Aside from Nvidia (NVDA), which will report its quarterly earnings later this month, all of the other “Magnificent 7” stocks have released their earnings - and except for Meta Platforms (META), all of the Mag 7 constituents impressed markets, and their shares rallied after their turns in the earnings confessional. Even Tesla (TSLA) \- which entered this earnings season as the worst-performing S&P 500 Index ($SPX) stock - jumped after its report, despite missing on both the top line and the bottom line.

Meta, on the other hand, lost $132 billion in market cap after its earnings, and several analysts lowered their target prices following the report. Is it time to sell Meta stock? We’ll discuss in this article, beginning with a snapshot of its Q1 earnings.

Why Meta Stock Fell After Earnings

Meta’s Q1 revenues surged 27% YoY to $36.46 billion, and surpassed analysts’ estimates. The company’s earnings per share (EPS) more than doubled to $4.71, and easily surpassed the $4.32 that analysts were expecting.

Management forecast revenues between $36.5 billion and $39 billion for Q2, which at the midpoint of $37.75 billion, arrived below the $38.3 billion that analysts were expecting. Meanwhile, the steep decline in Meta stock – which at one point shaved off nearly $200 billion from its market cap – wasn’t only due to the light guidance.

Meta Expects Its Investments Towards AI and Metaverse to Increase

While “efficiencies” were the core of Meta’s earnings calls last year, after CEO Mark Zuckerberg touted 2023 as the “year of efficiency,” we saw a marked change in the Q1 2024 earnings call, where the focus was on growing the capex to drive long-term growth.

Specifically, Meta raised its 2024 capex guidance to $35 billion-$40 billion, compared to the previous guidance of $30 billion-$37 billion. It now expects total expenses of $96 billion-$99 billion in the year, versus the previous guidance of $94 billion-$99 billion. While Meta lowered its 2023 expense guidance multiple times, thanks to the aggressive cost cuts, it now expects costs to rise in 2024, which it attributed to “higher infrastructure and legal costs.”

Meta’s Reality Labs posted an operating loss of $3.8 billion in Q1. The segment reported an operating loss of $16.1 billion in 2023, which was wider than the $13.7 billion loss in 2022. Management warned of widening losses in 2024, and expects the segment’s “operating losses to increase meaningfully year-over-year due to our ongoing product development efforts and our investments to further scale our ecosystem.”

While the company did not provide capex guidance for 2025, it said that the outlay is expected to rise as compared to 2024, as it continues to invest “aggressively to support our ambitious AI research and product development efforts.”

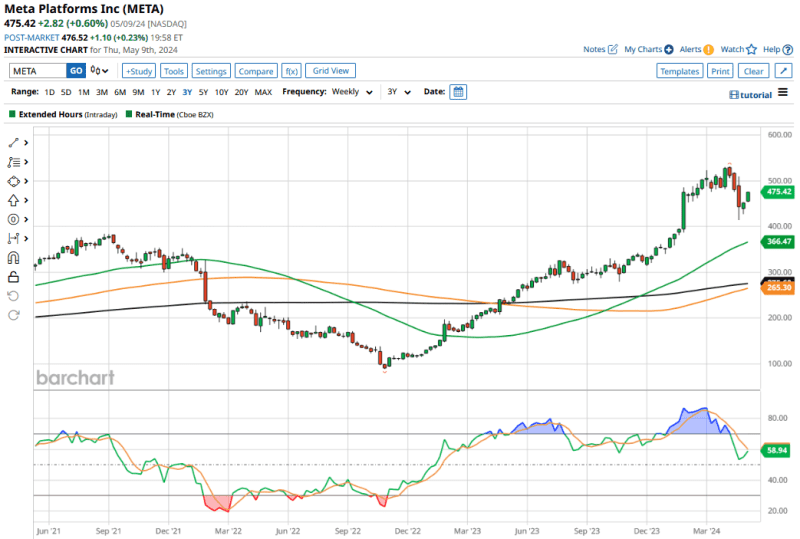

Zuckerberg Warned of Volatility in Shares

During the earnings call, Zuckerberg referred to past initiatives like Reels, Stories, and the transition to mobile to drive home the point that Meta shares can be volatile during periods when the company is investing in new products that have yet to be monetized.

