Whales with a lot of money to spend have taken a noticeably bullish stance on Duolingo.

Looking at options history for Duolingo (NASDAQ:DUOL) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 22% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $85,200 and 6, calls, for a total amount of $234,893.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $210.0 and $270.0 for Duolingo, spanning the last three months.

Volume & Open Interest Development

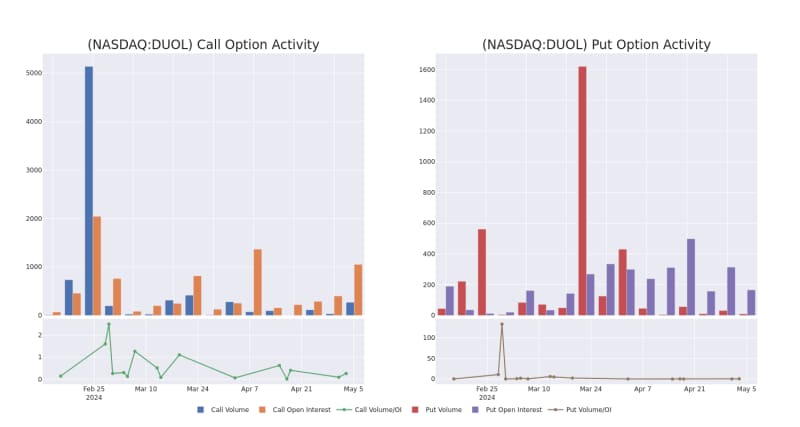

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Duolingo's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Duolingo's substantial trades, within a strike price spectrum from $210.0 to $270.0 over the preceding 30 days.

Duolingo Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

About Duolingo

Duolingo Inc is a technology company that develops mobile learning platform to learn languages and is the top-grossing app in the Education category on both Google Play and the Apple App Store. Its products are powered by sophisticated data analytics and artificial intelligence and delivered with class art, animation, and design to make it easier for learners to stay motivated master new material, and achieve their learning goals. Its solutions include The Duolingo Language Learning App, Super Duolingo, Duolingo English Test: AI-Driven Language Assessment, Duolingo For Schools, Duolingo ABC, and Duolingo Math. It has three predominant sources of revenue; time-based subscriptions, in-app advertising placement by third parties, and the Duolingo English Test.

In light of the recent options history for Duolingo, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Duolingo

- Currently trading with a volume of 638,786, the DUOL's price is up by 4.85%, now at $240.0.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 5 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Duolingo with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.