Jim Cramer, in his latest CNBC Investing Club “Morning Meeting” livestream, highlighted a chip stock that is poised for a significant upturn.

What Happened: On Friday, Cramer, the host of CNBC’s “Mad Money,” noted that despite the market’s overbought status, there are still opportunities for investors to capitalize on. Chip stocks, which had a down day on Thursday, saw a broad increase in the final session of the week. This was largely due to the robust April sales figures of Taiwan Semiconductor Manufacturing Co. (NYSE:TSM), a major chipmaker, reported CNBC.

The company’s monthly business update indicated a sustained demand for artificial intelligence chips. This development led to a rise in the shares of Nvidia (NASDAQ:NVDA), a key customer of TSMC and a leading AI chip designer, by 1.2% on Friday.

He suggested that it might be time to consider trimming strong performers, such as Procter & Gamble (NYSE:PG), which reached a new all-time high on Friday.

Another chip stock that Cramer highlighted was Broadcom (NASDAQ:AVGO), which also has an AI chip business. Despite it not being on anyone’s radar, Cramer believes that Broadcom is about to break out. The stock, which was trading at around $1,330 per share on Friday, might need to be trimmed when it reaches $1,400 per share.

"Broadcom is not an anybody's radar screen … but Broadcom is going to break out here, and that's the one we may have to trim next when that gets to $1,400 [per share]," Cramer said.

On the other hand, Alphabet (NASDAQ:GOOGL) was the worst-performing stock in Friday’s session, with a 1.1% decline. This was attributed to various factors, including a report by Bloomberg News that Alphabet was in talks to acquire HubSpot, a provider of customer management relationship software and other marketing tools.

Why It Matters: Cramer’s insights into the chip market are particularly noteworthy given his previous comments on the sector. In March, he expressed a strong preference for Nvidia over other AI stocks, emphasizing the company’s potential for growth.

Nvidia has also been making significant strides in the tech industry. The company recently unveiled its highly anticipated next GPU, Blackwell, at its GTC artificial intelligence event. Nvidia CEO Jensen Huang also highlighted the past, present and future of AI at the event, emphasizing the emergence of a new industry.

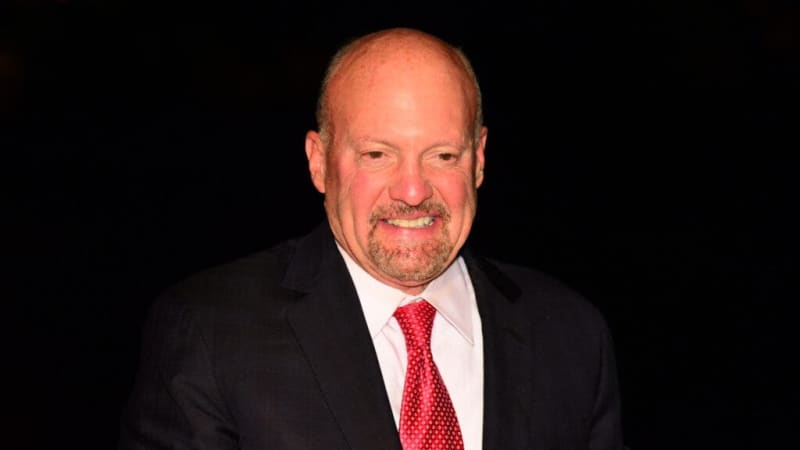

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.