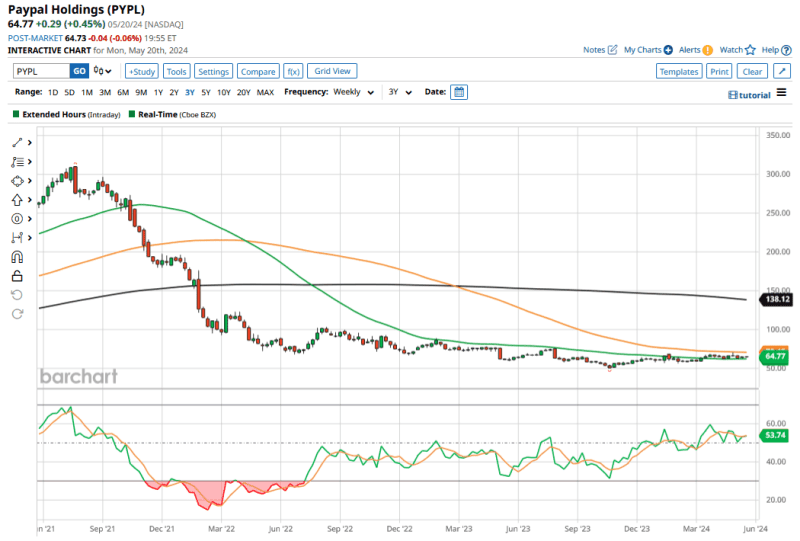

With a YTD gain of only around 4.4%, PayPal (PYPL) is underperforming the S&P 500 Index ($SPX) in 2024. That said, the stock’s underperformance is not limited to 2024, and it has closed in the red in the previous three years - completely missed out on the rally in tech stocks.

PayPal has lost three-fourths of its market cap over the last three years, and fell to multi-year lows last year before rebounding slightly. In this article, we’ll discuss why PYPL stock has been underperforming so badly, and whether it should consider initiating a dividend now.

Why Is PYPL Stock Underperforming?

PayPal’s growth – both on the top line as well as the bottom line – has sagged. Its revenues rose 9% YoY in Q1 2024, and analysts expect full-year sales to rise 7.5% and 8.1%, respectively, in 2024 and 2025.

The fintech's profit growth has been muted, and it expects 2024 earnings per share (EPS) to grow in the “mid-to-high single digits.” The updated guidance was nonetheless an improvement over the previous forecast of flat earnings in 2024.

With rising competition, digital payment companies have been feeling pressure on their take rate (the fees they charge for processing the transaction). PayPal’s GAAP operating margin, which hit 18.1% in Q2 2020 despite higher credit losses that quarter, fell to 15.2% in Q1 2024.

PayPal Stock Forecast

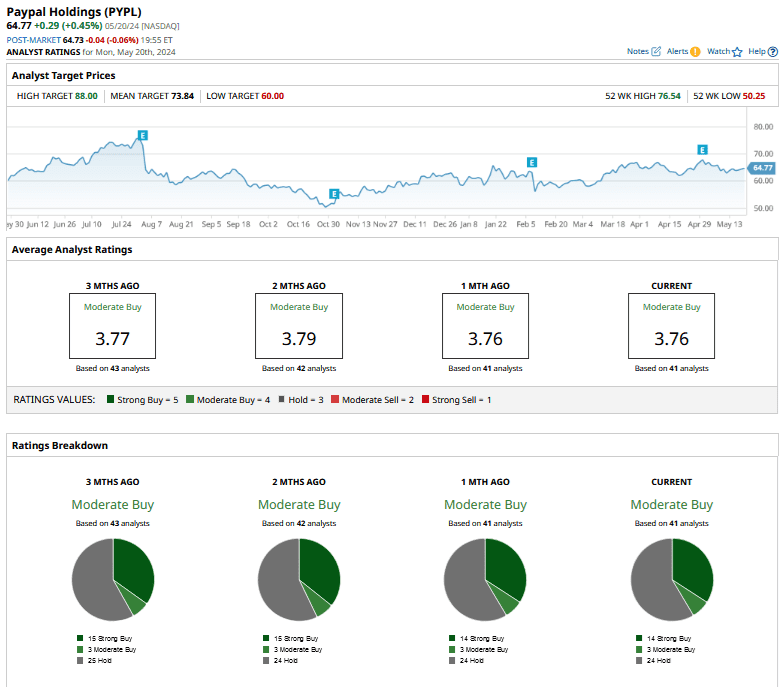

Wall Street analysts rate PYPL stock as a “Moderate Buy.” Of the 41 analysts covering PayPal, only 14 rate it as a “Strong Buy,” while 3 say it's a “Moderate Buy.” The remaining 24 rate the stock as a “Hold” or some equivalent. Its mean target price of $73.84 is 15% higher than today’s closing prices, while the Street-high target price of $88 is almost a 37.3% premium.

PayPal Is a Value Stock Now

Last year, PayPal appointed Alex Chriss as its CEO, who has been trying to transform the business by focusing on profitable growth and product innovation. So far, these actions haven’t cut much ice with either the markets or sell-side analysts.

PayPal trades at a next 12-month (NTM) price-to-earnings multiple of 15.7x. The company expects to generate free cash flows of around $5 billion in 2024, and given its current market cap of around $68 billion, we get a 2024 price-to-free cash flow multiple of 13.6x.

Amid the dismal price action over the last few years, PayPal’s valuations have plummeted, and it now almost looks like a value stock – a far cry from a prominent growth name it once was.

Should PayPal Start Paying a Dividend? Morgan Stanley Says Yes

While tech companies are not exactly known for paying fat dividends, and instead use their hefty free cash flows to either reinvest in the business or share repurchases, the clamor for tech dividends has risen.

Meta Platforms (META) and Alphabet (GOOG) – two of the "Magnificent 7" constituents – have initiated dividends in 2024. Chinese tech giant Alibaba (BABA) \- the “Amazon of China” - also initiated a dividend in late 2023, after years of underperforming markets.

In a note earlier this month, Morgan Stanley listed PayPal as among the tech companies that could follow the lead of Meta and Alphabet and start paying a dividend.

To be sure, PayPal boasts negative net debt, and the cash and investments that it holds on its balance sheet are higher than the debt it owes. It also generates positive free cash flows regularly, and is in a strong financial position where it can consider paying a dividend.

Some investors prefer companies that pay a dividend. Specifically, some funds are bound to invest in only dividend-paying companies. By initiating a dividend, PayPal could make its shares more appealing to this set of investors. The argument would make even more sense amid the stock’s underperformance over the last three years.

Why Share Repurchases Are a Better Strategy for PayPal for Now

However, I believe the time is not ripe for PayPal to initiate a dividend for two main reasons. First, the company is currently in what Chriss described as a “transition” year. It is working on the business transformation and is figuring out its investment priorities. I believe PayPal should first focus on the business transformation before making a call on dividends.

Second, and perhaps more importantly, given its depressed valuations, it would make sense for PayPal to repurchase more shares. The company has in fact been working along those same lines, and expects its share repurchases to be at least $5 billion in 2024 – which, for context, is similar to the free cash flows that it expects to generate this year.

PayPal should certainly start paying a dividend sometime over the next couple of years, as the business is quite mature and generates stable cash flows. However, for now, repurchasing shares seems to be a better capital allocation decision for PayPal.

On the date of publication, Mohit Oberoi had a position in: PYPL , META , GOOG , BABA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.