The buzz surrounding artificial intelligence (AI), sparked by the public launch of ChatGPT in November 2022, remains strong in 2024. According to Cognizant (CTSH), generative AI technology could significantly impact the U.S. economy, potentially boosting productivity by 1.7% to 3.5%, and increasing gross domestic product (GDP) by an estimated $477 billion to $1 trillion annually over the next decade.

As the demand for AI solutions soars across various industries and society, analysts at AllianceBernstein (AB) just backed their preference for two tech giants, Microsoft Corporation (MSFT) and Alphabet Inc. (GOOG), that have already solidified their foothold in the dynamic landscape of AI through relentless innovations.

AB highlighted that Microsoft's cloud platform and its partnership with industry pioneer OpenAI form a robust foundation for growth in the AI era. Simultaneously, the investment firm pointed out that Alphabet’s strong track record of innovation positions its digital advertising platform to capitalize on AI advancements.

Furthermore, the allure of these stocks is amplified by their dividend payouts, offering investors a steady income stream. Let’s take a closer look at these AI leaders.

AI Dividend Stock #1: Microsoft

Commanding a massive market cap of $3.2 trillion, Washington-based Microsoft Corporation (MSFT) is a global tech titan. Its renowned offerings, such as Microsoft Office and Teams, play a vital role in daily business life. Over the past year, Microsoft has significantly ramped up its investment in AI technology. Leading in AI research, Microsoft seamlessly integrates the technology into a wide array of its products, including Windows, Xbox, Microsoft 365, Teams, and Azure AI, delivering billions of intelligent experiences every day.

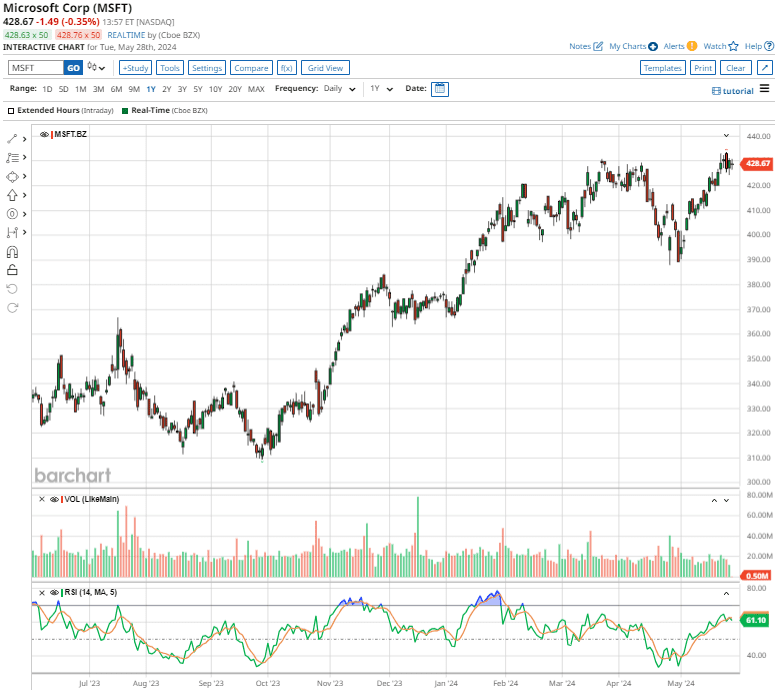

Shares of this mega-cap stock have surged 28.9% over the past 52 weeks, outpacing the broader S&P 500 Index’s ($SPX) return of 26.2% over the same time frame.

Microsoft is highly committed to delivering value to its shareholders. In fiscal Q3, the company returned approximately $8.4 billion through a combination of share repurchases and dividends. Moreover, the company has a remarkable track record of 19 consecutive years of dividend growth. Its annualized dividend of $2.93 per share translates to a 0.68% dividend yield.

In terms of valuation, the stock is trading at 36.65 times forward earnings. That’s higher than some of its industry peers, but MSFT is also projected for above-average earnings growth.

On April 25, Microsoft reported its Q3 earnings results, which exceeded forecasts on both the top and bottom lines. Total revenue surged 17% annually to $61.9 billion, marginally beating estimates, while the company’s EPS of $2.94 grew 20% year over year, topping projections by 4.6%. Microsoft Cloud revenue rose 23% to $35.1 billion.

