By Lars Mucklejohn

Buy-now pay-later giant Klarna has reportedly ditched rights held by large shareholders to block smaller investors’ share trades as it gears up for a blockbuster public listing.

The Swedish fintech told investors in a memo last week that it had taken control of stock transaction approvals, Sky News reported.

Klarna said it had “listened to” shareholders and that large investors no longer “have the right to interfere” in future share transactions.

“A lot of you have raised issues with the slow process of approving secondary transfers but even more with lack of certainty whether the buyer will be able to complete the transaction,” it said.

“Large shareholders… do not have the right to interfere in the process any more”, it added.

Preferential purchase rights held by Klarna founders Victor Jacobsson, who left in 2012, and Sebastian Siemiatkowski, who remains chief executive, had reportedly caused tension.

The rights allowed them to buy up Klarna shares on the secondary market through special vehicles. While a spokesperson for Siemiatkowski has said he supported removing the rights, Jacobsson had reportedly used his “right of first refusal” to become one of Klarna’s largest shareholders.

The news comes as Klarna looks to float its shares on the public market.

The firm triggered hopes of a potential London float when it established a British holding company last year, but reports have since surfaced that it is targeting a New York IPO at a valuation of $20bn (£15.7bn) early next year.

Sky reported on Wednesday that insiders expected Klarna to select investment banks for the float in the next three months.

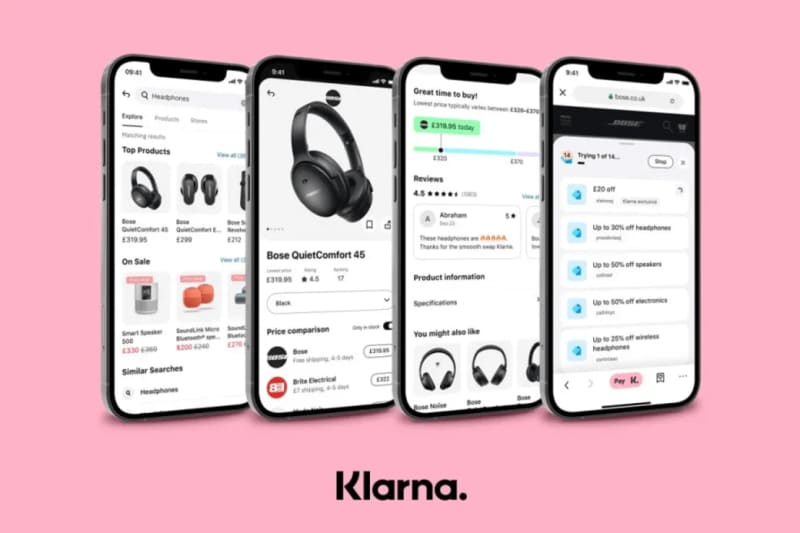

Klarna, which offers around 150m active users the ability to delay or spread the cost of their purchases, was once one of Europe’s most valuable tech groups. Its valuation hit $46bn (£36.1bn) in June 2021.

However, higher interest rates have punished venture capital valuations, and Klarna’s valuation fell to $6.7bn (£5.3bn) in July 2022.

City A.M. approached Klarna for comment.