Nio (NYSE: NIO) stock price has crashed hard this year as the electric vehicle industry has become a toxic wasteland. It has tumbled by over 41.2% this year and by over 92% from its highest level in 2021. Other Chinese EV companies like Li Auto and XPeng have also tumbled.

Nio faces many challenges ahead

Nio’s stock price has crashed hard in the past few years as the industry has faced numerous challenges. The biggest issue, in my view, is that the EV industry is highly saturated with over 100 companies seeking to gain share.

As a result, most firms, including Nio, have been forced to slash vehicle prices to compete, which has affected its profit margins. This trend will likely continue in the next few years until vehicle prices starts rising.

Additionally, there is the ongoing fear that China will saturate the vehicle industry as it did in the steel and solar energy sectors. The implication is that most countries still struggle to compete in these industries.

Most recently, there are concerns about whether Nio and other Chinese EV companies will be able to compete in Europe and the United States. Just this week, Joe Biden announced that Chinese EVs will be charged a 105% tariff and Europe is expected to respond with its levies.

The US and Europe have accused China of unfair competition by providing billions of dollars in subsidies to the industry. China, on the other hand, has mocked the US and Europe for de-industrialization and for spending trillions of dollars in foreign wars.

Still, there are signs that Nio is doing modestly well, which explains why JPMorgan has turned bullish. Its revenue rose by 6.5% in the fourth quarter to $2.4 billion while gross profit margin came in at 7%.

Nio is also intensifying its battle against Tesla after it launched Onvo, a vehicle it aims to compete with Model Y and Toyota Rav4. The vehicle will sell for $30,400, which is cheaper than Model Y, which starts at $34,000.

Nio and other Chinese companies are also looking beyond Europe and the United States. Many of them are targeting countries like Russia where most western brands have exited. It is also looking at the Middle East, which is the fastest-growing region. A UAE entity made a big investment in Nio in 2023.

Nio stock price forecast

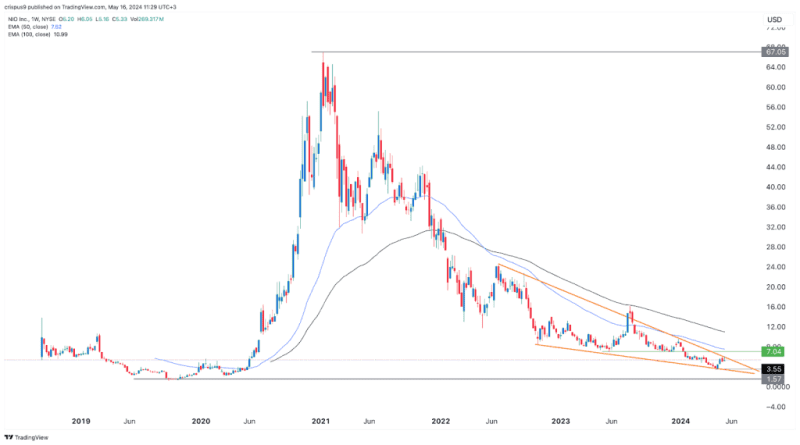

On the weekly chart, we see that the Nio share price peaked at $67 in 2021 and has now crashed to about $5.30. It is now hovering above the crucial support level at $1.57, its lowest level in 2019.

Nio has remained below all moving averages. Most importantly, Nio has formed a falling wedge pattern that I have indicated in orange. In most cases, this is one of the most bullish chart patterns in the market. Notably, it has now reached its confluence level, meaning that the stock could surge recently. This is the same pattern that AMC and GameStop formed before this week’s surge as I wrote hereand here.

The post Nio stock price forecast: the comeback could be epic appeared first on Invezz