By Chris Dorrell

This week was always going to be a big week of data for the UK with a number of important data releases and business surveys scheduled.

Of course, these all took on extra significance given Wednesday’s surprise election announcement.

Between now and 4 July, every piece of data will be closely scrutinised for any hints about what the figures reveal about the state of the economy.

So what’s the state of play after this week?

- Inflation fell to 2.3 per cent, its lowest level in nearly three years. However, this was higher than expected and all but wiped out the chance of a June interest rate cut.

- Borrowing came in ahead of expectations. This came just a day after the International Monetary Fund (IMF) warned about £30bn tax rises needed to balance the budget. Autumn tax cuts off the cards too, summer election anyone?

- The closely watched PMIsurvey came in comfortably below expectations, although still in expansionary territory. The survey suggests that growth is slowing after the strong start to the year.

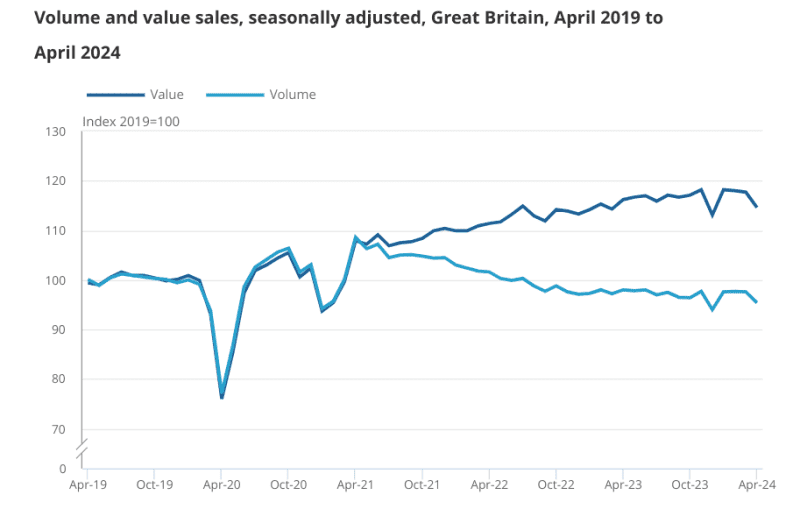

- Retail salesplunged in April with the ONS noting this was due to unseasonably wet weather. A more positive consumer confidence reading for May suggests that retail sales might recover in the months to come.

Rishi Sunak has made an improving economy a central part of his election pitch, but in truth these were not the figures he would have wanted to see at the beginning of an election campaign.

Start with inflation. Yes, it is now approaching the two per cent target, but Wednesday’s figures revealed alarming domestic levels of inflationary pressure.

Services inflation, which the Bank of England has identified as a key gauge of underlying price pressures, only moved from 6.0 per cent to 5.9 per cent, well above the 5.5 per cent expected by the Bank.

2.3 per cent is about as good as its going to get for Sunak. The Bank of England forecasts that headline inflation will pick up later in the year as the downward effect of falling energy prices eases in the coming months.

Inflation will likely end the year around three per cent, hence why a June interest rate cut is now all but ruled out.

And how about the economy more broadly? Combine yesterday’s PMI survey with this morning’s retail sales figures and it looks as if the UK’s economic momentum might be fading.

The PMI, which measures activity in the private sector, came in at 52.4. This was down from 54.1 in April and below the 54 expected by economists. Anything above 50 indicates economic expansion.

The slowdown in activity was driven by the services sector, with firms pointing to the impact of cost-of-living pressures on consumer spending.

Retail sales meanwhile crashed 2.3 per cent, far more than the 0.5 per cent contraction expected by economists. The ONS attributed the large fall in retail sales to the weather and some economists think sales volumes will recover strongly next month.

Still the figures do not make for great reading. Peter Arnold, chief UK economist at EY said “it’s clear that the retail sector is still struggling to generate much momentum”.

“Coming on the back of yesterday’s softer composite PMI, it suggests that the UK is likely to see a weaker out-turn for GDP growth in Q2, after Q1’s very strong performance,” he added.

More than anything else, this week’s figures show an economy still struggling with weak consumer spending and stubborn inflationary pressures. This is not a massive surprise given the range of shocks over the past few years.

The economy is recovering, but it remains a fragile recovery.