By Guy Taylor

XP Power has rejected the latest takeover proposal from the US giant Advanced Energy Industries, in a boost for London’s markets.

The Nasdaq-listed firm on Tuesday upped the stakes in its bid for XP Power, which holds a listing on London’s Main Market, offering a deal which valued its equity at £468m. It had previously tabled two bids worth £339m and £369m in October and November, respectively.

The latest offer, at a price of £19.50 per share, represents a 68 per cent premium to Singarepore-based XP Power’s closing share price of £11.64 on May 20 and an 82 per cent premium on its 30-trading day average price. The total proposed consideration of the latest offer is £571m, based on reported net debt of £103.4m

But XP’s top brass said after careful consideration with its financial adviser Rothschild and Co,it had “unanimously concluded” that the proposal “fundamentally” undervalued the company and its prospects.

The offer comes amid a slew of take-private deals involving London-listed firms, which have included the likes of Darktrace’s £4.3bn deal with Thoma Bravo.

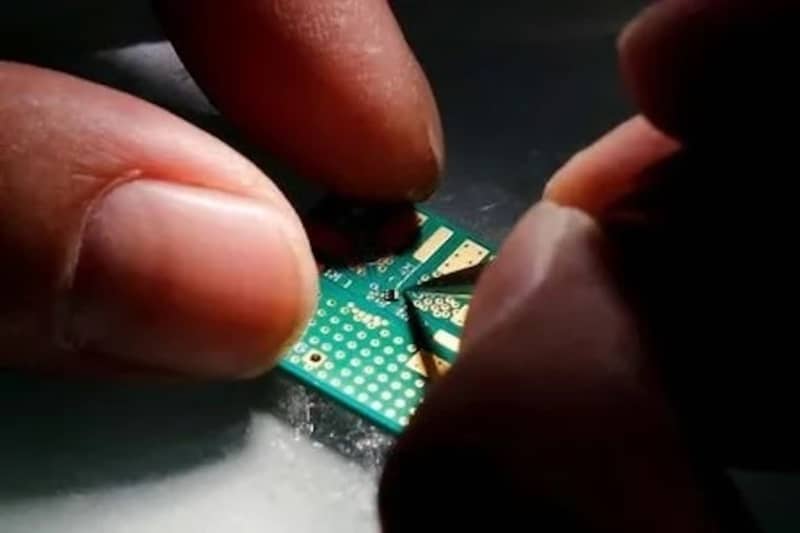

Headquartered in Denver, Colarado, Advanced Energy provides control and power technologies to the semiconductor, telecoms and renewable sectors.

“We believe that the proposed offer for XP Power provides compelling value for both Advanced Energy’s and XP Power’s shareholders,” Steve Kelley, the president and chief executive of Advanced Energy, said.

“By expanding our portfolio of products and technologies, and combining our technical capabilities, we believe we will be better able to meet the growing needs of our customers.”

In its statement to markets, the company said the acquisition would “extend Advanced Energy’s ability to service its customers with a broader and deeper set of products and technologies.”

“For semiconducter equipment use cases, the acquisition of XP Power would expand a portfolio of embedded system power solutions which would broaden Advanced Energy’s ability to support its OEM customers.”

It also said the takeover would boost its presence in the US, Europe and Asia Pacific.

Advanced Energy said it had $1bn cash on hand and low-cost debt as of 21 May. Any offer would be subject to Singaporean takeover regulations as opposed to City rules on mergers and acquisitions.