Penny stocks receive little to no attention because they are risky investments. Due to their low liquidity and susceptibility to market speculation, penny stocks can experience wild price fluctuations that are often driven by hype rather than underlying fundamentals.

However, this is not the case for SoundHound AI (SOUN), a pure-play AI company. With the dawn of the artificial intelligence (AI) era, SoundHound AI has piqued the interest of numerous investors. SoundHound's improving fundamentals have prompted analysts and investors to consider its long-term prospects. Furthermore, chip giant Nvidia's (NVDA) $3.7 million investment in the company piqued curiosity among investors.

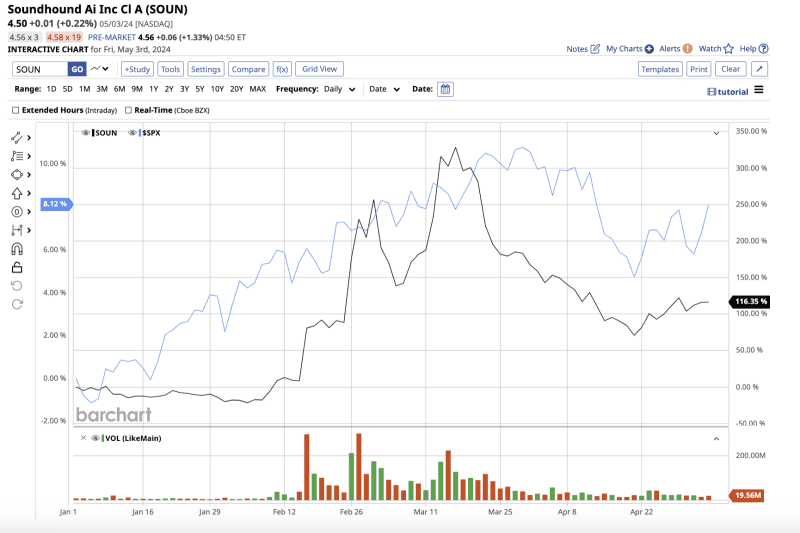

Four months into 2024, SOUN stock is up 145% year-to-date, compared to the S&P 500 Index's ($SPX) mere 8.6% gain. The company is scheduled to release its first quarter 2024 results this Thursday, May 9, after the market closes. On average, Wall Street expects the stock to rise another 37% over the next 12 months. Let’s take a look at whether SOUN is a good buy now before earnings.

SoundHound AI: Strengthening Financials

For a small AI company valued at $1.39 billion, SoundHound AI is experiencing rapid growth. Known for its music recognition app, the company has shifted its focus to developing cutting-edge AI solutions for a variety of industries, including automotive, healthcare, and consumer electronics.

From enabling voice-activated assistants in cars to facilitating conversational AI experiences on smart devices, SoundHound AI is establishing itself as a strong player in the AI race.

The company ended 2023 on a high note. Total revenue increased by 80% to $17.1 million in the fourth quarter, driven by a doubled subscription and booking backlog of $661 million. Booking backlog is defined as contractual revenue that will be recognized in the future.

Although its revenue growth is impressive, the bottom line remains red. Nonetheless, GAAP (generally accepted accounting principles) net losses narrowed to $0.07 per share in the fourth quarter, compared to $0.15 in the same period last year.

For the full year 2023, revenue increased 47% year-over-year to $45.9 million. Plus, the GAAP net loss of $0.40 per share was down significantly from $0.74 per share in the prior year.

At the end of the quarter, cash and cash equivalents stood at $95.3 million along with $84.3 million in long-term debt. While the company focuses on turning a profit, managing debt should also be a priority.

In the Q4 earnings report, CFO Nitesh Sharan stated, “We have fortified our balance sheet and taken prudent measures to strengthen our bottom line to ensure we can continue to capitalize on the tremendous customer demand for our AI solutions.”

Can SoundHound AI Report Another Robust Quarter?

Last year, the company introduced several new AI-powered products, which could boost revenue growth this year. These products include Employee Assist for Restaurants, Dynamic Interaction with Generative AI, SoundHound Chat AI for Automotive, Smart Answering, Vehicle Intelligence, and more.

Furthermore, strategic partnerships around the world will improve the company's total addressable market, which currently includes “30 million businesses."

