Dividend stocks offer a reliable income stream, which is especially appealing to retirees and income-oriented investors. Furthermore, dividend stocks can also provide significant total returns through capital appreciation. Overall, dividends can increase long-term investment returns significantly.

Here, we have three high-yielding dividend stocks: ONEOK (OKE) which pays a dividend yield of 4.7%; Dominion Energy (D), with a yield of 4.9%; and Altria Group (MO), which yields 8.4%.

While a high yield may be tempting to income-oriented investors, there are other considerations when selecting a dividend stock. Companies in emerging industries with strong financials have a better chance of maintaining dividend payments, despite market volatility.

Let's find out if these three are good dividend stocks to pounce on now.

1. ONEOK

ONEOK Inc. (OKE) is a major midstream service provider in the natural gas industry, specializing in the gathering, processing, storage, and transportation of natural gas (NGM24) and natural gas liquids (NGLs).

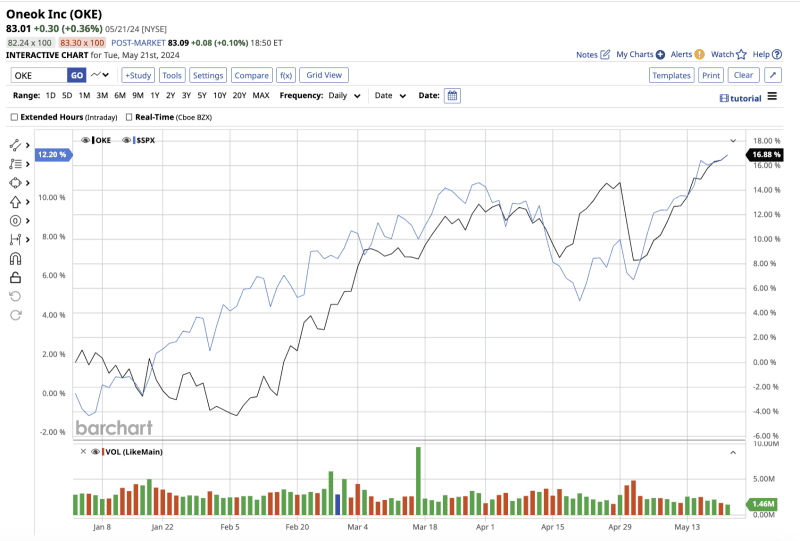

Valued at $48.4 billion, ONEOK’s stock is up 16.3% year-to-date, outperforming the S&P 500 Index’s ($SPX) surge of 11.3% over the same period.

In its first quarter, net income stood at $639 million, translating to earnings per share (EPS) of $1.09, a dip from $2.34 in the year-ago quarter. ONEOK’s forward dividend yield of 8.4%, is higher than the energy sector average yield of 4.2%.

The forward dividend payout ratio calculates the proportion of earnings distributed as dividends. The ratio also shows how effectively a company uses its earnings to reward shareholders while still leaving enough capital for growth and debt repayment.

ONEOK's payout ratio is around 71.9%, which, while high, is manageable if the company continues to grow earnings and generate positive free cash flow. The company generated $84 million in free cash flow during the most recent quarter.

Furthermore, in Q1, the company authorized a $2 billion share repurchase program, which it intends to implement over the next four years. Management anticipates a 10% decrease in earnings to $4.92 per share for the full year. Analysts expect earnings to fall 9.4% in 2024 before rising 10.6% in 2025.

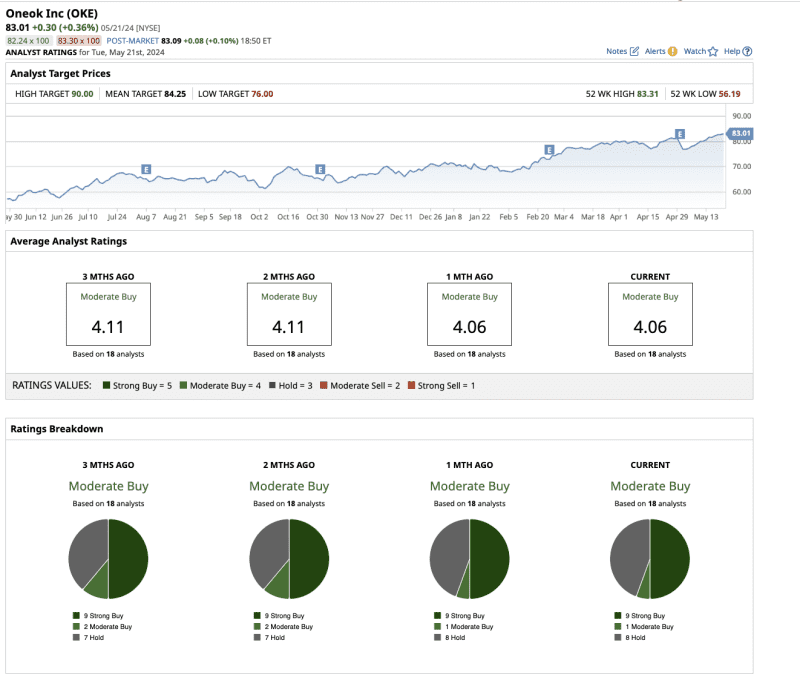

What Does Wall Street Say About ONEOK Stock?

