By Todd Harrison via Cannabis Confidential (May 17)

The Justice Department formally started the process of classifying marijuana as a less dangerous substance, moving toward a historic change in US drug policy.

The agency submitted a rulemaking notice to shift cannabis’ legal status to Schedule III from Schedule I. A 60-day public comment period will now begin, after which the DEA and DOJ will make a decision on how and when to stick the final landing.

Read the Room

Nearly 7 out of every 10 voters, including a majority of Republicans, support legalizing cannabis, according to a Fox News poll that found that 69% of registered voters in the U.S. want to end prohibition altogether (45% of which “strongly” favor the reform).

There’s support across the political and demographic spectrum, too. Dems are most likely to back the policy at 81% but 55% of GOP voters and 65% of independents are also on board.

Eurovision

Medical cannabis is taking over Europe as well, with efforts to decriminalize cannabis in numerous countries at local levels. Similar to what took place in the U.S., European nations are legalizing medical or adult-use cannabis through a patchwork of new laws.

Of the 27 EU countries—Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain andSweden—only six (Bulgaria, Hungary, Latvia, Lithuania, Slovakia and Sweden) are still affixed to their prohibitionist roots.

- Click hereto get Cannabis Confidential delivered to your inbox daily.

Research Assistant

If marijuana is rescheduled to a Schedule III substance, it won’t change laws regulating cannabis research but the demand for research of the plant and cannabis for research purposes will grow, legal experts and marijuana producers say.

“It’ll make researchers within universities or hospitals and private companies better armed to say, ‘We should be doing this, and we can be doing this.’”

We believe they’ll be absolutely amazed at what they find.

Stocks & Stuff

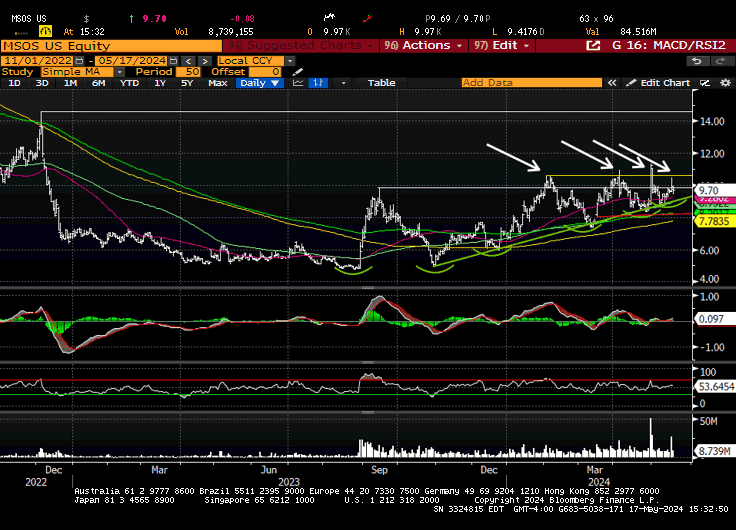

It was another whippy day in Cannaland as the ETF spend the session in search of it’s special purpose as the clock ran out on May paper. U.S. cannabis ETF MSOS (NYSE: MSOS) finished the session -2% to end this five-session set with a 3.5% gain.

Below, we’ll dive into the rulemaking process and timing thereof, digest the interplay bw the structural impediments and technical agendas, recap best-in-breed earnings, synthesize the well-placed aggravation and spy the upside of anger.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ PT Notional: $175M/ $116M

DOJ Advances Marijuana Rescheduling Plan Favored by Biden

Biden endorses cannabis reclassification, slamming 'failed approach'

Twenty-One of 27 European Union Countries Legalized Medical Cannabis

Why rescheduling could be boon to cannabis research

GOP House Leaders Propose Reducing Regulatory Barriers For Some Hemp Growers In Draft Farm Bill

Ohio gears up for legal marijuana sales for adult use

NJ Senate Committee Passes Bill to Regulate Intoxicating hemp

Nebraska MMJ advocates surpass one of two key signature hurdles

Wild West of Weed: Oklahoma Struggles to Regulate Booming MMJ Industry

Industry Headlines

Tilray to sell a large block of stock as it preps for cannabis reclassification

Cannabis reclassification a real milestone for industry, says Boris Jordan

Village Farms Considering Strategies to Enter Legal US Marijuana Market

Pregame (written 7:15AM)

I was planning on taking today off to celebrate our daughter but old habits die hard so when I’m up at 5AM, scanning the world for cannabis news, it almost seems like a waste not to share the observations, especially now.

