As much as the hype around the artificial intelligence (AI) revolution and related stocks continues to excite investors worldwide, the allure of hard commodities like gold (GCM24), silver (SIN24), and platinum (PLN24) remains as strong as ever. Thanks to their evergreen nature as stores of value, these commodities can act as a safe-haven buffer for investors' portfolios during times of heightened uncertainty, and periods of prolonged high inflation \- like we're seeing now.

The commodity upcycle has also received a boost from what appears to be a gradual but steady Chinese recovery. As key economic indicators show signs of an uptick for the world's largest consumer of metals, it bodes well for the global commodities market.

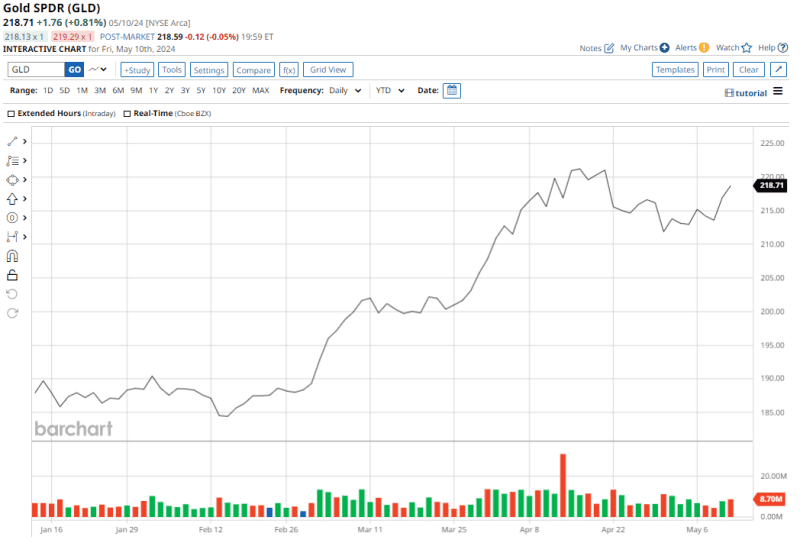

Against this backdrop, gold futures rallied to new highs in April. Likewise, the SPDR Gold Shares ETF (GLD) \- one of the most popular ETFs on Wall Street, with an AUM of about $63.5 billion - is up 13.1% on a YTD basis, outperforming the S&P 500 Index's ($SPX) rise of 9.5% over the same period.

While many analysts have hiked their gold price forecasts, at least one expert is urging investors to take some gold profits off the table - and invest in a precious metal that he argues is undervalued at current levels.

The Bullish Case for Platinum

Specifically, Larry McDonald of Bear Traps Report says platinum is the precious metal that offers real upside from here. While he believes gold is overvalued after its run higher, he notes that platinum prices have lagged - leaving the gold-platinum price ratio at a steep 2:1.

Making the case for platinum's cheap valuation, McDonald wrote, “It’s like buying Bitcoin without the… pump artists at a much cheaper risk-reward valuation.”

Specialty chemicals and sustainable technologies firm Johnson Matthey would seem to agree with McDonald's bull case for platinum here. The firm recently reported that the platinum market is on pace for its biggest supply shortfall in a decade, with demand for the metal remaining firm even as excess inventories have largely been unwound. Johnson Matthey expects the platinum market deficit to increase to 598,000 ounces this year from a shortfall of 518,000 ounces in 2023, with demand at roughly 7.61 million ounces.

Platinum has use cases in a plethora of industries, making it a compelling investment while it's cheap. For instance, in the realm of green energy, platinum serves as a catalyst in hydrogen-based fuel cells, facilitating the conversion of hydrogen and oxygen into water to generate electricity. Consequently, platinum is set to play a significant role in the emerging green economy, such as powering electric vehicles (EVs) through fuel cells.

Moreover, its catalytic properties make it indispensable in various chemical processes, including the production of fertilizers, nitric acid, and, notably, hydrogenation reactions.

Is PLTM a Good ETF to Buy?

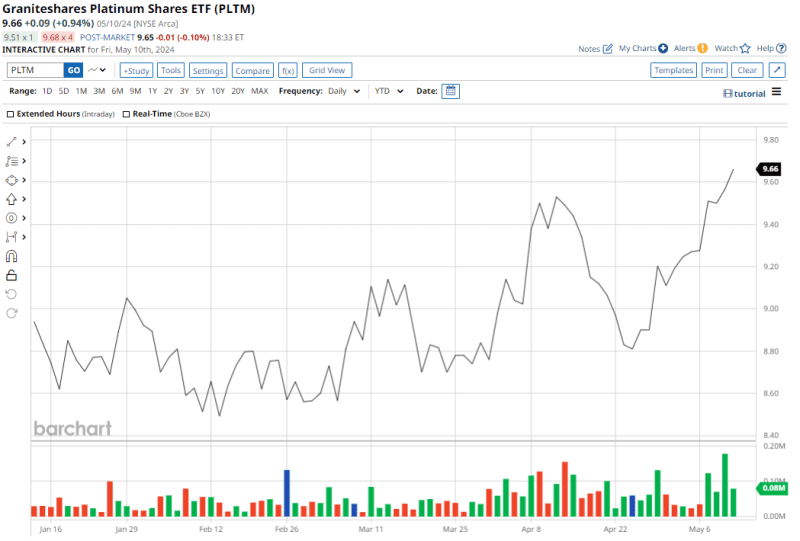

McDonald's call-out of the GraniteShares Platinum Trust (PLTM) is worth a closer look here. Like GLD, it's a physically backed exchange-traded fund that attempts to track the price of its underlying commodity.

With an AUM of $40.3 million, PLTM claims to be the lowest-cost platinum ETF that aims to mirror the spot price of platinum, minus the expense ratio. It holds physical platinum bullion bars stored in a secure vault located in London.

The shares of PLTM are up 0.6% on a YTD basis.

That narrowly outperforms the YTD return of spot platinum, suggesting PLTM could be a good choice for investors looking to leverage expected upside in the underlying commodity.

However, platinum has yet to gain much popularity among the investment community as their precious metal of choice, with sentiments still heavily skewed towards gold and silver in the commodities space. That means there are a few points of caution for potential PLTM buyers.

GLD vs. PLTM

For investors whose primary exposure to precious metals investing has been via the shares of GLD, it's worth pointing out how extremely liquid this ETF is compared to many others in the commodities space.

GLD, with its massive $63B AUM, averages daily volume of nearly 8 million shares, and has an active options market with daily contract volume in the six figures. That translates to a very active and liquid market for GLD that's user-friendly, with tight bid/ask spreads that make it easy to enter and exit trades quickly, and at favorable prices - even for smaller retail players.

PLTM hasn't drawn as big a crowd, with its $40M AUM, and the ETF's average daily share volume is fewer than 100,000. Notably, PLTM isn't optionable, either. On balance, this means the market is less active, with wider spreads that can create slippage when entering or exiting trades.

And PLTM carries a higher expense ratio, at 0.5%, than GLD's 0.4%.

The Bottom Line on PLTM Right Now

While none of those points above might necessarily be dealbreakers for potential platinum investors, they're worth considering before buying shares of PLTM - especially for retail investors who might be looking to keep their overall precious metals exposure, as a percentage of their portfolio, relatively modest.

That said, like all investments in the commodities space, the supply and demand backdrop will play a crucial role in platinum prices going forward. With a favorable demand forecast from industry experts, platinum's widespread applications across a range of industries, coupled with its relative underperformance so far this year, suggest there could be plenty more upside in store as platinum prices play catch-up.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.