Overall, analysts have an average rating of “moderate buy” for OKE stock, with a mean target price of $84.25. This denotes an upside potential of about 3.2% from current levels.

The high target price of $90 implies an upside potential of 10.2% over the next 12 months. Out of 18 analysts covering the stock, nine have a “strong buy” rating, one has a “moderate buy” rating, and eight have a “hold” rating.

2. Dominion Energy

Dominion Energy (D) is a leading utility company that supplies electricity and natural gas to nearly 7.5 million customers in 18 states. The company manages a diverse portfolio of energy assets, which includes electric generation, transmission, and distribution, as well as natural gas storage and transportation.

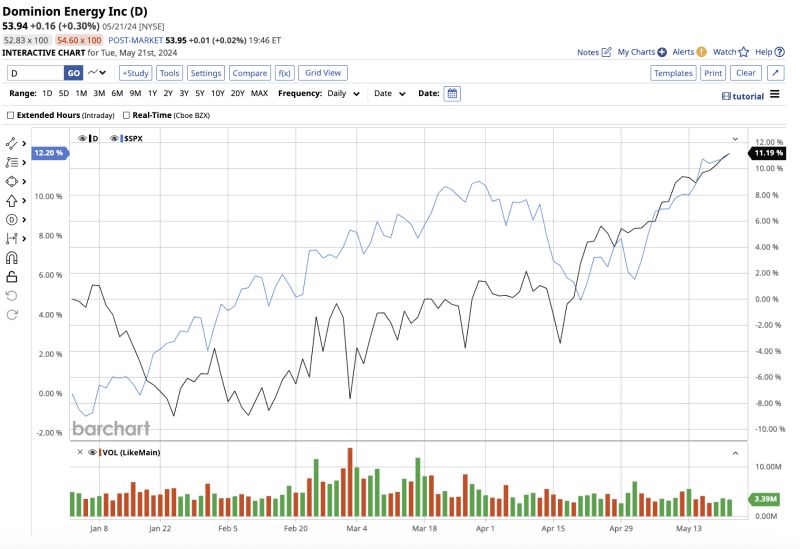

Valued at $45 billion, Dominion’s stock has gained 13.8% YTD, edging past the broader market.

Dominion Energy's financial performance has remained stable, thanks to its regulated utility operations. It provides consistent earnings that are less affected by macroeconomic volatility compared to other sectors.

Dominion has a forward dividend yield of 4.9%, which is higher than the utilities sector’s average yield of 3.7%.

In the most recent first quarter, the company generated adjusted net income of $483 million, or $0.55 per share, down from $0.59 in the previous year's quarter.

Management expects adjusted earnings to range between $2.62 and $2.87 per share in 2024, up from $1.99 per share in 2023, representing an average increase of 38%. Furthermore, earnings could rise to $3.25 to $3.54 per share by 2025. Analysts' projections land in the same range, with a 39% increase in 2024 and another 21% increase in 2025, respectively.

Dominion's forward payout ratio is around 79%, which is high and can only be sustained if earnings continue to grow. The payout ratio indicates that Dominion Energy pays out a significant portion of its earnings in dividends, which is manageable given the consistent cash flow generated by its regulated utility operations.

Furthermore, based on management and analyst projections, the company appears to be well-positioned to maintain dividend payments.

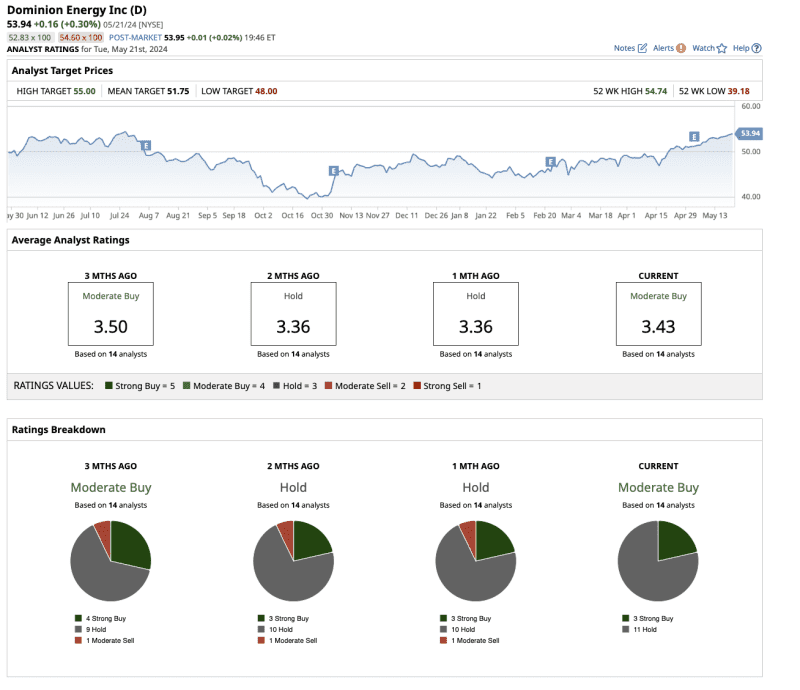

What Does Wall Street Say About Dominion Energy Stock?