So, a few things:

Yesterday’s DOJ news was “monumental,” to quote President Biden, but it was still an imperfect catalyst for a few reasons:

MSOS is +39% YTD and 76% YoY. Yes, it has a long way to go on this arduous road to redemption but it’s not like the ol’ college try ain’t there—but I don’t sense respect or appreciation on X, that’s for sure, and while I get the frustrated fret, I also believe:

Riddle me this: if a derivative is a financial contract whose value is dependent on an underlying asset, what happens when that derivative becomes outsized vs. the asset?

Beyond the exchange listing dichotomy, there’s ~500,000 MSOS calls and 150K MSOS puts on the board for the remainder of this year; add the 100X multiplier and you tell me how many of those fleas are wagging the tail that’s driving this dog?

The last two bullets are the primary reasons why we feel these markets are structurally managed. When large funds/dealers are caught on the wrong side of a bet (say, short vol), they have the muscle to overwhelm the “market” until they effect the prices they want/ need (say, to pin strikes on expiration).

I would go so far as to argue there’s a structural short in place, but I digress.

I’ll end this stream with the upside of anger: On Toby’s Spaces last night, Cura chair Boris Jordan mentioned HF advisors are bearish on policy given historical precedent, which is aggravating but also bullish as it means the buyers are still in front of us.

Between-the-Bells

Today we slipped from the typical script as MSOS didn’t register it’s daily 2% decline until 11:00 AM, which was more than an hour behind schedule. Mornings with deuce-like drawdowns are like Harold Melvin w/out the Bluenotes—they never goin’ platinum.

As we readied for the midday lunch crunch, I pulled up the MSOS primary trendline…

…which would arrive in the low $9s, depending on when, to demonstrate the whack-a-mole we so often discuss. If you don’t look at that chart and see a concerted effort to keep that ETF from triggering a breakout > $10, then idk what to tell you.

Volumes picked up into lunch, or at least that’s when slugs of Cresco + Verano traded, as we erased the rest of the officialDOJ rescheduling move, not to be confused with the reported DOJ rescheduling move, which is, of course, different than the WH video announcement alluding to the news that was done back in February.

As we edged into the afternoon and I readied to step away for that thing called life, it felt like the dynamics discussed—composition of volume, motivation of the marginal buyer—Madame Expiration as the Dom—were playing out in realtime as MSOS kept a wary eye on the trendline below, trading as low as $9.42 (-4%).

By 2PM, the ETF halved its losses as GTI (OTC: GTBIG) and Trulieve (OTC: TCNNF) tried to lead a late-day reversal, but the space felt tired, if not trapped. Great expectations and lurching, bureaucratic processes don’t make the best bedfellows, particularly when one side of the stadium is still sitting in their cars.

When the dust settled and the ink dried, it was a nothing-burger of a session in the context of an incrementally positive week, as measured by prices—but an entirely more profound week, through the lens of historical progress.

Jefferies on U.S. Cannabis Earnings:

GTI: Cash Generation Remains Stand-Out

The thing that has really separated GTI from peers the last couple of years is its consistent financial delivery, cash generation and strong balance sheet, and it was more of the same in the recent Q. While we would like to see broader expansion for greater long-term success, its current core provides a very strong foundation to deliver on this, allowing it to invest appropriately when opportunities arise. Stay Buy. PT to C$47.60.'

Cresco: Well-Placed To Now Go On Offense Again

Cresco's underlying strength in brands/wholesale is industry best. With this to be main driver of long-term value, in our view, it remains one of our top-picks. That said, recent top-line delivery has not reflected this strength. With the cost structure now in a much stronger place, however, the company is now well-placed to go on offense again, with the potential for near-term M&A to also support. Stay Buy. PT to C$19.50.

Cura: Long-Term Positioning Remains Industry Best

While recent delivery may be viewed as soft, the outlook for the year remains robust, and we are more focused on long-term positioning anyway. Here, Cura looks industry stand-out. It has broad state exposure, good strength at wholesale and international optionality. The announcement to enter Hemp THC also highlights this long-term thinking. Finally, its bus restructuring also provides a path to NASDAQ listing before peers, in our view. Stay Buy. PT to C$23.60.

AYR: About to See Inflection Top-Line Momentum

Ayr has established an attractive set of assets. The issue, to date, has been evidence they can drive any meaningful value from them. One major thing holding them back, and specifically the ability to really invest, has been a sizable near-term debt overhang. With this now largely addressed, attention should turn to top-line acceleration, with encouraging 1Q24 signs and a compelling set-up into 2H24 and FY25. Stay Buy. PT to C$7.90.

