Earlier this month, Chinese electric vehicle (EV) company Zeekr Intelligent Technology Holding (ZK) went public in the U.S. in an upsized IPO. It was the first major Chinese EV company to list in the U.S. after the 2020 euphoria, when both Li Auto (LI) and Xpeng Motors (XPEV) went public in quick succession. It was also the biggest U.S. IPO by a Chinese company since ride-hailing app Didi's ill-fated 2021 listing.

Zeekr opted for a traditional IPO instead of a special purpose acquisition company (SPAC) merger, which has been the preferred route for green energy companies.

The IPO’s timing was crucial for two reasons. First, Chinese EV stocks have crashed, and currently trade at a fraction of their previous highs. Second, market sentiments towards the sector are tepid at best amid the pessimism toward Chinese stocks in general, and EV names in particular.

Zeekr Had a Successful IPO

Incidentally, Zeekr’s IPO came amid reports that President Joe Biden was considering increasing the tariffs on some Chinese goods, including EVs. The U.S. did go on to impose sweeping tariffs on Chinese EVs, as widely expected.

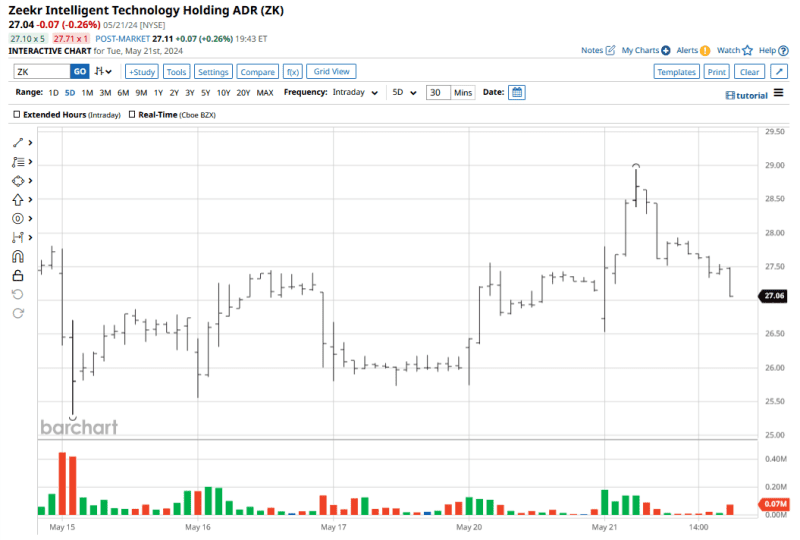

Zeekr had a successful IPO and jumped almost 35% on its first trading day after pricing its IPO at $21 per share, at the upper end of its price range. The stock has since pared its gains and trades at just below $27 – a significant discount to its $32.24 price peak.

What’s the forecast for Zeekr stock from here, and can the company compete in an increasingly crowded Chinese EV industry? We’ll discuss in this article.

Zeekr Is a Premium Brand Backed by Geely

Zeekr was incorporated in March 2021, and is a premium EV maker backed by Geely Holdings, which also owns Volvo (VLVLY) and Polestar (PSNY) brands. The company currently offers the following models:

- 009, a luxury six-seater MPV

- 001, a five-seater, cross-over hatchback

- 001 FR, a cross-over hatchback

- X, a compact SUV, and an upscale sedan model

The company delivered 49,148 vehicles in the first four months of 2024, which for context, is higher than what NIO (NIO) and Xpeng delivered over the period. Zeekr is targeting deliveries of 230,000 cars in 2024, which is almost twice what it delivered in the previous year.

ZK Stock Forecast

The EV maker generated revenues of $7.3 billion in 2023. In comparison, NIO reported revenues of $7.7 billion, while Xpeng – whose deliveries sagged in the first half of the last year – could generate only about $4.3 billion.

Zeekr’s current market cap is around $6.7 billion, which gives us a 2023 price-to-sales multiple below 1. NIO and Xpeng Motors trade at a 2023 price-to-sales multiple of 1.39x and 1.80x, respectively. The 2024 delivery outlook for Zeekr also looks promising compared to its peers. That said, both Xpeng and NIO hold much more cash on their balance sheet as compared to Zeekr.

Having a strong balance sheet is quite important for loss-making EV companies, considering the tough macro environment and the relentless price war. That especially holds true in the hyper-competitive Chinese market, where multiple domestic and international players, including Tesla (TSLA) are trying to grab a piece of the world’s biggest automotive market through aggressive pricing.

Chinese EV Industry Outlook Amid Price War and Rising Competition

China’s EV overcapacity isn’t exactly a secret, and earlier this year, the country's vice minister of industry and information technology said that the government will take “forceful measures to prevent superfluous projects." According to Automobility, China has an excess EV production capacity of between 5 million-10 million units – no small number, by any standards.

China, however, has denied that its EV industry gets any unfair subsidies, and has emphasized that it is just more efficient – an assertion that Elon Musk himself might agree with, given his praise for Chinese EV companies.

Meanwhile, amid fears that China’s exports will flood their markets, several countries have either imposed stiff tariffs on Chinese EVs or are contemplating doing so. To be sure, China has exported its overcapacity woes in the past, in industries ranging from steel to chemicals and solar panels.

Should You Buy Zeekr Stock?

Zeekr's listing provides investors with yet another alternative to invest in the world’s biggest and perhaps most competitive EV market. While Chinese stocks are still uninvestable for many U.S. investors, considering the policy uncertainty under President Xi Jinping and the near-Cold War between the U.S. and China, Chinese EV stocks look like an asset class worth having some exposure to.

While Zeekr's valuations look reasonable and its 2024 guidance implies strong growth, investors also have reason to be wary about the company, given the dismal past performance of Geely-backed companies - which have lost 60% on average since the listing.

Polestar is a case in point, as it trades below $1 compared to the SPAC merger price of $10. The company is also facing a possible Nasdaq delisting due to the non-filing of its annual report. While past performance is never an indication of the future, it would be safe to say that history is not on Zeekr's side in an increasingly competitive Chinese EV industry.

On the date of publication, Mohit Oberoi had a position in: NIO , XPEV , LI , TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.