Whales with a lot of money to spend have taken a noticeably bearish stance on Mastercard.

Looking at options history for Mastercard (NYSE:MA) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $130,653 and 4, calls, for a total amount of $225,385.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $420.0 to $470.0 for Mastercard over the recent three months.

Insights into Volume & Open Interest

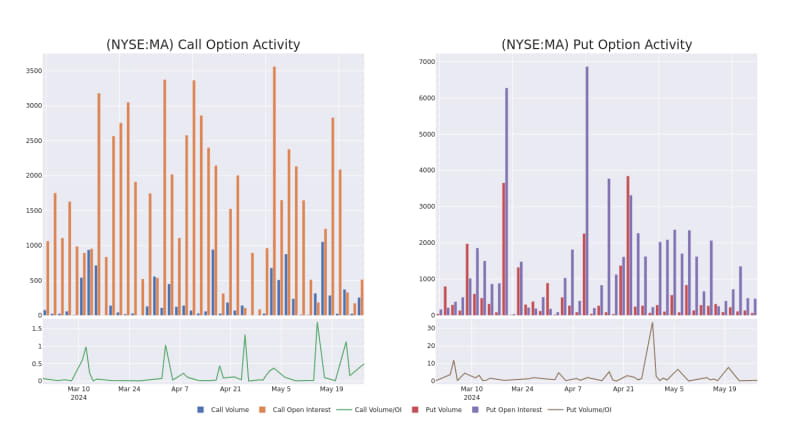

In terms of liquidity and interest, the mean open interest for Mastercard options trades today is 122.62 with a total volume of 313.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Mastercard's big money trades within a strike price range of $420.0 to $470.0 over the last 30 days.

Mastercard Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

About Mastercard

Mastercard is the second-largest payment processor in the world, having processed close to over $9 trillion in volume during 2023. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

After a thorough review of the options trading surrounding Mastercard, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Mastercard

- Currently trading with a volume of 2,359,649, the MA's price is down by -1.35%, now at $445.08.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 58 days.

Professional Analyst Ratings for Mastercard

In the last month, 5 experts released ratings on this stock with an average target price of $514.6.

- An analyst from JP Morgan persists with their Overweight rating on Mastercard, maintaining a target price of $510.

- Consistent in their evaluation, an analyst from Mizuho keeps a Buy rating on Mastercard with a target price of $478.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Mastercard, which currently sits at a price target of $524.

- An analyst from Piper Sandler has revised its rating downward to Overweight, adjusting the price target to $531.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Mastercard, targeting a price of $530.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Mastercard with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.