We’re all familiar with perhaps the most well-known of Aesop’s Fables, “The Tortoise and the Hare,” which teaches us how “slow and steady” wins the race.

As it happens, a real-life Tortoise and Hare race is playing out at the moment in the global auto market.

There are several categories of electrified vehicles (EVs): hybrids, plug-in hybrids, battery electric vehicles, and fuel-cell vehicles. Hybrids use a combustion engine to create electricity, which then powers the motors. Plug-in hybrids split the difference with EVs, offering both gasoline and battery-powered driving.

But for many automakers - and many stock investors - there is only one category, and that's battery electric vehicles (BEVs).

Elon Musk’s Tesla (TSLA)is the best-known company that exclusively ships BEVs. Its closest rival, BYD (BYDDY), exited the combustion engine car market in 2022, and last year produced a roughly even split between battery and hybrid cars.

Then we have Japanese automakers, such as Toyota Motor (TM)and Honda Motor (HMC), which have been emphasizing hybrids over pure EVs. Hybrids do burn fossil fuels, but they’re still better than full-combustion vehicles, and produce lower emissions than BEVs charged by coal-fired power stations. The deciding factor is the cleanliness of a region’s electricity supply.

If we look at Toyota, just 37% of the vehicles it sold last fiscal year were electrified, up from 30% the year prior. But only 1.1% of its retail car sales were battery electric.

Nevertheless, this cautious approach toward electric vehicles looks more and more like the winning “tortoise” strategy versus Tesla’s “hare” strategy.

Despite all of the hype surrounding EVs, most consumers aren’t ready to make the shift. Range anxiety is among the primary reasons, along with higher costs.

Drivers are confident that there’s always a gasoline station close at hand, but worry there’s a lack of charging bays. They have reason for concern; there are five times as many gas pumps as EV chargers in the U.S., according to a study by the EV solutions provider NovaCHARGE.

So rather than preach to unwilling customers, Toyota and Honda are letting car buyers dip their toes into greener waters through their hybrid vehicles. Let’s take a look at how that strategy is paying off for these companies.

Hybrids Are a Moneymaker

The reality is that many hybrids make automakers double-digit returns, compared with often loss-making electric cars.

Toyota, the world’s largest automaker, recently reported an annual operating profit of $32 billion \- the first time any Japanese company reached that threshold. It also had an industry-topping margin of 11.9%. That's thanks to the cost to manufacture hybrid vehicles now weighing in at just one-sixth of the levels when the Prius first debuted in Japan back in October 1997, and was introduced in America in July 2000.

Hybrid sales jumped 32% to 3.59 million units, accounting for one out of every three cars Toyota sells. As consumers vote for hybrids with their wallets, it gives Toyota and Honda an opportunity to hoover up cash that can then be reinvested into the long-term transition to fully electric vehicles.

Toyota forecasts 4.48 million hybrid vehicle sales in the current fiscal year through March 2025. It has a goal of 5 million units for the next fiscal year, which it will likely surpass.

The company said recently that it aimed to increase spending on new technologies — such as artificial intelligence (AI), EVs, and software — by more than 40%, while sales of hybrid cars are boosting its profits to record levels.

Honda has also improved the profitability of its hybrids. Excluding EVs, Honda’s car business should be able to post an operating profit margin of around 8% this fiscal year, according to the company. The low profitability of the car unit has been an issue for years; its margin stood at 4.1% last year.

Honda is targeting hybrid sales of about 1 million units this fiscal year, up from approximately 800,000 in the latest period. And in anticipation of greater demand, Honda is working on building capacity to 2 million units annually.

Let’s hone in specifically on Honda’s plans.

Honda’s Electric Plans

While the company will continue to boost hybrid vehicle offerings - it expects hybrid demand to rise throughout the decade - its investment plans signal it is bullish on full electrification over the longer term.

The plan centers on rolling out new hybrids that will be smaller, more energy-efficient, and cheaper to build, in order to generate cash to expand its EVs business.

Honda will invest $65 billion on its electrification strategy through fiscal 2031, as it expects demand for battery-powered vehicles to rebound from the current headwinds.

The spending will cover areas including software, research and development, and establishing supply chains in key markets, including the U.S., Canada, and Japan.

Honda will roll out seven new EV models globally and produce more than 2 million EVs by 2030, representing about 40% of its global auto sales. It also plans to start selling two new EV models in China later this year, and will introduce an EV with a swappable battery to Japan by the end of fiscal 2026.

As with other automakers, supply chains are a core concern for Honda. It announced in April that it will spend $11 billion to build one in Canada, where it will start producing EVs in 2028. The automaker aims to reduce EV manufacturing costs by about a third and bring down battery procurement costs by 20% in North America.

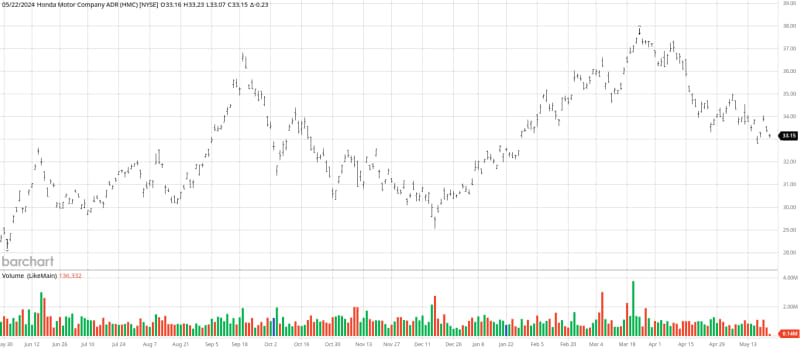

Both Toyota and Honda are following the correct strategy by being tortoises instead of hares. But while Toyota stock has soared, Honda’s stock is still stuck in the slow lane. That makes HMC a buy anywhere in the mid-30s.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.