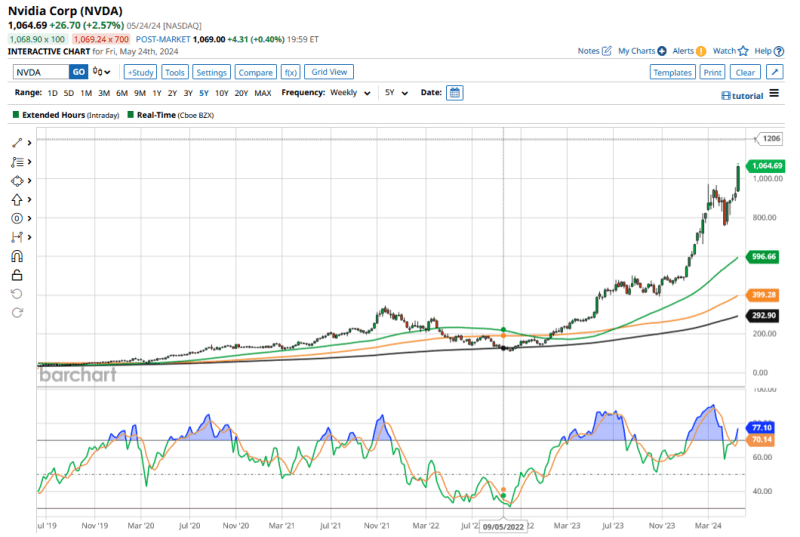

Nvidia (NVDA) has created stellar wealth for investors, and the stock has risen by more than 3,000% over the last five years. The returns would look even more mind-boggling if we extend the period to a decade.

The rise in Nvidia’s stock has been backed by solid growth, both on the topline and bottom line. For instance, analysts expect Nvidia to post revenues of over $120 billion in the fiscal year 2025, which is over 11x the $10.9 billion it posted in the fiscal year 2020. The company’s profit growth has been even more stellar; it's expected to post net income of over $67 billion in the current fiscal year, which is almost 19x its fiscal year 2020 earnings.

When plotting Nvidia’s price action versus its earnings metrics, we’ll see them trending upwards, which might be quite usual for any company. After all, over the long term, the returns from any stock tend to mimic its earnings growth.

Nvidia Has Been Quite Frugal with Dividend Payouts

However, we see a different picture when we plot Nvidia’s share price against its dividend metrics. While the company recently raised its quarterly dividend by 150% to $0.10 ($0.01, on a post-split basis), it has been quite frugal with dividend payouts.

The chip designer paid total dividends of $395 million in fiscal year 2020, which is similar to what it paid out in fiscal year 2024. While Nvidia’s profits have spiked, it didn't raise dividends, and its dividend payout ratio has dipped to a mere 1.32% - which basically means that it pays only 1.32% of its net income as dividends.

The company’s dividend yield is a mere 0.038%, even after the “generous” 150% increase in quarterly dividends. Nvidia’s dividend yield has been moving in inverse proportion to its share price, as the payouts haven't kept pace with the price action.

Nvidia’s Dividend Yield Is Quite Low Compared to Big Tech Companies

While Big Tech companies – especially the “Magnificent 7” stocks – have never been known for their fat dividends, Nvidia’s frugality with dividends stands out. The company’s dividend yield is the lowest among the group, if we exclude names like Amazon (AMZN) and Tesla (TSLA) that don’t pay a dividend at all (and in all likelihood, won’t pay one anytime soon). Tesla investors especially shouldn’t expect a dividend for the foreseeable future, considering the company’s high capex needs and the price war in the electric vehicle (EV) industry.

Incidentally, Meta Platforms (META) and Alphabet (GOOG) which both initiated a dividend in 2024, have a dividend yield of over 0.40%, or over 10x that of Nvidia. Microsoft (MSFT) has the highest dividend yield of 0.70% among Magnificent 7 stocks, and while that's still only around half of what an average S&P 500 Index ($SPX) constituent pays, it's still a respectable number.

Why Tech Companies Don’t Pay High Dividends

While tech companies often generate healthy cash flows, they tend to be quite frugal with dividends for multiple reasons.

First, since they are typically growth companies, they use their cash flows to either reinvest in growth or acquire/invest in other companies.

Secondly, tech companies generally prefer share buybacks as their preferred mode to return cash to shareholders. Apple (AAPL), for instance, just announced a record $110 billion share buyback.

Nvidia repurchased $9.5 billion worth of its shares in the fiscal year 2024, which was slightly below the $10 billion it repurchased in the previous year.

Why Do Companies Pay Special Dividends?

Companies generally pay special dividends when they make a windfall gain, which can be the result of a restructuring or asset sale. Also, at times, companies will announce a special dividend when their cash pile soars. For instance, Ford (F) paid a special dividend of $0.65 per share in 2023 after it sold the bulk of its stake in EV startup Rivian (RIVN).

The company paid a supplemental dividend of $0.18 earlier this year, as well. Ford's cash pile soared after impressive earnings and cash flows over the preceding couple of years, and it rewarded shareholders with another one-time dividend. Incidentally, rival General Motors (GM) announced a massive $10 billion buyback last year to utilize its burgeoning cash pile, while Ford opted for fat dividends.

Among the Magnificent 7 stocks, the only instance of a special dividend came in 2004, when Microsoft paid a one-time dividend of $3, distributing $32 billion to shareholders.

Should Nvidia Consider Paying Special Dividends?

Nvidia’s earnings are currently on a strong trajectory, with net income expected to more than double in the current fiscal year. Nvidia held $31.4 billion as cash, cash equivalents, and marketable securities on its balance sheet at the end of its fiscal Q1 2025.

To be sure, Nvidia investors shouldn't be complaining about the low dividend yield, as they have made stellar total returns (dividends plus capital appreciation) from the stock, which outstrips its fellow Magnificent 7 stocks by a wide margin.

While as a Nvidia investor, I would like a special dividend, I don’t foresee the company paying one out anytime soon. For a special dividend to make sense, it should be healthy compared to the share price. Given Nvidia’s current market cap of over $2.6 trillion - even if it were to extinguish all of the cash and marketable securities - the special dividend’s yield would be just above 1%.

One alternate scenario could be Nvidia swapping share repurchases for special dividends. That strategy would put cash directly in the hands of investors, especially as Nvidia shares now no longer look as cheap as they did a year back.

On the date of publication, Mohit Oberoi had a position in: NVDA , MSFT , TSLA , GOOG , AMZN , META , AAPL , F , GM , RIVN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.