Overall, analysts have assigned D stock a "moderate buy" rating. The stock has outperformed its mean target price of $51.75, while the Street-high estimate of $55 represents about a 2.9% increase from current levels. Three analysts have a "strong buy" rating on the stock, while 11 rate it a "hold."

3. Altria Group

Altria Group (MO) has earned a name in the tobacco industry by producing and marketing tobacco products globally. It owns several iconic brands, including Marlboro, Skoal, and Copenhagen, that have a loyal following.

Altria has managed to handle the headwinds of declining cigarette consumption in the U.S. and increasing regulatory pressures through price increases and a diversified product portfolio of wine, e-cigarettes, and cannabis.

Valued at $79.5 billion, Altria’s stock is up 14.8% year-to-date.

Altria has a forward dividend yield of 8.4%, which is higher than the consumer staples industry average yield of 1.89%. As consistency in dividend payments is more important than yield, Altria has proven its worth there, as well.

By paying and increasing dividends for more than 55 years, Altria has earned the "Dividend King" status that is awarded to companies that have hiked their dividends for at least 50 years in a row. Furthermore, the company’s Board has authorized a $2.4 billion increase to its existing $1.0 billion share repurchase program. This demonstrates a strong commitment to returning capital to shareholders.

However, I am concerned that Altria's earnings must continue to grow to maintain its high forward payout ratio of 74%. In 2024, the company expects earnings to rise by 2% to 4.5% over the previous year.

Furthermore, it plans to attain earnings-compound annual growth rates in the mid-single digits by 2028. In addition, at its 2023 Investor Day, the company announced that it intends to increase its dividend annually by a mid-single digit until 2028. Analysts, on the other hand, expect Altria's earnings to rise by 2.9% in 2024 and 3.9% in 2025.

Altria's high yield and Dividend King status make it an appealing income stock to buy now. However, despite its dependable dividend stock status, investors must keep an eye on how the tobacco industry's headwinds might impact its earnings in the future.

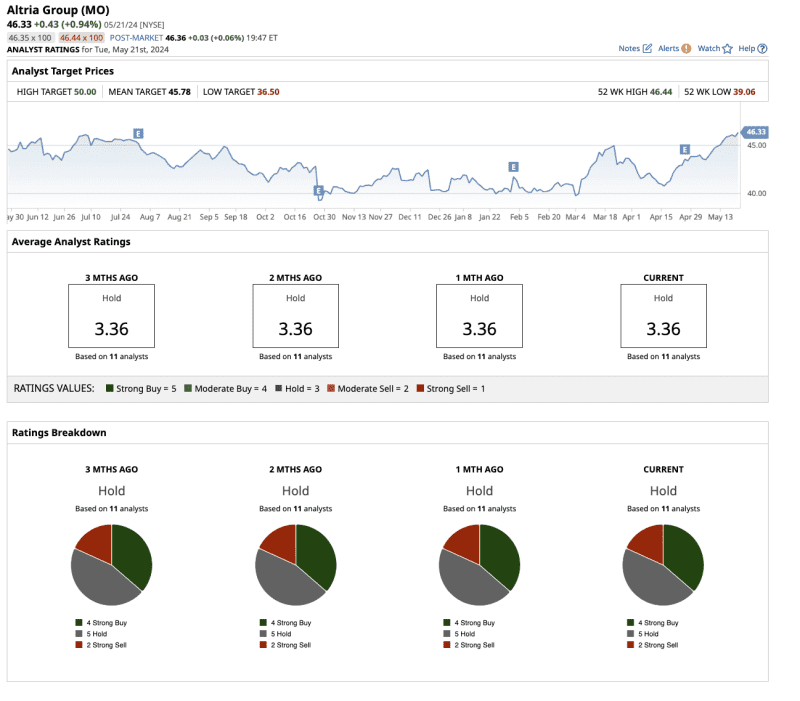

What Does Wall Street Say About Altria Stock?

Overall, analysts have rated MO stock a "hold," with an average target price of $45.78, which is below its current trading price. The high target price of $50 indicates a 7.9% increase from current levels. Four of the 11 analysts covering the stock have a "strong buy" rating, five have a "hold" rating, and two recommend a "strong sell."

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.