Major purchases by company insiders, like executives and major shareholders, can be a bullish signal for the stock. Their unique access to the company's inner workings gives them a potential edge in valuing it. When they put their own money behind the stock, it suggests confidence in the company's future.

That's why it's interesting to note recent insider buying in the shares of a real estate investment trust (REIT) recently, after a gap of about a year and a half.

About Public Storage Stock

Founded in 1972, Public Storage (PSA) is the world's largest owner and operator of self-storage facilities, with over 2,900 locations across the U.S., serving nearly 2 million customers. They offer a variety of storage solutions including standard units, climate-controlled units, vehicle storage, and boat storage. Its market cap currently stands at $49.74 billion.

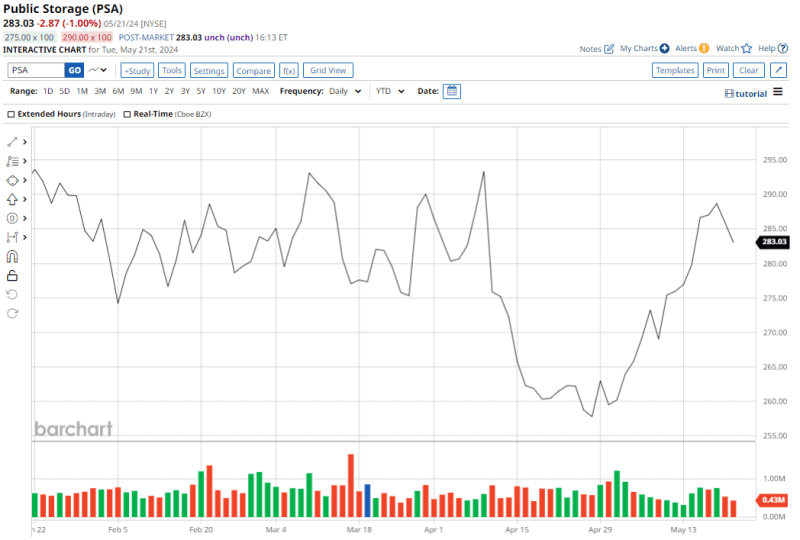

PSA stock is down 7.2% on a YTD basis, though it's rallied a quick 10% from its May 1 low. The REIT pays a quarterly dividend of $3.00, for a yield of 4.2%, and it's backed by roughly three decades of consistent payments.

On May 14, Kristy M. Pipes, a Public Storage board member, purchased 2,149 shares at an average price of $278.96 each for a total value of $599,486. The stock is up about 1.5% in the week since.

Prior to that, the last insider purchase of PSA stock was back in December 2022, when CEO Joseph D. Russell, Jr. bought 2,500 shares for an average price of $297.65 each, totaling $744,137.

Of course, a single insider buy isn't enough reason to pile into the REIT - even with its high yield as an added incentive. Here's what else you should know about PSA right now.

PSA Reports Mixed Q1 Earnings

With revenues beating and funds from operations (FFO) missing estimates, Public Storage's numbers for the latest quarter - reported on April 30, about two weeks before Pipes bought shares - were mixed. However, the company reported YoY growth on both fronts.

Revenues for the first quarter came in at $1.16 million, up 6% from the previous year, as the company's core segments of Self-storage Facilities and Ancillary Operations both reported growth. FFO increased even more sharply, up 7.6% over the same period to $4.24 per share. Rising expenses weighed on PSA, up to $702.5 million in Q1 of 2024 from $568.5 million in Q1 of 2023.

That said, the company closed the quarter with a cash balance of $271.6 million, and the value of its real estate holdings also increased to $27.6 million from $27.5 million at the start of the year. Looking ahead, CEO Russell called out "positive trends in customer behavior and waning deliveries of competitive new supply across the country."

What's the Outlook for Public Storage?

As mentioned earlier, Public Storage is the world's largest owner and operator of self-storage facilities. It operates in an industry that is projected to reach $101.8 billion in size by 2032, which positions Public Storage well to leverage its leading position and expand its own market share.

Notably, the company's growth has been stellar since the global financial crisis. Its income has expanded at a CAGR of 5.1% since then, which is almost double that of the broader real estate sector. Further, the company is fundamentally strong with an A-rating in terms of credit and a solid balance sheet.

Moreover, to sustain its leadership edge, PSA has fully incorporated a digital app and ecosystem into its operations. The REIT's customer sourcing channels, e-rental agreement solution, and available properties are all part of the real estate sector's first end-to-end digital ecosystem platform.

Plus, the company has earmarked considerable budgets of $500 million and $450 million for incremental acquisition and development activity, respectively, in 2024, to further expand its presence - suggesting that though it may be a mature REIT, PSA still has its eye on growth.

Analysts Say PSA Is a Buy

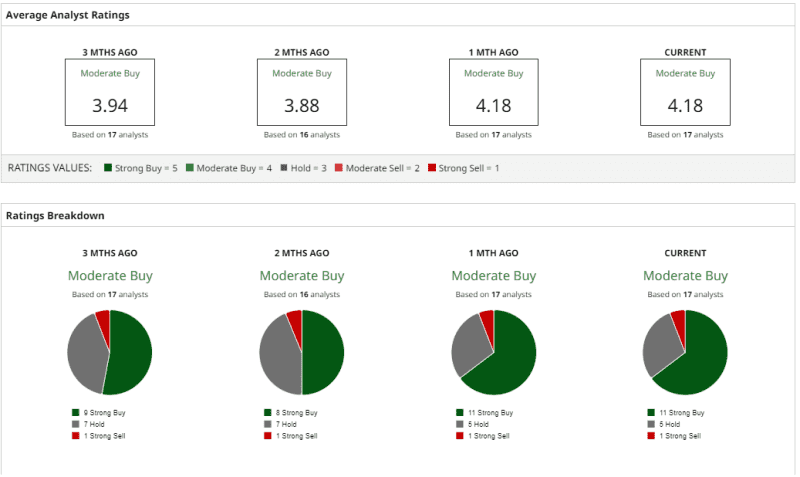

Analysts see more upside in store, too - and in fact, they've gotten more optimistic on Public Storage stock over the past few months, with a couple of experts migrating from the “Hold” camp to “Strong Buy” ratings.

Overall, analysts deem the stock a “Moderate Buy,” based on 11 “Strong Buy” ratings, 5 “Holds," and 1 “Strong Sell.”

The mean price target for PSA is $309.60, indicating upside potential of about 9.4%. The Street-high target stands at $348, which is roughly 23% overhead.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.