The iShares Select Dividend ETF (DVY) is one of the popular funds in Wall Street, thanks to its higher dividend yield than its peers. As a result, it has attracted over $18 billion in assets under management (AUM) from investors despite its higher expense ratio. But is it a good dividend ETF to buy?

What is the DVY ETF?

The iShares Select Dividend ETF is a leading fund that gives investors access to 100 companies with a record of growing their dividends for five years. It has an expense ratio of 0.38%, higher than most similar funds like SCHD, VYM, and DGRO.

Most of its constituent companies are in industries like utilities, financials, consumer staples, materials, and consumer discretionary. Unlike other growth-focused funds, it has minimal exposure to the technology industry.

The biggest companies in the fund are giants like Altria, AT&T, International Paper, Verizon, Pfizer, and Philip Morris International. AT&T has a dividend yield of 6.35% while Altria, Verizon, and Pfizer yield 8.59%, 6.73%, and 5.86%, respectively.

These companies have a strong market share in their industries but have slow revenue and profitability growth. They also have substantial debt loads, with AT&T having over $124 billion in debt and Verizon having $175.6 billion.

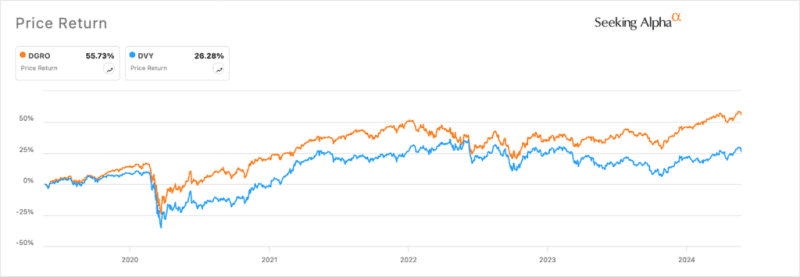

DVY’s performance, however, has not been better than its peers. For example, its total return in the past five years stood at over 51.3% while the Schwab US Dividend Equity (SCHD), iShares Dividend Growth (DGRO), and Vanguard High Dividend Yield Index Fund (VYM) delivered 80%, 65%, and 76%, respectively.

Why DGRO is a better fund

Regular readers know that I am not a good fan of dividend-focused exchange-traded funds because most of them underperform the broader market. Therefore, I always prefer investing in traditional funds like the SPDR S&P 500 ETF (SPY) and Invesco QQQ ETF (QQQ).

However, if you are interested in a dividend fund, I would prefer the iShares Dividend Growth Fund (DGRO) for a few reasons. First, DGRO’s expense ratio is just 0.08% while DVY charges a whopping 0.38%, Most related funds have a ratio of less than 0.10%, making DVY highly expensive.

The 20 basis points spread can be a huge concern, especially for investors buying and holding the fund for a long time.

Second, DGRO has a long track record of beating DVY. In the past five years, DGRO’s total return was 75% while DVY returned 51.50%. The same trend has happened in the past 12 months when they returned 19% and 13%, respectively.

DVY vs DGRO total 5-year returns

Third, while DGRO’s 2.31% yield is smaller than DVY’s 3.65%, it is growing at a faster pace. Its five-year Compounded Annual Growth Rate (CAGR) in the past five years was 9.70% while DVY has 6.33%.

The post I’d avoid the iShares Select Dividend ETF (DVY) and buy DGRO instead appeared first on Invezz