Additionally, revenue from server products and cloud services surged by 24% annually, fueled by the growing demand for Microsoft’s Azure and other cloud offerings. Commenting on AI’s pivotal role in the company’s business, Chairman and CEO Satya Nadella said, “Microsoft Copilot and Copilot stack are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry.”

During the Q3 earnings call, management said it expects fiscal 2024 operating margins to be up over 2 points year over year. Furthermore, management underscored their expectation that capital expenditures for fiscal 2025 will exceed those of fiscal 2024. This projection reflects Microsoft’s efforts to scale operations in response to the growing demand for its cloud and AI products.

Analysts tracking Microsoft project the company’s profit to increase 20% year over year to $11.77 per share in fiscal 2024 and grow another 12% to $13.18 per share in fiscal 2025.

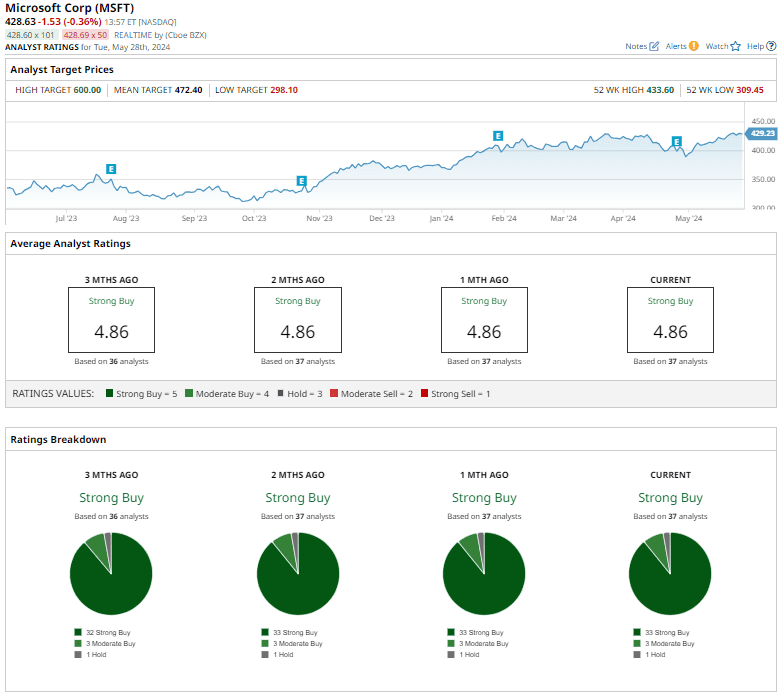

Microsoft stock has a consensus “Strong Buy” rating overall. Out of the 37 analysts covering the stock, 33 recommend a “Strong Buy,” three suggest a “Moderate Buy,” and the remaining one gives a “Hold” rating.

The average analyst price target of $472.40 indicates a potential upside of 10% from the current price levels. However, the Street-high price target of $600 suggests that the stock could rally as much as 39.7%.

AI Dividend Stock #2: Alphabet

Mountain View, California-headquartered global tech giant Alphabet Inc. (GOOG), Google’s parent company, hardly requires much introduction. In recent years, it has integrated AI into its flagship products, including Gmail, Google Maps, and Photos. With a robust market cap of $2.2 trillion, the company's primary revenue generator remains Google Search, which dominates the global search engine market.

