In the fast-paced and cutthroat world of business, conducting thorough company analysis is essential for investors and industry experts. In this article, we will undertake a comprehensive industry comparison, evaluating Johnson & Johnson (NYSE:JNJ) in comparison to its major competitors within the Pharmaceuticals industry. By analyzing crucial financial metrics, market position, and growth potential, our objective is to provide valuable insights for investors and offer a deeper understanding of company's performance in the industry.

Johnson & Johnson Background

Johnson & Johnson is the world's largest and most diverse healthcare firm. Three divisions make up the firm: pharmaceutical, medical devices and diagnostics, and consumer. The drug and device groups represent close to 80% of sales and drive the majority of cash flows for the firm. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. The device segment focuses on orthopedics, surgery tools, vision care, and a few smaller areas. The last segment of consumer focuses on baby care, beauty, oral care, over-the-counter drugs, and women's health. The consumer group is being divested in 2023 under the new name Kenvue. Geographically, just over half of total revenue is generated in the United States.

By conducting an in-depth analysis of Johnson & Johnson, we can identify the following trends:

Debt To Equity Ratio

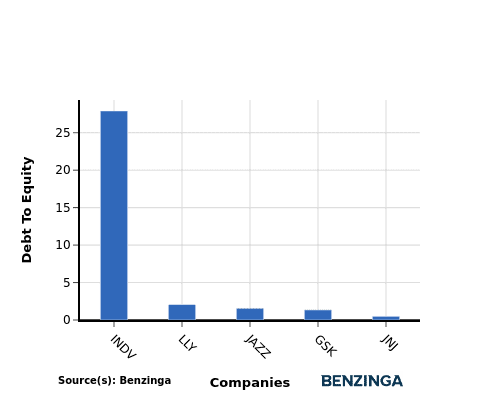

The debt-to-equity (D/E) ratio gauges the extent to which a company has financed its operations through debt relative to equity.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

When evaluating Johnson & Johnson alongside its top 4 peers in terms of the Debt-to-Equity ratio, the following insights arise:

Key Takeaways

For Johnson & Johnson in the Pharmaceuticals industry, the PE, PB, and PS ratios are all low compared to its peers, indicating potential undervaluation. However, the low ROE, EBITDA, gross profit, and revenue growth suggest weaker financial performance relative to industry competitors. This may require further investigation into operational efficiency and growth strategies to enhance overall valuation within the sector.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.