In recent years, artificial intelligence (AI) has been revolutionizing various sectors, and drug development is no exception. Projections indicate that the global AI in drug discovery market is set to reach $4.6 billion in size by 2030, expanding at a solid 27.6% compound annual growth rate.

A recent study by consultancy giant Boston Consulting Group (BCG) highlighted that drugs discovered using AI have an 80% to 90% success rate in Phase I clinical trials, significantly higher than the historical average of Phase I success rates. This indicates that AI is highly effective at identifying molecules with promising drug-like properties.

Considering AI's tremendous potential to double the productivity of companies operating in this space, it might be an opportune time to scoop up shares of three promising AI-driven small-cap stocks, Recursion Pharmaceuticals, Inc. (RXRX), Schrödinger, Inc. (SDGR), and Exscientia plc (EXAI). Let’s take a closer look.

Small-Cap Stock #1: Recursion Pharmaceuticals

With a market cap of $2.23 billion, Utah-based Recursion Pharmaceuticals, Inc. (RXRX) is a leading clinical-stage “TechBio” company revolutionizing drug discovery by decoding biology. Its core platform, the Recursion OS, integrates diverse technologies to expand one of the world’s largest proprietary biological and chemical datasets.

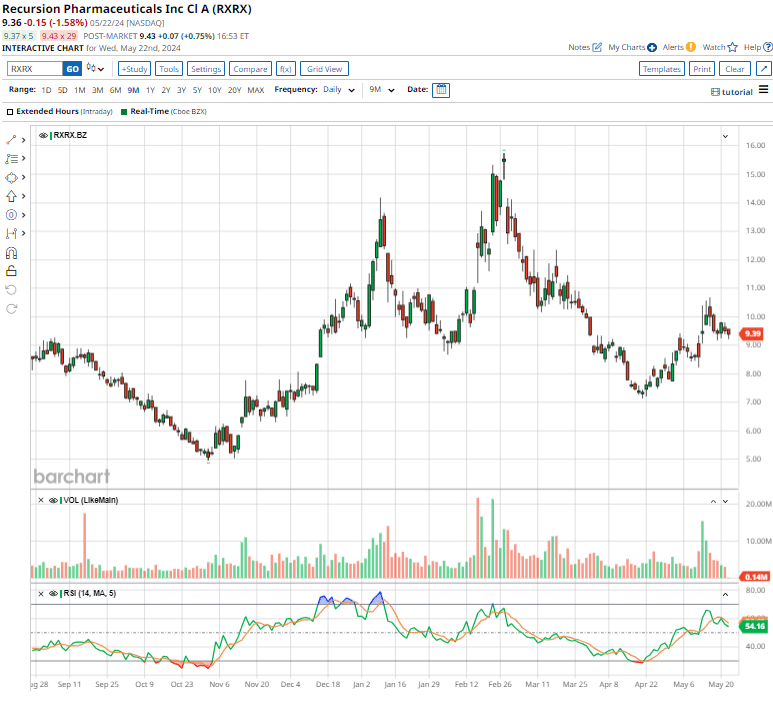

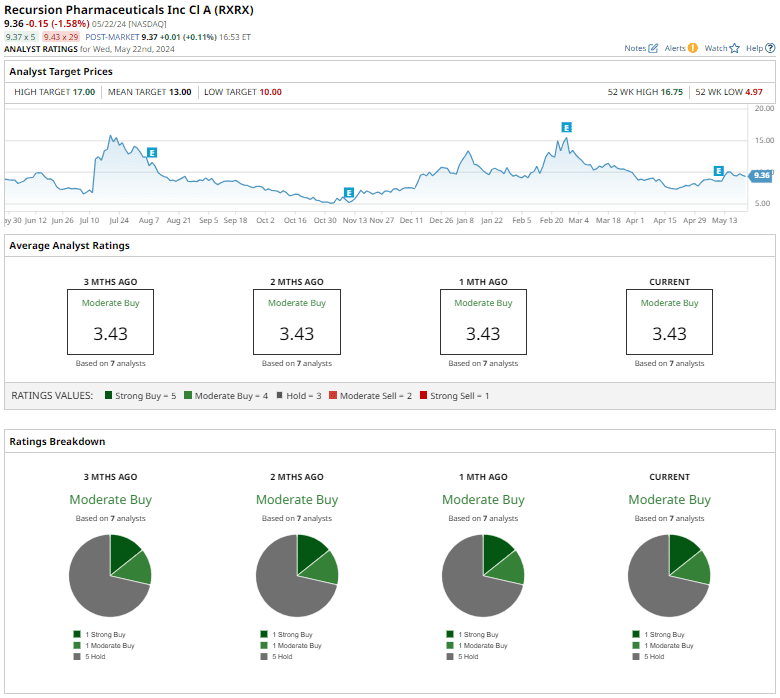

Shares of Recursion have rallied 13.6% over the past 52 weeks and 36% over the past six months.

