By Ben Aris in Berlin

Russia’s leading MOEX index regained its pre-war level after crossing 3,500 on May 18 as Russia’s stock market recovers thanks to investment by domestic investment.

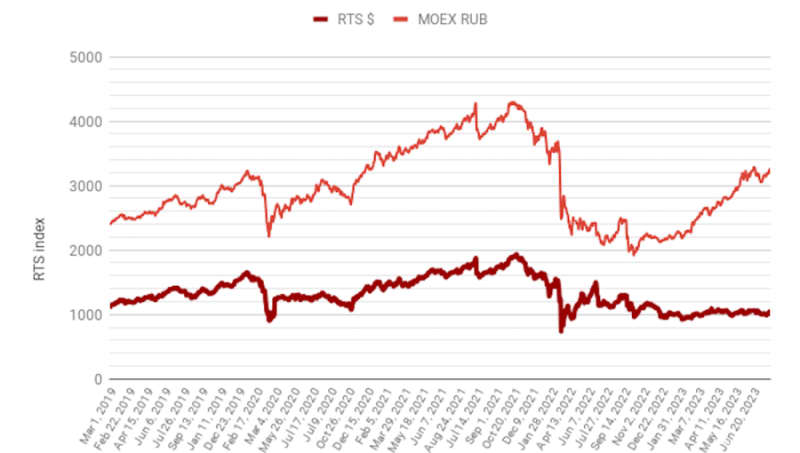

“As of the end of April, the MOEX Russia Index gained 4.1%, hitting a new record high over the past two years,” the Central Bank of Russia (CBR) said in an update. (chart)

The ruble-denominated MOEX Index exceeded 3,500 points for the first time since February 18, 2022, according to trading data on May 18. The total trading volume in April amounted to RUB124.5 trillion, remaining at the March level, but up by 38% year on year.

As reported by bne IntelliNews, Russia’s domestic stock market was booming just before the Ukraine invasion as Russian retail investors piled into equities in the autumn of 2020 as they looked for better returns than they were earning from the traditional store of wealth: bank deposits. By February 2021 they were also investing into foreign stocks, looking to diversify their portfolios and facilitated by the St Petersburg based SPB Exchange in a rapidly growing business.

Russian retail investors have traditionally kept their savings in high yielding bank deposits, but after a long run of rate cuts, by 2021 the return over inflation from bank deposits have shrunk to next to nothing, pushing Russians to cast about for alternative investments and into equities.

Since the war started inflation has soared to 7.8% in April, but the CBR has hiked rates aggressively to 16% so the spread on bank deposit rates and inflation is again very attractive, but that has not cooled the new interest in equity investments.

Nevertheless, extreme financial sanctions imposed on Russia hit the market hard and specifically cut off the foreign access to the central depositary effectively trapping the stocks owned by foreign investors inside Russia. Foreign portfolio investors have always been an important part of Russia’s equity capital market, accounting for about 40% of equity ownership and was mostly invested into the dollar denominated RTS, which has remains more or less flat since the invasion of Ukraine. Since then foreign funds holding these shares have marked down their valuation by over 90% of their nominal value as they have little hope of ever recovering their investment.

However, domestic investors and investors fromfriendly countries, who still have access to the Russian market, have been fuelling a recovery over the last two years and MOEX remains a source of capital for Russian firms looking for investment funds.

And Russia’s companies are making money thanks to the strong growth that is a result of the military Keynesianism bump. Russian corporations have mostly just reported their first quarter results. The national gas champion Gazprom reported catastrophic losses of $6.9bn and has seen its share price collapse, but most of the oil companies have made strong returns on the back of therising oil prices and the ineffectiveness of the Western oil sanctions, and their stocks have performed much better.

Tatneft reported financial results under Russian Accounting Standards (RAS) for 1Q24, with revenues up by 57% y/y and sales up by. 37% y/y. Russian oil major Surgutneftegaz posted a 1Q24 RAS revenue increase of 57% y/y to RUB650bn, although net profit declined by 30% y/y to RUB269bn ($2.9bn).

Russia's banks have also become extremely profitable. Russian banks ended 2023 with arecord RUB3.3 trillion ($33.3bn) in profits (adjusted for dividends), up by about half from the pre-war 2021 result, their most profitable year on record. The state-owned Sberbank reported an all-time high profit of $16bn in profits in 2023 and is on course to beat that record in 2024

There is a similar story in consumer related businesses. Russian national air carrier Aeroflot posted a RAS revenue increase of 58% y/y to RUB145bn in 1Q24, with net loss down five-fold y/y to RUB6.9bn ($74mn) following restrictions on the company under the sanctions regime.

And Russia’s leading agricultural company Rusagro disclosed IFRS financial results for 1Q24 where revenue increased by 44% y/y to RUB68.3bn ($751mn).

Most of Russia’s leading corporations have been hurt by the sanctions, but most of them are reporting strong gains in revenues this year, as they continue to adjust to the new realities, and profits are covering, allowing management to go back to paying dividends. There are plenty of good stories for retail investors to choose from.

And IPOs are slowly remaking their appearance. Russia was enjoying anIPO boom at the end of 2021 after years of inactivity, including 12 international IPOs of Russian companies that all earned more than $1bn each. At the start of 2022 there was a pipeline of another 24 international IPOs and more domestically that was abruptly curtained by the start of the war.

The Russian equity market has seen a rise in pre-IPO deals, according to a review by Kommersant daily, and a handful of smaller domestic IPOs. In 2023 the Russian market saw eight IPOs for a total of almost RUB41bn ($452mn), and in the first four months of 2024 there were six IPOs for RUB37.6bn. In four cases (Eurotrans, Sovcombank, Europlan, MTS Bank), the volume raised exceeded RUB10bn. The IPOs are many times oversubscribed, by over 10-40 times in some cases), as investors look into earlier stages of financing, such as venture capital and direct investments, which drives demand for pre-IPOs.