Patrick Paul Gelsinger, the legendary founder of Intel (INTC), is a much-respected name in the annals of Silicon Valley. Intel stock might be underperforming this year as it transitions to a foundry, but it's still one of the world's largest semiconductor chip manufacturers by revenue. Notably, the veteran CEO seems to think his stock is a bargain, scooping up INTC stock worth nearly $500,000 in four tranches so far this year.

Gelsinger's purchases of Intel have been roughly timed to the chip company's quarterly earnings events, buying the dip a few days after the news as investors sold into soft revenue guidance with each report.

Simultaneous with his latest INTC pickup, on May 1, Gelsinger made another purchase - over $100,000 of Mobileye Global (MBLY) stock.

About Mobileye Global Stock

Founded in 1999, Mobileye Global (MBLY) is an autonomous driving company based out of Israel. Mobileye was publicly traded for years before its acquisition by Intel in 2017, then returned to public markets via a 2022 spin-off.

Mobileye is a leading developer of vision-based Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies. Its operations include product development, manufacturing of specialized computer chips called EyeQ, software development, partnerships and data services. It currently commands a market cap of $21.87 billion.

MBLY stock is down 34.8% on a YTD basis, significantly underperforming the broader market.

Like Intel, shares of Mobileye sold off after its latest quarterly results. During Q1 of 2024, revenue slipped by 48% from the previous year to $239 million, while the adjusted loss per share of $0.07 came in wider than the consensus estimate of a loss of $0.06 per share.

Mobileye is a debt-free company, and generated net cash from operating activities of $40 million in the quarter. The company closed the quarter with a cash balance of $1.2 billion.

Management reiterated its guidance for 2024, with revenues expected to range between $1.83 billion and $1.960 billion, and adjusted operating income between $270 million and $360 million.

Looking ahead, analysts expect Mobileye to report full-year EPS of $0.10, down sharply from $0.52 in the prior year.

Despite the stock's underperformance, MBLY isn't particularly cheap. Currently, the stock is priced at a steep 73x expected 2024 earnings, and more than 12x expected sales.

However, Gelsinger - who has been the Board Chair at Mobileye since its October 2022 spinoff - seems to like the shares around current levels. He bought 3,611 Mobileye shares shortly after earnings at an average price of $27.8146, totaling an investment of over $100,000.

What's Driving Growth at Mobileye?

Mobileye is a top player in the growing robotaxi market, and the company's position as a leader in the autonomous driving space means it's set to benefit from growth in the underlying market over the coming years. According to this report by Morodor Intelligence, the autonomous driving market is set to grow by more than 2.5 times from $14.79 billion in 2024 to $37.56 billion in 2029, clocking a CAGR of 20.5%.

Notably, Mobileye's announcement at CES 2023 indicates they have secured contracts worth $3.5 billion in revenue related to Mobility as a Service solutions between now and 2028, pointing out that its services will be used in several robotaxis.

Specifically, Mobileye is expected to benefit from an expected rise in demand for SuperVision, its most advanced driver-assistance system (DAS) currently available. Mobileye delivered 39k SuperVision units in the first quarter of 2024 with guidance to deliver a total of 185,000 units in the year.

Critically, the company has scored an order from automobile giant Volkswagen (VWAGY) for its SuperVision, Chauffeur, and Drive products. With the Volkswagen order in its bag, Mobileye believes that it will have a positive ripple effect on its backlog, as it is already in advanced discussions with OEMs from around the globe for more orders in its pipeline.

Moreover, the company has design wins or is in advanced discussions with 14 OEMs, representing 46% of the industry production, up from 37% just a quarter ago. Further, it shared that they are bidding on RFQs that represent a multiple of the $4.5 billion in pipeline revenue that it generated from SuperVision and Chauffeur design wins in 2023.

What Do Analysts Forecast for MBLY Stock?

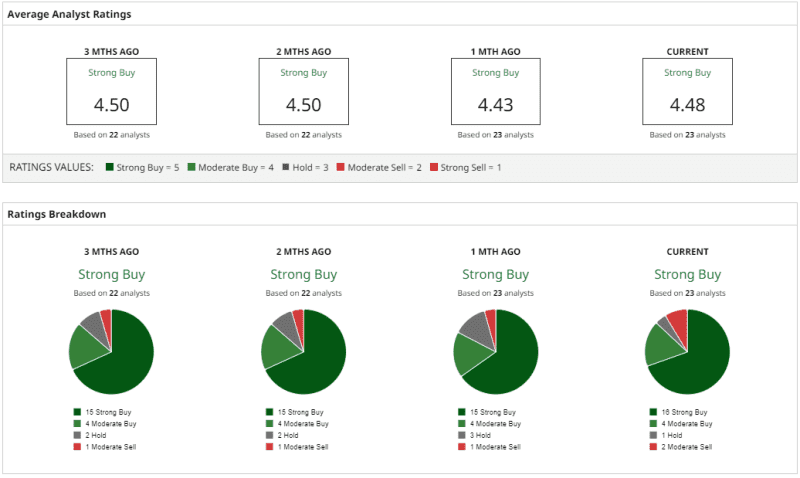

Analysts are quite gung-ho about Mobileye stock, with an overall rating of “Strong Buy” and a mean target price of $39.78. This indicates an upside potential of about 40.7% from current levels.

Out of 23 analysts covering the stock, 16 have a “Strong Buy” rating, 4 have a “Moderate Buy” rating, 1 has a “Hold” rating, and 2 have a “Moderate Sell” rating.

That said, given the premium valuation and expected deceleration in growth this year, MBLY stock is best reserved right now for investors who are willing to practice some patience, and who believe in the long-term growth story for this autonomous driving name.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.