On May 9, Recursion reported its Q1 earnings results, which sailed past Wall Street’s predictions. The company’s total revenue soared 13.7% annually to $13.8 million, beating estimates by 5.6%. Its loss per share of $0.39 outshone forecasts by 9.3%.

During the quarter, the company’s Research and Development (R&D) expenses amounted to $67.6 million, up 44.7% year over year. This surge in R&D expense spanned all developmental stages and reflects the company's ongoing efforts to enhance and broaden its platform. As of March 31, the company held $296.3 million in cash and cash equivalents.

On May 13, the company grabbed investors’ attention by revealing its latest AI supercomputer, BioHive-2, powered by Nvidia (NVDA) DGX SuperPOD technology, sending its shares soaring nearly 10.2%. This cutting-edge Nvidia-powered supercomputer delivered four times the speed of Recursion's previous supercomputer, BioHive-1, in benchmark performance tests. BioHive-2 is the fastest supercomputer owned and operated by any pharmaceutical company globally.

While the company didn't provide any guidance, analysts tracking Recursion expect its loss per share to narrow by 8.1% in fiscal 2025.

Recursion stock has a consensus “Moderate Buy” rating overall. Out of the seven analysts covering the stock, one suggests a “Strong Buy,” one advises a “Moderate Buy,” and the remaining five give a “Hold” rating.

The average analyst price target of $13 indicates a potential upside of 36.9% from the current price levels. However, the Street-high price target of $17 suggests that the stock could rally as much as 79.1%.

Small-Cap Stock #2: Schrödinger

New York-based Schrödinger, Inc. (SDGR) develops a physics-based computational platform that facilitates the discovery of novel molecules for both drug development and materials applications. Valued at $1.6 billion by market cap, the company offers services to biopharmaceutical and industrial companies, academic institutions, and government laboratories across the globe.

