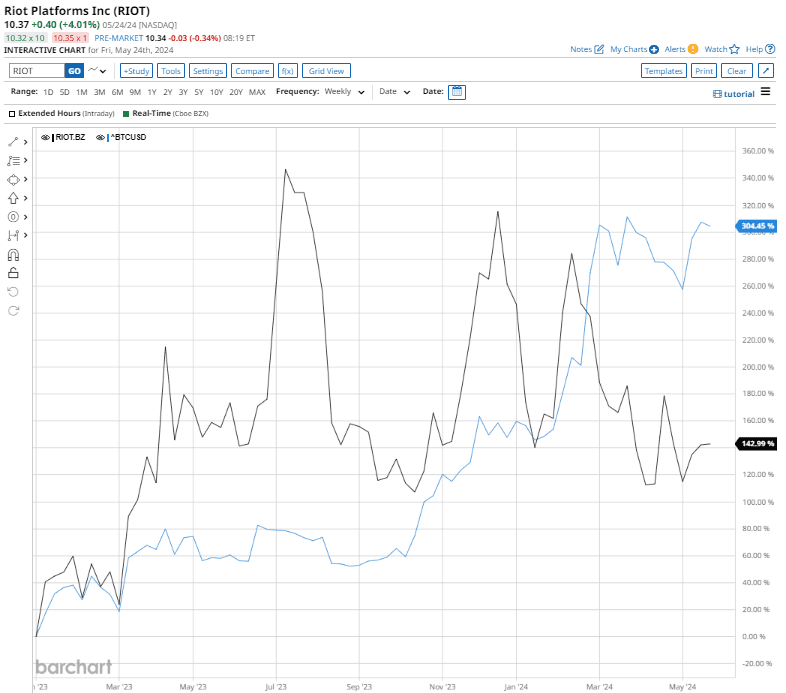

Valued at almost $3 billion by market cap, Riot Platforms (RIOT) is among the largest Bitcoin (BTCUSD) mining companies in the world. The prices of BTC miners are closely tied to the world’s largest cryptocurrency. While Bitcoin prices have more than quadrupled since the start of 2023, Riot Platforms stock is up over 142% in the last 17 months.

Let’s see if it makes sense to own RIOT stock at the current valuation.

Riot Platforms Posts Strong Q1 Numbers

In Q1 of 2024, Riot Platforms reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $245.7 million and net income of $211.8 million, a new quarterly record for the crypto miner. A significant portion of these gains can be attributed to changes in fair-value investments.

For instance, the rapid rise in BTC prices positively impacted Riot’s operations by $234 million in Q1. Comparatively, mining costs almost doubled to $41.1 million, while selling and administrative costs more than quadrupled year over year to $57.7 million. Higher BTC prices allowed Riot to end Q1 with operating income of $204 million, sharply higher than just $17.4 million in the year-ago period.

Investors should understand that the Bitcoin halving event has reduced the mining rewards for Riot Platforms and its peers by 50%. So, to offset this decline, it's essential to increase the efficiency of mining the digital asset by improving the hash rates.

To that end, Riot Platforms has been investing heavily to increase its hash rate, allowing it to mine BTC at a lower price. It aims to end 2024 with a hash rate capacity of 31 exahashes per second, almost tripling the current capacity. Moreover, once completed, Riot’s Corsicana facility will be the largest Bitcoin mining facility globally.

Riot Platforms is Diversifying

Bitcoin mining is a capital-intensive process in which miners use supercomputers to solve complex mathematical problems and validate blockchain transactions. Due to its high energy consumption, Riot Platforms enters into long-term power purchase agreements with energy suppliers to satisfy its electricity requirements. However, BTC miners have the flexibility to scale down operations and take advantage of volatile energy prices.

In August 2023, Riot Platforms provided more than 84,000 megawatt hours of energy to Texas, helping the state stabilize its energy grid amid a heatwave. Riot earned $7 million from ERCOT (Electric Reliability Council of Texas), a membership-based independent system operator that operates 90% of the electric grid in Texas.

Last year, Riot sold around $24 million of pre-purchased energy to TXU, an energy provider. In the last two years, Riot earned close to $100 million in power credits. The BTC miner explains, “When economically efficient to do so, Riot does not use the energy it has purchased for business operations and instead sells it back to TXU in exchange for credits to apply to future energy bills.”

Ahead of what's predicted to be another scorching hot summer for Texas, according to ERCOT forecasts, RIOT CEO Jason Les said “we are in a really good position" again this year to provide backup grid support.

Is RIOT Stock a Good Buy?

Higher Bitcoin prices would mean RIOT stock’s adjusted earnings would climb to $0.46 per share in 2024, compared to a loss of $0.28 per share in 2023. So, priced at 22.5x forward earnings, RIOT stock is not too expensive, especially if BTC prices remain elevated and touch all-time highs in the next 18 months.

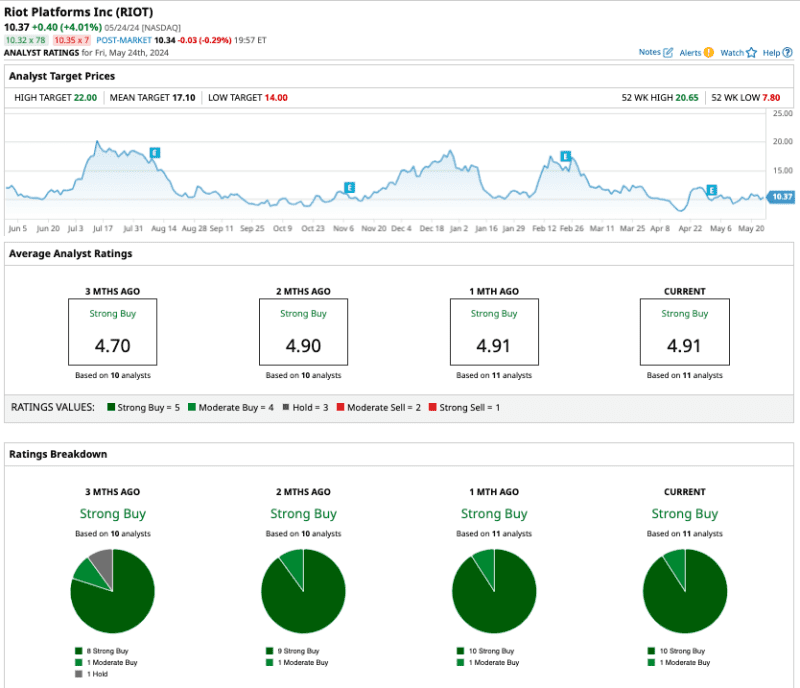

Out of the 11 analysts covering RIOT stock, 10 recommend “strong buy,” and one recommends “moderate buy.”

Analysts' average target price for RIOT stock is $17.10, suggesting expected upside potential of nearly 65% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.