions, would need to be four times higher to equal the level of the old random-length contract.

The latest open interest data at the end of April showed 10,328 contracts, which has steadily risen. However, the current level would correspond to under 2,600 contracts of the random-length lumber market, which remains low. The CME’s efforts to attract more liquidity to the lumber arena have not succeeded as of early May 2024.

Illiquid markets tend to suffer from significant price volatility when bullish or bearish trends take hold. Offers to sell tend to disappear during rallies, and bids to buy often evaporate when the price declines. The physical lumber market’s current liquidity suggests that any significant price trend will suffer explosive or implosive price action, as we witnessed with the random-length contract in 2020-2022.

Inflation remains stubborn- Higher rates for longer

Lumber prices edged higher in late 2023 and early 2024 as anticipation for Fed Rate cuts peaked. However, the inflation data over the past months has caused the U.S. central bank to leave the short-term Fed Funds Rate unchanged at 5.25% to 5.50% and continue tightening credit via quantitative tightening to reduce the Fed’s balance sheet.

Lumber is highly sensitive to interest rates as the demand for new homes moves lower when rates climb. A thirty-year fixed-rate conventional mortgage that was below 3% in late 2021 has climbed to over 7%. On a $400,000 loan, borrowers now pay over $1,300 more monthly for the financing. Moreover, a shortage of existing homes has not caused home prices to decline because of higher rates. High rates and home prices have excluded many potential new homeowners from purchases. The realization that rates will remain higher for longer in 2024 has dampened the prospects for new home building and lumber demand, leading to lower physical lumber futures prices.

Interest rates are a problem- JP Morgan’s CEO warns of even higher rates

The bottom line is that stubborn inflationary pressures will likely leave interest rates higher for longer. Jamie Dimon, JP Morgan Chase’s CEO, recently commented that rates could rise to 8% or higher.

I purchased my first home in the early 1980s when mortgage rates were above 12%. An 8% mortgage rate is not shocking for me, but it is for many younger potential buyers who have never experienced high rates. However, what is surprising is the ascent of home prices while mortgage rates climb. Higher interest rates over the coming months and the lack of existing homes for sale because owners are locked into sub-3% rates only exacerbate the problems for new home buyers.

The bottom line for lumber is that the path of least resistance of interest rates will likely dictate lumber futures trends over the coming months.

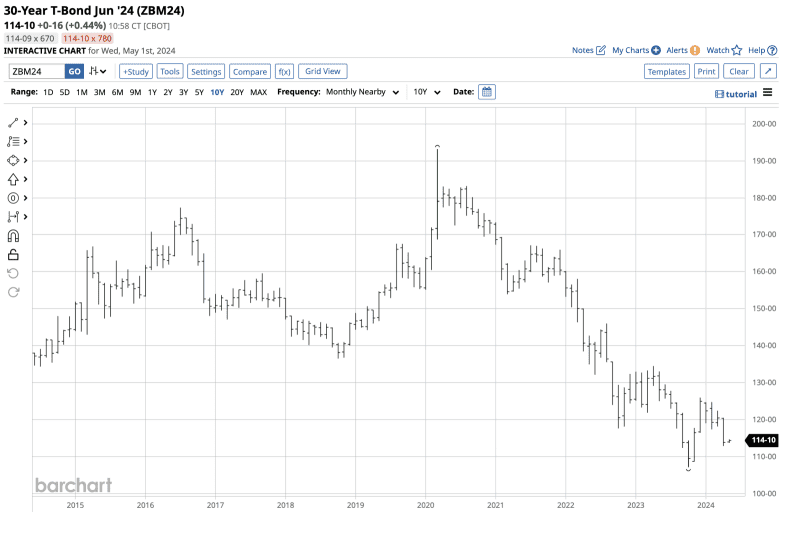

The ten-year chart of U.S. 30-year Treasury Bond futures highlights the bearish trend in bonds and the higher rates that weigh on new home construction demand, as well as lumber prices.

Levels to watch in lumber futures- Remember wood prices can be implosive or explosive

Over the past twenty years, the range in random-length and physical lumber futures has been from $137.90 in 2009 to $1,711.20 per 1,000 board feet in 2021. At the $528 level in early May 2024, the wood price is closer to the 2009 low than the 2021 high. However, the illiquid futures could experience explosive or implosive price action in the blink of an eye. A shift in Fed monetary policy could trigger a significant move in the lumber futures arena.

The chart dating back to August 2022 shows technical support levels at $502.50, $478, $430, and $400 per 1,000 board feet. Technical resistance is at $613.50, $627, $655, and $712 per 1,000 board feet. Illiquidity in lumber futures could cause the price to blow through technical levels like a hot knife through butter.

Lumber is in a bearish trend in May 2024, and the trend is always your best friend. The path of least resistance of physical lumber futures could depend on the Fed’s monetary policy path over the coming weeks and months. Higher rates will likely be bearish, while rate cuts could ignite an explosive upside move.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.