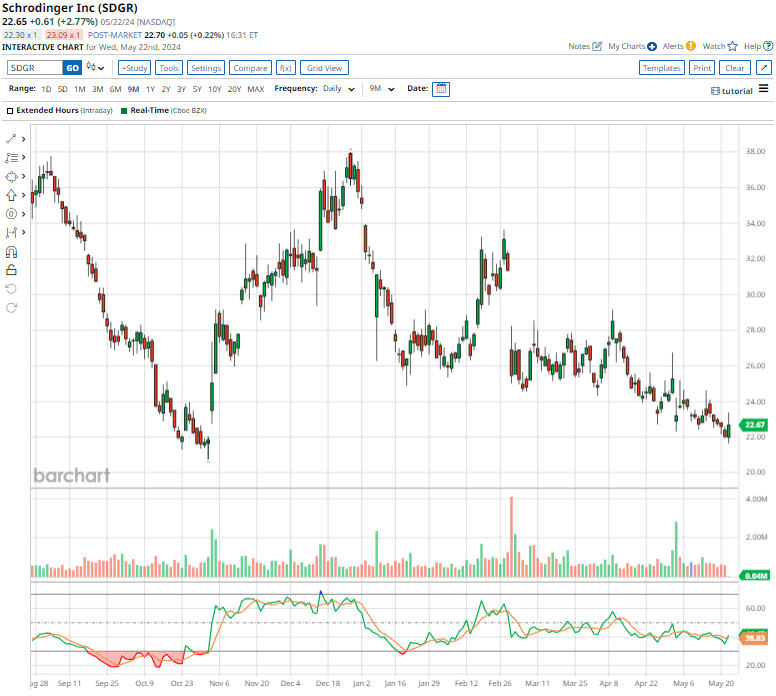

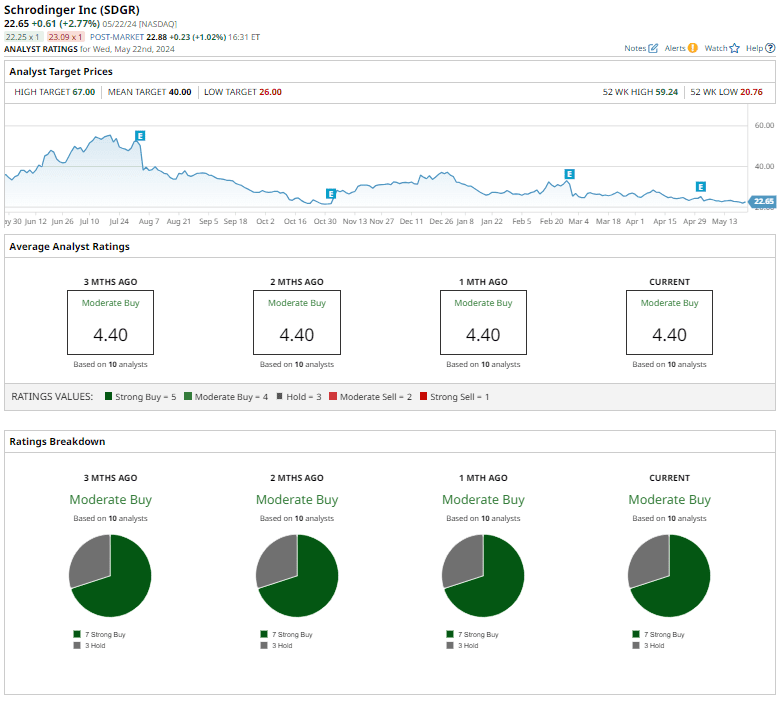

Shares of Schrödinger have pulled back nearly 42% over the past 52 weeks.

On May 1, Schrödinger disclosed its Q1 earnings results, reporting a total revenue of $36.6 million, while its loss per share of $0.76 aligned with expectations. As of March 31, the company held around $435.7 million in liquid assets. Additionally, on the same day, Schrödinger announced that it received clearance from the Food and Drug Administration (FDA) for its investigational new drug (IND) SGR-3515.

“Over the past year, we have witnessed unprecedented interest in computational drug discovery, and we are excited by the growing appreciation for using computation to drive pharmaceutical innovation. We are excited about the opportunities we have to increase customer adoption of our platform this year and drive revenue growth going forward,” said CEO Ramy Farid, Ph.D.

For fiscal 2024, management reaffirmed its guidance. Software revenue is anticipated to grow between 6% and 13%, while drug discovery revenue is projected to range between $30 million and $35 million. Analysts tracking Schrödinger expect the company’s loss per share to narrow by 38.5% in fiscal 2025.

Schrödinger stock has a consensus “Moderate Buy” rating overall. Out of the 10 analysts offering recommendations for the stock, seven suggest a “Strong Buy,” and the remaining three give a “Hold” rating.

The average analyst price target of $40 indicates a potential upside of 76.6% from the current price levels, while the Street-high price target of $67 suggests a remarkable potential upside of nearly 196%.

Small-Cap Stock #3: Exscientia

Headquartered in Oxford, the UK, Exscientia plc (EXAI) is an AI-driven precision medicine company dedicated to rapidly discovering and developing optimal drugs. It created the first functional precision oncology platform to enhance treatment selection and patient outcomes in clinical studies and to advance AI-designed small molecules to clinical trials. Exscientia’s market cap currently stands at $568 million.

