Lemonade (NYSE: LMND) stock price is not doing well as the company’s revenue and losses rise. It has plunged by over 91% from its highest level in 2021, pushing its total market cap from over $12 billion to about $1 billion today.

Root Inc. is beating Lemonade

Root, Inc. (NASDAQ: ROOT), another insurance technology company, has also plunged from over $500 in 2020 to about $56 today. Its market valuation has moved from almost $6 billion to about $890 million today.

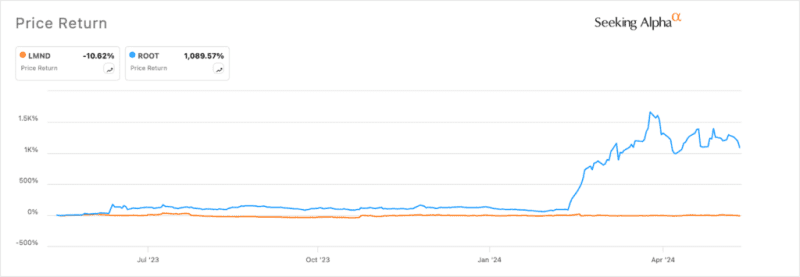

Recently, however, the two companies have diverged. Root stock price has soared by over 1,090% in the past 12 months, beating popular names like Nvidia and Super Micro Computer. Lemonade, on the other hand, has crashed by over 10% in the same period.

Lemonade’s business has continued growing in the past few years as more people embrace digital insurance and as prices continue rising. Its annual revenue jumped from over $63.8 million in 2019 to over $315 million in 2023.

Most recently, its first-quarter revenue rose from $95.2 million to $119.1 million and the company expects that its growth will continue this year. However, its growth has come at a cost as its quarterly loss narrowed to $47.3 million. It has lost over $1 billion in the last financial year.

Root has also seen strong revenue growth, which jumped from over $275 million to $399 million in 2023. Its revenue growth is accelerating as evidenced by its last quarter performance when revenue jumped from over $70 million in Q1’23 to over $254 million. It also narrowed its net loss from $40 million to $6.2 million.

Root vs Lemonade stocks

Root is growing at a faster pace than Lemonade

Analysts also expect that Root’s growth momentum will continue at a faster rate than Lemonade. According to Yahoo Finance, the average estimate is that Root’s revenue will grow by 132% to over $975 million in 2024 and $1.3 billion in 2025.

For Lemonade, the estimate is that its revenue will grow by less than 20% this year to $514 million and $605.4 million in 2025. Therefore, Lemonade’s stock price is underperforming Root because of its slower growth.

For starters, Lemonade and Root are some of the biggest insuretech companies in the United States. Root focuses on auto insurance while Lemonade specialises in the broader insurance industry with products like homeowners, renters, pet, car, and life.

Its main benefit is that its business has advanced artificial intelligencefeatures like AI Maya for onboarding, AI Jim for claims, and CX AI for customer service.

Analysts have a neutral outlook for the Lemonade stock price, with the average target being $20, slightly above the current $16. Recently, analysts at Jefferies maintained their underperform rating while Piper Sandler, JMP Securities, and KBW maintained their neutral outlooks

The post Lemonade stock price is trailing Root Inc.: What next? appeared first on Invezz