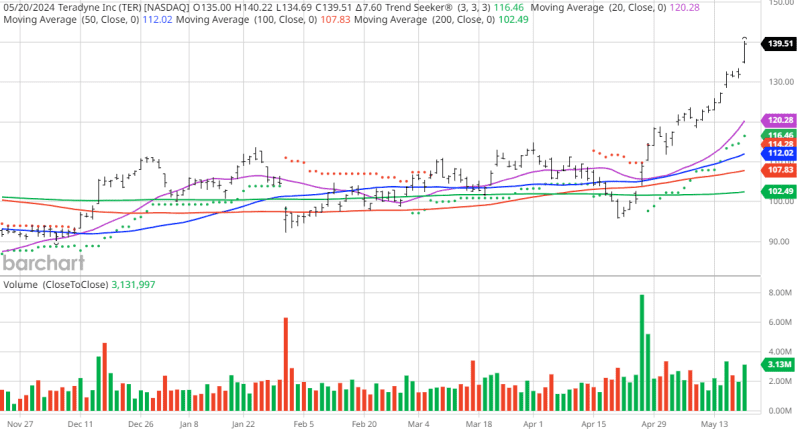

The Chart of the Day belongs to the semiconductor company Teradyne (TER). I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 4 /29 the stock gained 18.03%.

Teradyne, Inc. designs, develops, manufactures, and sells automated test systems and robotics products worldwide. It operates through four segments; Semiconductor Test, System Test, Robotics, and Wireless Test. The Semiconductor Test segment offers products and services for wafer level and device package testing of semiconductor devices in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game, and other applications. This segment also provides FLEX test platform systems; J750 test system to address the volume semiconductor devices, including microcontrollers; Magnum platform that tests memory devices, such as flash memory and DRAM; and ETS platform for semiconductor manufacturers, and assembly and test subcontractors in the analog/mixed signal markets. It serves integrated device manufacturers that integrate the fabrication of silicon wafers into their business; fabless companies that outsource the manufacturing of silicon wafers; foundries; and semiconductor assembly and test providers. The System Test segment offers defense/aerospace test instrumentation and systems; storage and system level test systems; and circuit-board test and inspection systems. The Wireless Test segment provides wireless test solutions for silicon validation, wireless module manufacturing, and wireless end device manufacturing under the LitePoint brand. This segment also offers IQxel-MX and IQxel-MW7G series products for edge measurement performance in the manufacturing of connectivity products; IQxstream-5G and IQgig-5G family products to support 4G and 5G technologies; and IQgig-UWB+ for certification and manufacturing test support for ultra wideband products. The Robotics segment provides collaborative robotic arms, autonomous mobile robots, and advanced robotic control software for manufacturing, logistics, and industrial customers. The company was incorporated in 1960 and is headquartered in North Reading, Massachusetts.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 49.46+ Weighted Alpha

- 43.89% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 45.59% in the last month

- Relative Strength Index 79.80%

- Technical support level at $130.72

- Recently traded at $139.51 with 50 day moving average of $112.02

Fundamental Factors:

- Market Cap $20.60 billion

- P/E45.50

- Dividend yield .34%

- Revenue expected to grow 3.30% this year and another 22.30% next year

- Earnings estimated to increase 5.50% this year, an additional 54.40% next year and continue to compound at an annual rate of 7.68% for the next 5 years

Analysts and Investor Sentiment \-- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 9 strong buy, 1 buy, 7 hold and 1 sell recommendation

- Analysts have price targets from $100 to $161

- Value Line has the stock rated its average rating of 3 and a price target of $151

- CFRAs MarketScope has a hold rating with a price target of $104

- MorningStar gives the stock an average 3 star rating with a Fair Value of $135

- 26,520 investors monitor the stock on Seeking Alpha

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.