This month, President Joe Biden announced new tariffs aimed at Chinese electric vehicles (EVs), solar cells, batteries, steel, aluminum, and medical equipment. Biden criticized the Chinese government's subsidies for creating unfair competition by allowing their products to undercut the global market without needing to turn a profit. The move is part of Biden's strategy to support American industries and workers, and it extends the ongoing trade tensions between Beijing and Washington.

The announcement of these tariffs has sparked a political clash with Biden's competitor, Donald Trump, with the current president accusing the former of failing to address Chinese trade abuses during his tenure. Meanwhile, Chinese authorities have labeled the tariffs as "bullying," and warned the U.S. of potential repercussions on bilateral cooperation. This move marks a significant step in the U.S. strategy to bolster domestic manufacturing while reducing reliance on Chinese imports.

With this context in mind, let's take a look at one domestic steel producer that analysts have labeled as undervalued.

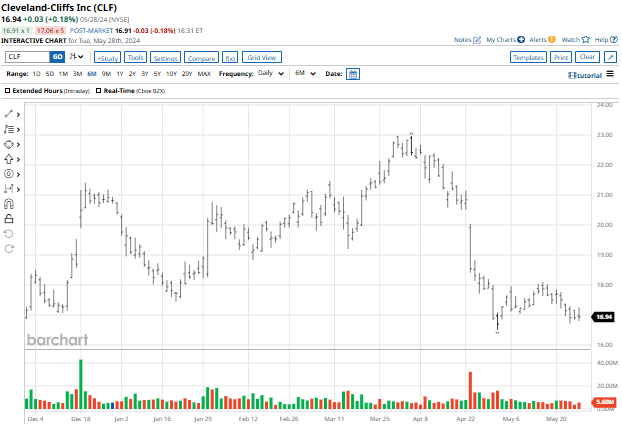

Cleveland-Cliffs Stock Underperforms

Cleveland-Cliffs Inc (CLF) is a flat-rolled steel producer in North America. Its operations can be categorically organized into four segments: Steelmaking, Tubular, Tooling and Stamping, and European Operations. It also produces direct reduced iron (DRI)-grade pellets. Cleveland-Cliffs serves clients from multiple industries, including automotive, distributors and converters, infrastructure and manufacturing, and steel producers.

The company briefly changed its name to Cliffs Natural Resources in 2008 amid a failed takeover bid for Alpha Natural Resources as it moved into the coal industry, but ultimately changed its name back to Cleveland-Cliffs in 2017, reflecting its home base and headquarters in Cleveland, Ohio.

Cleveland-Cliff’s stock has plunged 17% YTD, underperforming the broader market, and now carries a market cap of $8.05 billion.

However, at an EV/sales multiple of 0.56x and EV/EBITDA of 6.98x, the stock looks cheap - both relative to its industry peers, and on a historical basis.

CLF Misses on Q1 Earnings, Eyes Russia Deal

Cleveland-Cliffs reported their first quarter results on April 22, with revenue of $5.2 billion missing estimates by 1.79%, and decreasing marginally from $5.3 billion reported in the same quarter last year. The company also reported adjusted EPS of $0.18 per share, which missed expectations of $0.22. Its steelmaking revenue fell 2% in the quarter, but average net selling price per net ton increased 4.1% YoY to $1,175.

The steel producer company ended the quarter with $30 million cash and cash equivalents, down from $59 million last year and long-term debts decreased 19.6% to $3,664 million.

CLF also announced a $1.5 billion stock buyback program, which CFO Celso Goncalves described as "a much better use of capital than any M&A opportunities at current valuations." Nevertheless, reports on Tuesday suggested that Cliffs was in talks with Russia's Novolipetsk Steel to acquire the firm's U.S. assets at a price tag expected to approach $500 million.

Management provided 2024 guidance for a total steel shipment volume of 16.5 million net tons. It also expects a $30 reduction in per net steel ton unit cost, leading to a $500 million increase in its adjusted EBITDA. Capital expenditure is expected in the range of $675 million-$725 million for the year.

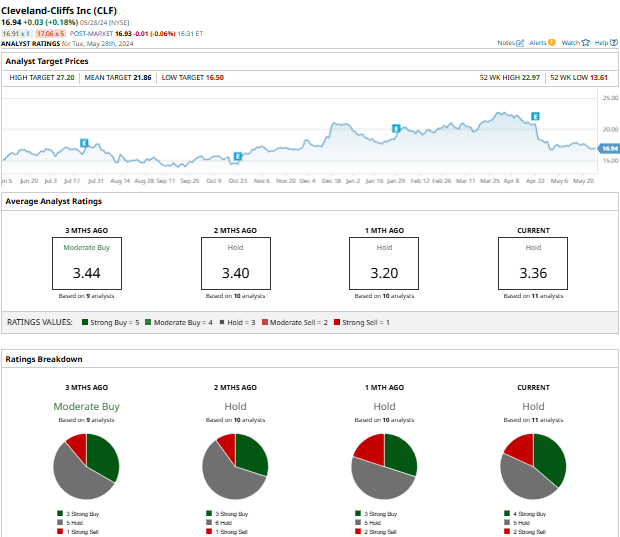

What Do Analysts Say About CLF?

Analysts are fairly neutral on the stock, with a consensus “Hold” rating among the 11 analysts in coverage. Just four have a “Strong Buy” rating, 5 have a “Hold” rating, and 2 have a “Strong Sell” rating on CLF.

The mean price target is $21.86, indicating an upside potential of 29% from current levels.

However, brokerage firm Jefferies just initiated coverage on the steel producer with a “Buy” rating, calling CLF its top pick in the steel industry. According to Jefferies, Cleveland-Cliffs stock is undervalued, and looks well-positioned to benefit from strong near-term demand.

Looking ahead, Jefferies says it expects the company’s EBITDA and free cash flow to decline in 2023 and 2024 before returning to growth in 2025 as it aims to reduce its debt and pension liability. Perhaps anticipating the talks with its Russian counterpart, Jefferies added "we would not rule out strategic M&A for Cliffs."

The firm has a $22 price target for CLF, which is nearly 30% north of current prices.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.