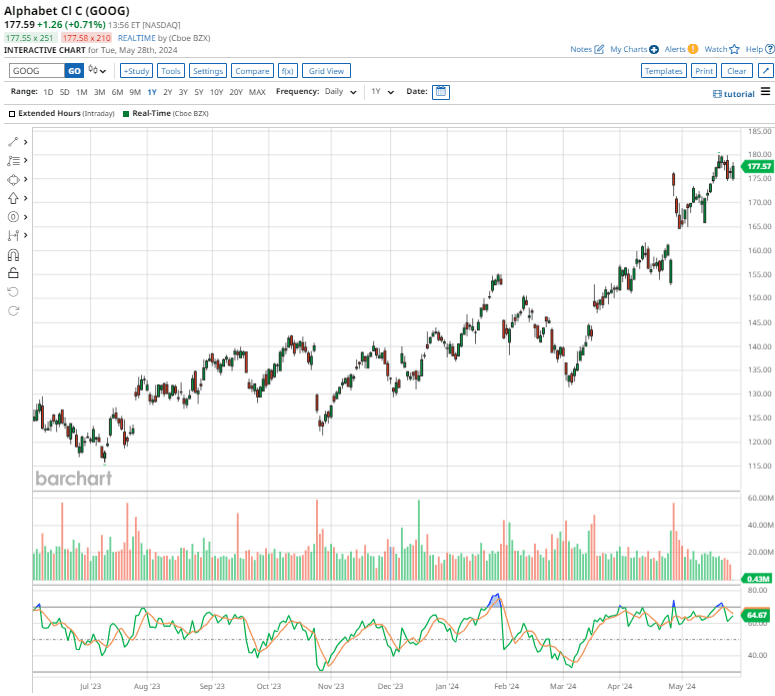

Shares of this tech giant have soared nearly 41.5% over the past 52 weeks, overshadowing the broader SPX’s rally during the same period.

On April 25, Alphabet announced its inaugural quarterly dividend of $0.20 per share, to be distributed to its shareholders on June 17. Additionally, Alphabet’s Board of Directors approved a massive $70 billion for share repurchases.

The company also reported its Q1 earnings results on April 25, which sailed past Wall Street’s projections. Its revenue of $80.5 billion grew 15.4% year over year, outpacing forecasts by 2.3%. The company’s EPS of $1.89 rose 61.5% annually, also surpassing estimates by a notable 26.9%.

Revenue from Google advertising soared 13% year over year to $61.7 billion, while revenue from Google Cloud jumped 28.4% annually. Alphabet's stellar Q1 performance and debut dividend captured investor attention, propelling the stock to a nearly 10% surge on April 26.

Commenting on the solid Q1 performance, CEO Sundar Pichai said, “Our results in the first quarter reflect strong performance from Search, YouTube and Cloud. We are well under way with our Gemini era and there’s great momentum across the company. Our leadership in AI research and infrastructure, and our global product footprint, position us well for the next wave of AI innovation.”

Analysts tracking Alphabet project the company’s profit to reach $7.70 per share in fiscal 2024, up 32.8% year over year, and grow another 13.5% to $8.74 per share in fiscal 2025. Priced at 22.91 times forward earnings, the stock is trading lower than its own five-year average of 25.78x.

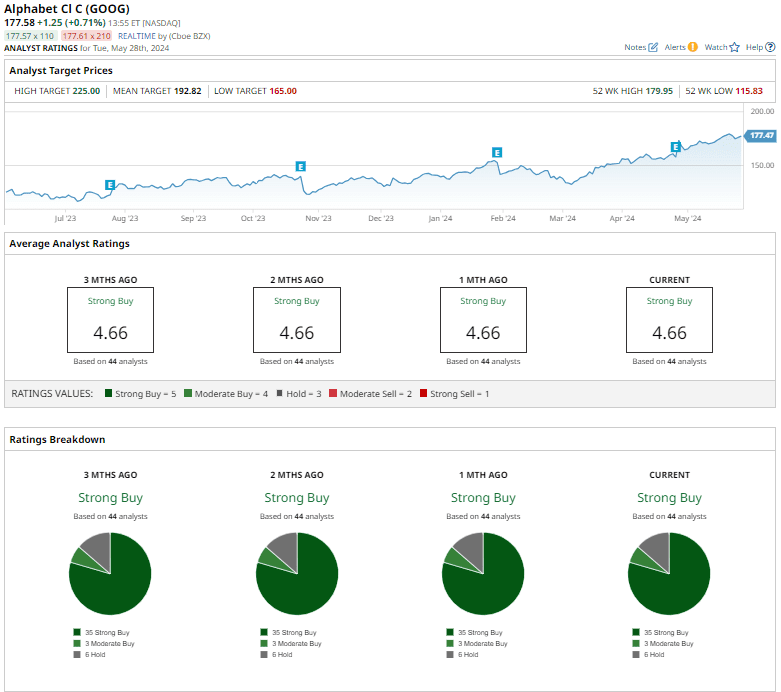

Alphabet stock has a consensus “Strong Buy” rating overall. Out of the 44 analysts offering recommendations for the stock, 35 suggest a “Strong Buy,” three advise a “Moderate Buy,” and the remaining six give a “Hold” rating.

The average analyst price target of $192.82 indicates a potential upside of 8.6% from the current price levels. However, the Street-high price target of $225 suggests potential upside of nearly 26.7%.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.