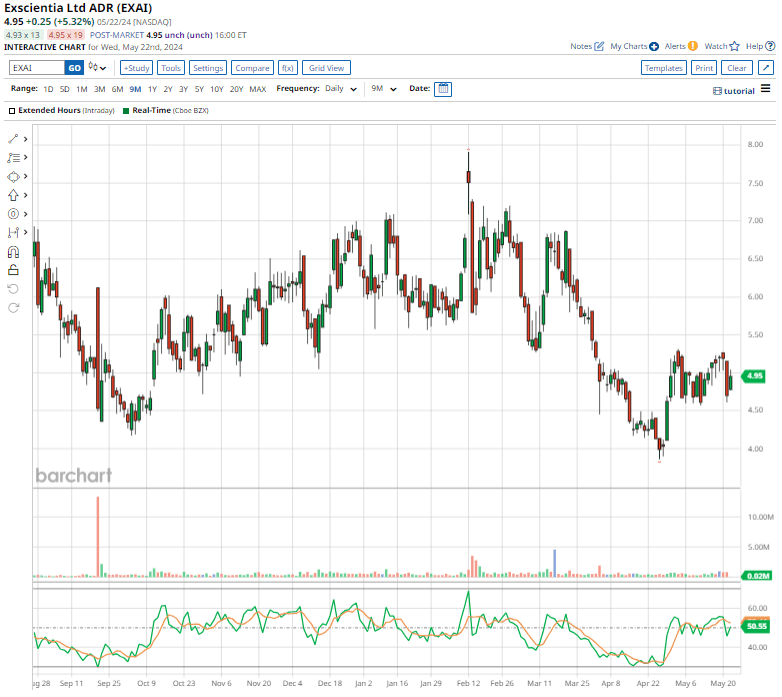

Shares of Exscientia have surged 16.5% over the past month, though the biotech stock is still down 22.8% YTD.

On May 21, Exscientia reported its Q1 earnings results. Although revenue dipped slightly to $6.7 million, there was a notable annual improvement of 46.2% in its loss per share, which stood at $0.21. R&D expenses declined 29.4% year over year to $29.8 million, which was mainly attributed to strategic cost-saving measures from pipeline prioritization initiatives initiated in the latter half of 2023, coupled with operational enhancements, including faster cycle times and decreased outsourcing expenses.

“With the ramp up of activities at our automation lab, we are beginning to see the transformative power of fully integrating AI drug design with the sheer capacity of comprehensive robotic automation across the entire experimentation cycle,” said Dr. David Hallett, Exscientia's interim CEO and Chief Scientific Officer. Hallett further highlighted the company’s intentions to expand its oncology-focused internal clinical-stage pipeline.

Looking ahead, Exscientia will maintain its strategic focus while rolling out efficiency measures to streamline operations for the rest of the year. These initiatives are expected to generate annualized savings surpassing $40 million starting in 2025. Analysts tracking Exscientia expect the company’s loss per share to improve by 3.4% in fiscal 2025.

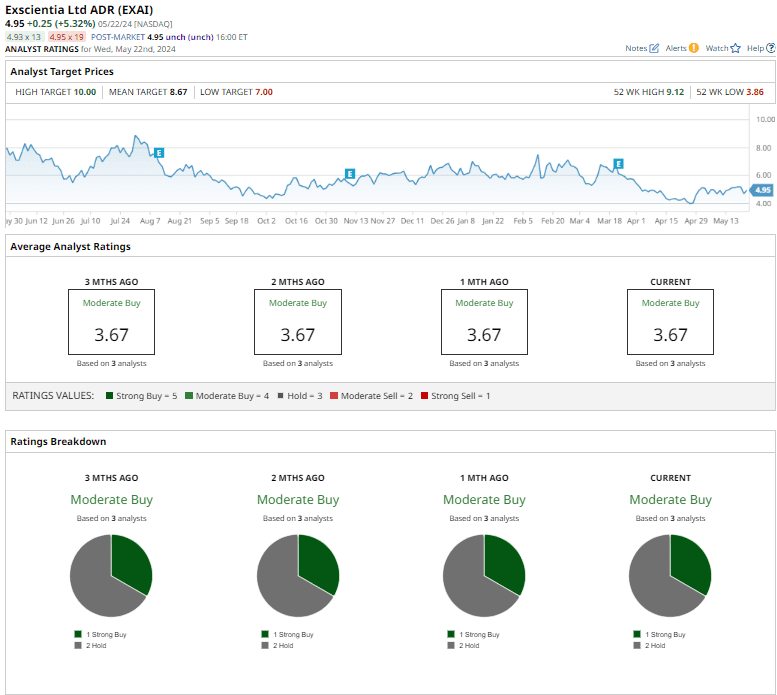

Exscientia stock has a consensus “Moderate Buy” rating overall. Out of the three analysts covering the stock, one recommends a “Strong Buy,” and the remaining two give a “Hold” rating.

The average analyst price target of $8.67 indicates potential upside of 75.2% from the current price levels, and the Street-high price target of $10 suggests that the stock could rally as much as 102%.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.