When the COVID-19 pandemic first upended the global economy, enterprises that depended on social interaction simply cratered. That was the case for Dave & Buster’s Entertainment (PLAY), which owns and operates high-volume dining and entertainment centers. During the worst of the crisis, PLAY stock incurred a weekly average price of less than $8.

However, with the fading of fears of the SARS-CoV-2 virus, the broader entertainment ecosystem stormed back. A combination of retail revenge and revenge travel helped fuel demand for experiential services. That was understandable. With millions effectively quarantining to avoid getting sick, the desire for normalcy started to build. Once the gates opened, a surge of demand quickly stormed through.

Still, with the ebb and flow of the COVID cycle largely in the rearview mirror, how should investors approach PLAY stock? It’s a tricky situation.

On the positive side of the ledger, the aforementioned social normalization plays a huge role for the underlying industry. If people are no longer fearful of being in close contact with each other, that helps boost the case for PLAY stock. It’s not a guaranteed catalyst because of competition. Still, Dave & Buster’s enjoys a strong brand presence.

Second, more companies have started to mandate return-to-office policies. Of course, the matter has aroused controversy. At the same time, it’s difficult for enterprises to track productivity. That’s especially the case when they hire new workers. Cynically, Dave & Buster’s benefited from the collective misery of the nine to five, offering a platform to let out some steam.

Nevertheless, not everything is pointing in the right direction. For one thing, work-from-home directives remain prominent. Further, hybrid schedules may translate to a smaller addressable market for PLAY stock. Also, people generally prefer to stay at home these days, as evidenced by declining ticket sales at the box office.

Sure enough, the derivatives market presents even more complexities.

Unusual (But Unclear) Options for PLAY Stock

Following the end of the May 24 session, PLAY stock ranked among the top highlights in Barchart’s unusual stock options volume screener. This interface allows retail investors to better understand what the smart money is doing with its funds.

For Dave & Buster’s, total volume reached 4,478 contracts against an open interest reading of 36,299 contracts. The magnitude difference between the Friday session volume and the trailing one-month average metric came out to 372.86%. Call volume hit 3,323 contracts while put volume landed at 1,155.

On paper, the aforementioned pairing yielded a put/call volume ratio of 0.35. At face value, that appears bullish as it indicates greater demand for calls than puts. Looking at Barchart’s options flow screener – which filters exclusively for big block transactions likely placed by institutional investors – there are indeed more derivative contracts with bullish sentiment than bearish.

There is one wrinkle to note. For bullish-sentiment transactions, the greatest premium stood at $66,100. This was for the June 21‘24 50.00 Call, with volume of 2,364 contracts. However, the biggest bearish-sentiment transaction carried a premium of $70,000. This was for the Jul 19’24 49.00 Put.

It raises the question: which side is right?

Looking at the Barchart Technical Opinion indicator, it rates PLAY stock as an 8% weak sell. Specifically, the investment resource states that PLAY incurs a weak short-term outlook on maintaining the current direction. In many ways, a “weak” sell designation can be problematic as it could gather bearish strength and become a “strong” sell.

On the flipside, a strong sell can sometimes be an opportunity. Basically, when too many traders bet against a security, it could respond sharply to the other side.

Respect What the Chart is Saying

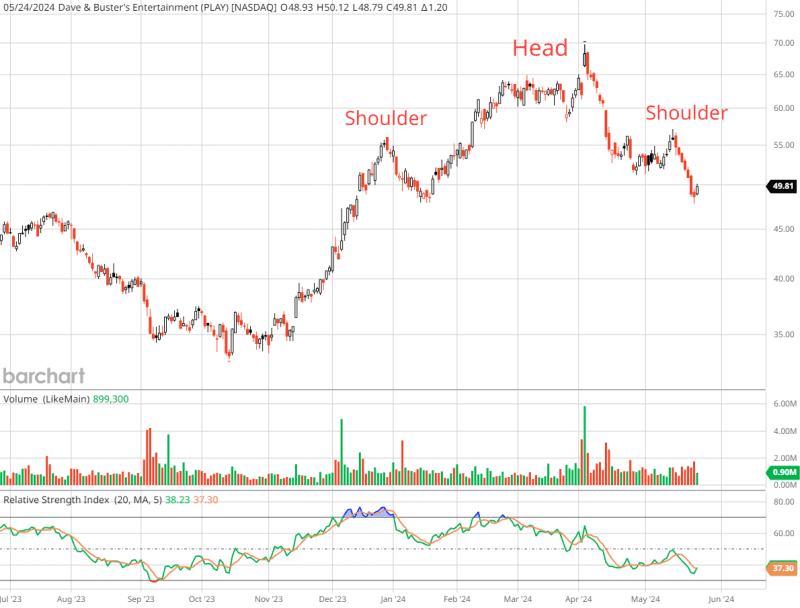

For me, I’m worried about the technical profile. Simply put, PLAY stock appears to be in the back end of forming a bearish head-and-shoulders pattern. And that may be why PLAY is a “weak” sell – it just hasn’t yet completed the negative implications of this chart formation.

Granted, technical analysis isn’t the most standardized discipline because it requires interpretations, which can be misleading. However, enough patterns have emerged that traders can leverage that information for their trades.

Regarding PLAY stock, it appears that the first shoulder formed in late December last year. The period of flat trading from late February through late March may represent the head. Interestingly, PLAY hit a near-term high on May 14. That could have been the second shoulder. Since May 14, shares have been quite volatile.

Again, I must stress that the technical approach isn’t a scientific assessment. However, it also reflects snapshots of demand. Right now, the chart says that PLAY stock lacks upside momentum.

Therefore, even with the bullish slant in the options arena, I think you have to respect what the chart is saying. It may be better to hold off for a better price if you’re interested in PLAY stock.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.