CEO Keyvan Mohajer believes SoundHound had an upper hand in quickly developing an AI model due to its years of experience, and that the "introduction of large language models and generative AI" has been a positive development for the company.

This is most likely why analysts predict a staggering 51.5% revenue increase in 2024, followed by 47.8% growth in 2025. Analysts also expect losses to narrow further from $0.40 per share in 2023 to $0.30 in 2024 and $0.21 in 2025.

By comparison, management expects revenue to range from $63 million to $77 million in 2024. Furthermore, revenue is expected to exceed $100 million by 2025, propelling the company toward positive adjusted EBITDA.

For the first quarter of 2024, analysts expect revenue to increase by 50.7% to $10.1 million. GAAP net losses could be around $0.09 per share, compared to $0.13 in Q1 2023.

Because the company is unprofitable, we will use its price-to-sales ratio for valuation. SOUN stock is currently trading at 20 times forward 2024 estimated sales, which appears high. However, given the expected growth over the next two years, the premium may be justified.

How High Is SOUN Expected To Rise in 2024?

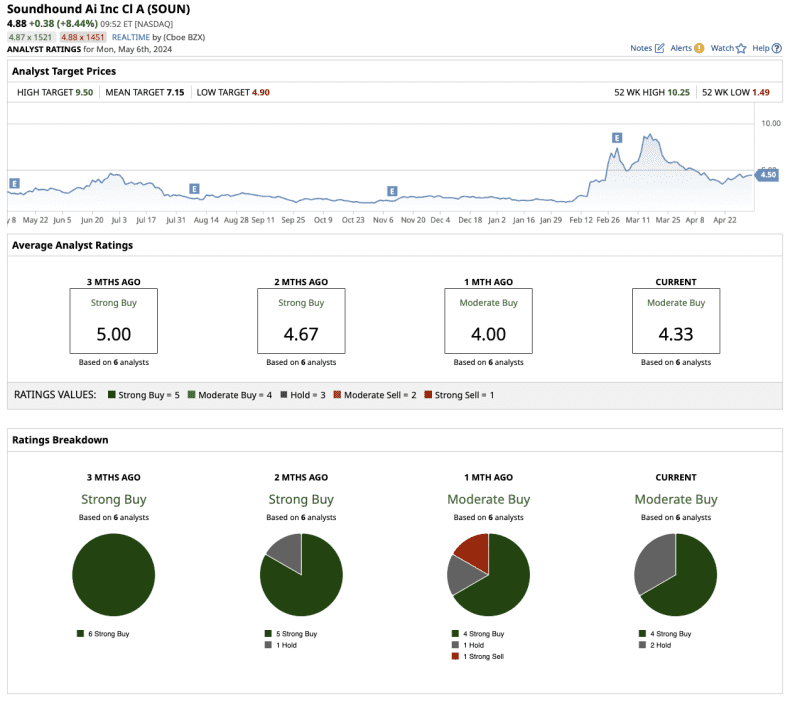

In the analyst community, four out of six analysts covering SOUN stock are rating it a "strong buy," with two more rating it a "hold." Overall, the stock is rated a “moderate buy.” SOUN stock has an average target price of $7.15, implying 37.2% upside potential from Monday's close

Following SOUN's strong Q4 results, DA Davidson analyst Gil Luria raised the target price to $9.50 and assigned it a "buy" rating. This implies that the stock has the potential to rise by 82.3% over the next 12 months.

Luria believes that SoundHound has a competitive advantage due to its "technology & the magnitude of the AI customer service opportunity" and that it could grow its revenue 16 times by 2026.

The Bottom Line on SOUN

As the digital era advances, AI customer service will become a top priority for all businesses around the world. SoundHound, with its moat in this field, has an advantage over competitors and new entrants.

While the company remains unprofitable, new products and strategic partnerships may help it turn a profit soon. Another strong quarter could push the stock price closer to its average target price for the year. That said, as AI is progressing rapidly, SoundHound makes a compelling case to buy and hold the stock for the long haul, thanks to its innovative AI technologies and strategic positioning in the market.

However, investing in SoundHound AI, like any penny stock, necessitates thorough analysis and risk management. While there is potential for significant returns, there is also the risk of loss. As a result, investors should only consider this penny stock after conducting extensive due diligence and diversifying their portfolios to reduce risk.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.