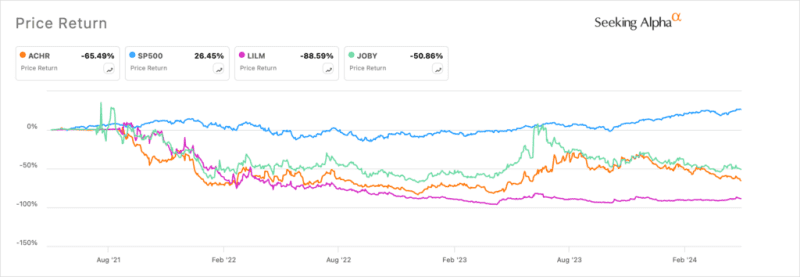

Lilium (LILM) and Archer Aviation (ACHR) stock prices have crashed hard in the past few years, costing investors billions of dollars. Archer’s shares have plunged by over 81% from the highest point in February 2021. Its market cap has dropped from over $2.12 billion in 2021 to $1 billion today.

Most eVTOL stocks have plunged

Similarly, the Lilium share price has plunged from the all-time high of $15.56 to less than $2, bringing its valuation from $2.8 billion to $600 million. The same has happened among other eVTOL companies like Joby and Blade Air Mobility, whose shares are significantly lower than their all-time highs.

Joby Aviation vs Lilium vs Archer Aviation vs S&P 500

The eVTOL industry has been one of the most hyped sectors globally. Multiple reports have highlighted its use case, potential compounded annual growth rate (CAGR), and the benefits to cities and safety.

A report by Research and Markets estimated that the industry was valued at $10.46 billion in 2022 and that it would have a CAGR of 22.4% by 2030. Another study by Precedence Research revealed that it would be worth over $38 billion by 2032.

However, the reality has been that these companies have spent years and billions of dollars to research and develop the eVTOLs. Lilium has been in the industry since 2015 while Archer and Joby were started in 2018 and 2009, respectively,

They raised huge sums of money as private companies. Lilium scoopeed $375 million as a private company and $830 million when it went public in 2021 through a SPAC merger. In its most recent quarter, the company had $215 million in cash and short-term investments. It is also raising 100 million euros in debt from Kfw.

Joby Aviation raised $720 million from the likes of Toyota and Uber before going public in a $6.6 billion valuation. It has over $920 million in cash in its recent results. Archer Aviation raised $826 million and received a $3.8 billion valuation in its SPAC merger.

eVTOL companies have made progress

These companies have made genuine progress, with most of them receiving substantial orders from cities and corporates. For example, Lilium received its design approval from the European safety regulator, signed an MoU with Lufthansa, and started full-scale assembly of its jet.

The company also recently received an order of 20 Lilium jets from UrbanLink. It is now working on its jet propulsion unit and battery packs.

Archer Aviation, on the other hand, has received many orders, including by the UAE and the US military. It has also completed the first phase of flight test program as it works to gain certification by the FAA.

Joby Aviation is also collaborating with the DoD, has a $3.5 billion backlog, and made several steps towards its FAA certification.

Are these good stocks to buy?

I believe that Lilium, Archer Aviation, and Joby are high-risk and high-reward investments. If they work well, these companies could achieve success as we saw with Tesla. Besides, there is a big market opportunity for their products in cities, military, and disaster response.

However, my main concern is that they will need to raise more money before becoming profitable since they are losing millions of dollars each year. Lilium had a net loss of over $429 million in 2023 and has lost over $1.4 billion in the past five years.

Joby Aviation had a net loss of over $513 million in 2023 and lost over $1 billion in the past four years. Archer Aviation lost $457 million in 2023 and over $1.14 billion in the past five years. As we have seen in the electric vehicleindustry, these losses will continue even when deliveries start.

Therefore, there is a possibility that all these companies will raise cash in the coming years, which will dilute investors. As such, while there is a significant opportunity in the eVTOL industry, I believe that companies like Lilium, Joby, and Archer are high-risk investments.

The post Are Joby, Archer Aviation, and Lilium good eVTOL stocks to buy? appeared first on Invezz