TSNDF: Really Like the Set-Up From Here

While possible disappointment on delivery the last couple of Q's, we really like the set-up from here. One, it has a skew to states that have recently switched to adult-use or are likely to; two, it is seeing strong momentum in its wholesale business, and three, additional M&A, inc. transformational deals, are likely near-term. Added to this, its bus restructuring should also provide a path to NASDAQ listing before peers, in our view. Stay Buy. PT to C$7.00.

Trulieve: Very Strong 1Q24, Driven By Florida

Credit where it's due, delivery in 1Q24 was very strong, with improvements in the cost structure really impressing. Taking a near-term view, potential 2025 adult-use in Florida could also provide meaningful support. That said, we like to focus on the long term, where we continue to think its reliance on Florida is a negative, and the company seeing limited success to date outside this state, particularly in wholesale. Stay Buy. PT to C$26.10.

ATB on the Rescheduling Process

Investors should keep 4 things in mind regarding DOJ’s proposed rulemaking posted yesterday (full note here):

The rulemaking was initiated by the AG, not the DEA. In fact, DEA hasn’t made a decision on cannabis scheduling, and appears to be against it at this point. The AG has ultimate authority over re-scheduling, so even if DEA doesn’t agree with it, re-scheduling can get done. However, can DEA’s disagreement delay the process? Has there been any instance of a substance being re-scheduled by a determination of the AG while DEA disagrees with it? Does this increase the chances of judicial challenges?

The AG is relying on a legal memo by the OLC, which states that re-scheduling would not infringe on international treaties. However, the memo states that DEA may satisfy the US’ Single Convention obligations by imposing additional restrictions on cannabis. DEA will consider those additional cannabis-specific controls concomitantly to the rulemaking process. Can those additional controls be material and impact state-legal operators? We don’t think they will, but it adds uncertainty.

There is a strong political will to get this done before the election. The President and VP both posted videos announcing re-scheduling. We think the administration will do what it takes.

The 60-day comment period starts today, taking us to July 16. After that, it’s a matter of addressing the comments and coming up with a final rule. After the final rule gets published, it would come into effect in 30 to 60 days. All considered, there’s enough time to get it done before November. However, judicial challenges could delay it.

Overall, we think it’s more likely than not re-scheduling will happen this year (the 75% probability assigned by investors in our Spring 2024 Survey appears about right). We’re one step closer to it, but there are still some lingering questions that add noise to the subject and may remain an overhang until it actually gets done. Because of this, we think (i) stocks will remain volatile on noisy headlines, and (ii) stocks will not fully price in re-scheduling just yet.

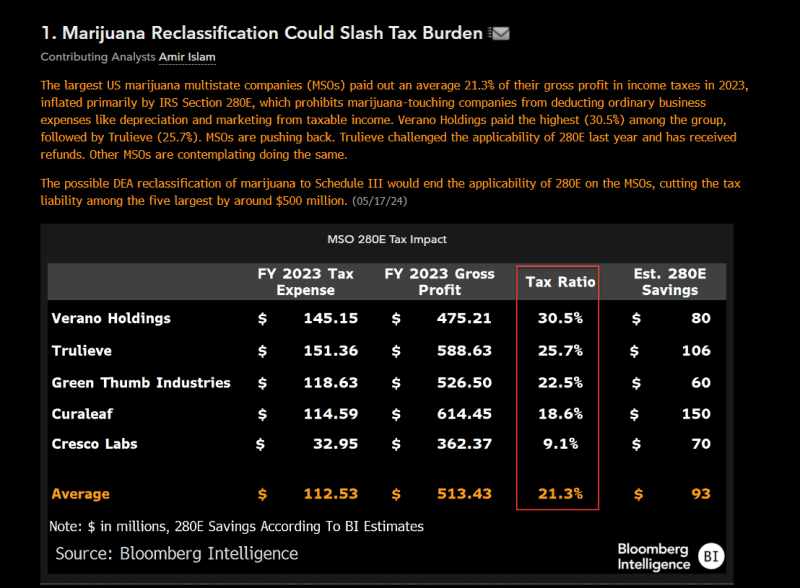

Bloomberg Intelligence on 280E Tax Stuff

“DEA reclassification of marijuana to Schedule III would end the applicability of 280E on the MSOs, cutting the tax liability among the five largest by around $500 million.”

Stems & Seeds

AI is making cannabis cultivation smarter

Enjoy your weekend, stay safe and please enjoy responsibly.

*If you’d like to help Mission \[Green\] change federal cannabis policies, please *__[click here\.](https://www.projectmissiongreen.org/donate)__

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

This article is from an external unpaid contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.