Ryanair (NASDAQ: RYAAY) share price has done well over the years, transforming it into the biggest airline in the world after Delta Air Lines. It has soared by over 4,300% since going public, giving it a market cap of over $23 billion.

Outperforms legacy airlines

Ryanair’s performance is notable because it is a budget airline that charges some of the lowest fares in Europe. It also has a smaller fleet than some of the biggest European airlines. It has a fleet size of 584 aircraft

IAG (LON: IAG), the parent company of British Airways and Aer Lingus has over 650 planes while Delta and United have over 900 planes. Lufthansa has more than 700 planes.

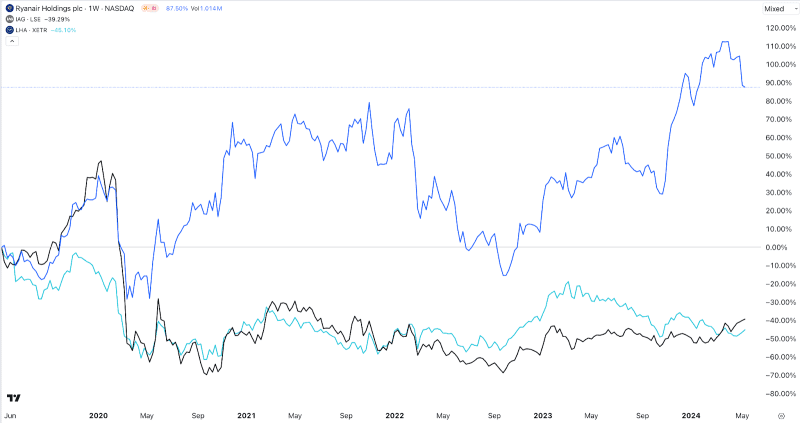

Ryanair’s stock has outperformed legacy airlines like IAG, Lufthansa, and Air France KLM over the years. It has soared by over 80% in the past five years while the three have crashed by over 40% in the same period.

The same trend has happened in the past 12 months as it jumped by over 30%. IAG has risen by 20% while KLM and Lufthansa have dropped by more than 20%.

This performance is also visible in terms of their valuation metrics. Ryanair has a higher price-to-earnings (PE) metric of 10.35, while IAG and Lufthansa have 4.0 and 5.0, respectively.

Ryanair vs Lufthansa vs IAG

Why Ryanair beats big airlines

There are a few reasons why Ryanair outperforms other European and American legacy airlines. First, unlike the other companies, it uses a single-model plane. It primarily uses Boeing 737, a plane whose reputation has deteriorated recently. This explains why Ryanair shares are not doing well this year.

Nonetheless, operating a single model has the benefit of having lower operation costs like maintenance and training. It has 25,000 employees while IAG and Lufthansa have 63k and 98k, respectively.

Additionally, Ryanair prefers cheaper airports. For example, in London, the company has avoided using Heathrow Airport. Instead, it uses smaller airports like Gatwick, where it commands a big market share.

Data shows that Ryanair has gross margins of about 30% while IAG, Lufthansa, and KLM have 25%, 19%, and 10%, respectively. Its EBITDA margin stands at 24% while the other companies have a figure of less than 15%.

Second, Ryanair is growing at a faster rate than these other companies. Its revenue is growing at almost 30% while the other three are growing at less than 17%. The CAGR revenue growth in the past five years was 11.13% compared to IAG, Lufthansa, and KLM’s 3.95%, 0.02%, and 2.05%.

Further, Ryanair uses a simple business model while the other companies operate as conglomerates. IAG owns several brands like British Airways, Iberia, and Aer Lingus while Lufthansa owns Eurowings, Discover, Austrian, and Lufthansa Cargo and others. Conglomerates always attract cheaper valuations than simpler organisations.

Looking ahead, there is a possibility that the Ryanair’s shares will likely continue doing better than the other giant airlines.

The post Here’s why Ryanair shares beat IAG, Lufthansa, and KLM appeared first on Invezz