In today’s ever-evolving business landscape, the software industry has remarkable growth potential. With businesses rapidly adopting technology to streamline operations and enhance customer experiences, the demand for innovative software solutions is soaring.

Projections indicate that global revenue in the software-as-a-service market is anticipated to expand at a steady compound annual growth rate (CAGR) of 7.3% by 2028. Amid such solid industry prospects, Twilio Inc. (TWLO) emerges as a standout software candidate.

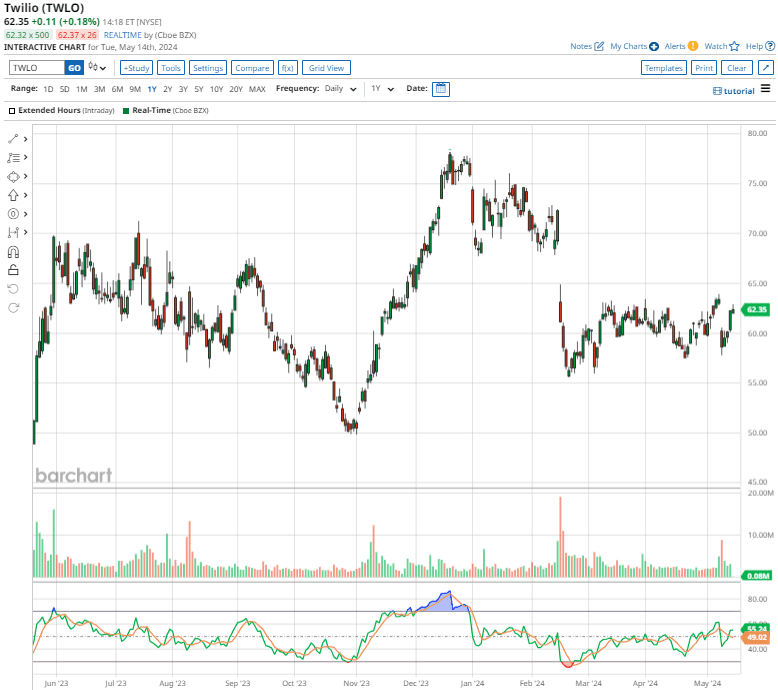

Despite experiencing a nearly 25.6% pullback from its 52-week high of $78.16 achieved last December, analysts still believe there’s major upside potential in Twilio. Plus, with Twilio stock trading at an attractive valuation, now might be the perfect time to snag the shares for potential gains.

About Twilio Stock

Established in 2008, San Francisco-headquartered Twilio Inc. (TWLO) provides a cloud communications platform as a service. The company enables developers to effortlessly integrate real-time communications into their software applications, fostering smooth interactions between customers and end-users. The company's suite of solutions spans messaging, voice, email, flex, marketing campaigns, and user identity and authentication. Twilio’s market cap currently stands at $11.3 billion.

Shares of Twilio have plunged 17.5% on a YTD basis, significantly lagging behind the broader S&P 500 Index’s ($SPX) 9.5% gains during the same time frame.

Priced at 2.63 times sales, Twilio now trades at a significant discount to the internet services and infrastructure industry median and its own five-year average. In fact, with a PEG ratio of 0.68 and EV/sales of 1.84, TWLO has rarely looked cheaper.

Twilio’s Q1 Beats Wall Street Projections

The software company reported its Q1 earnings results on May 7, which surpassed Wall Street’s predictions on both the top and bottom lines. Twilio’s revenue of $1.1 billion grew 4% year over year, while non-GAAP EPS of $0.80 showed a solid 70.2% annual improvement, exceeding forecasts by a notable 34.7%.

Moreover, Twilio remains steadfast in its commitment to enhancing shareholder value through share repurchases. Last year, Twilio's board of directors approved a share repurchase program, allowing the company to buy back up to $1 billion of its outstanding Class A common stock.

Building on this, in March 2024, the company expanded the program by authorizing an additional $2 billion for share repurchases. As of March 31, Twilio has completed approximately $1.5 billion in aggregate repurchases and aims to finish the remaining $1.5 billion before 2024 ends.

For Q2, management anticipates revenue between $1.05 billion and $1.06 billion, indicating projected annual growth of 1% to 2%. During the quarter, the company expects organic revenue growth to be slightly higher, ranging between 4% and 5%. Additionally, non-GAAP EPS is expected between $0.64 and $0.68.

Analysts tracking Twilio predict the company’s GAAP loss to narrow 90.4% year over year in fiscal 2024 and then swing to a profit of $0.34 per share in fiscal 2025.

What Do Analysts Expect for Twilio Stock?

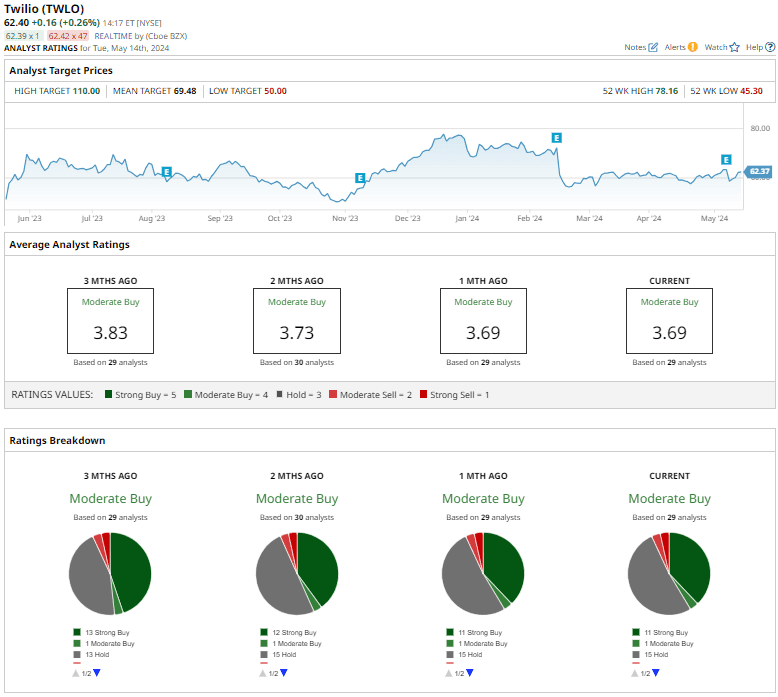

Despite its relative underperformance on a YTD basis, Twilio stock has a consensus "Moderate Buy" rating on Wall Street. Out of 29 analysts covering the stock, 11 recommend a "Strong Buy," one advises a "Moderate Buy," 15 suggest “Hold,” one gives a “Moderate Sell,” and the remaining one gives a "Strong Sell” rating.

The average analyst price target of $69.48 indicates upside potential of 11.4% from current levels. The Street-high price target of $110, reiterated by JMP Securities last month, suggests that the stock could rally as much as 76.4% from the current levels.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.