While Zuckerberg talked about the “multi‐year investment cycle” in AI, he stressed that the company has a strong track record in monetization.

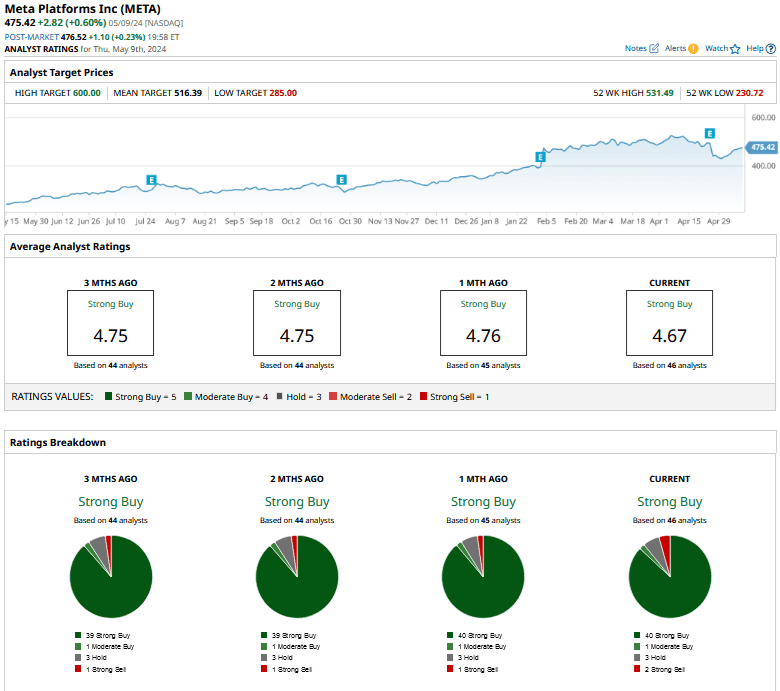

Meta Stock Forecast: Analysts Lower Target Prices

After Meta’s Q1 earnings, multiple brokerages - including Barclays (BCS), Goldman Sachs (GS), KeyBanc (KEY), Citi (C), and JPMorgan (JPM) \- lowered the stock's target prices.

Along with higher capex, KeyBanc analyst Justin Patterson is apprehensive about a deceleration in Meta’s revenue growth amid tougher comps. Notably, Meta reported its first annual revenue decline in 2022, which translated into easier comps in 2023. However, those tables have now turned, and the company is facing tougher comps this year - and the increase in expenses following last year’s efficiency drive is not helping matters, either.

Overall, Meta still has a “Strong Buy” rating from analysts, and its mean target price of $516.39 is 8.6% higher than current prices. Its Street-high target price of $600 represents an upside potential of about 26%.

Is Meta Stock a Buy?

I believe Meta stock is now fairly valued at a next 12-month (NTM) price-to-earnings of 23.2x, which is largely in line with its 5-year average. On the upside, the company has several growth drivers, even as the monetization of Threads, AI initiatives, and metaverse will take some time. A possible U.S. ban on TikTok could also help divert some ad dollars to the likes of Meta.

However, the company faces legal and regulatory risks, which could dampen sentiments. During the Q1 earnings call, CFO Susan Li warned of “increasing legal and regulatory headwinds in the EU and the US that could significantly impact our business and our financial results.”

Social media companies like Meta will also be under a scanner amid the upcoming elections in the U.S., even as the event is also a revenue opportunity.

Overall, given the more balanced risk-reward at these levels, I would remain on the sidelines and won't add any new positions to Meta, while holding on to existing shares as the company transitions from its “year of efficiency” to “years of AI investments.”

On the date of publication, Mohit Oberoi had a position in: META , NVDA , TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.