Today a large and unusual volume of Nvidia Inc. (NVDA) call options traded for a four-month out expiration period. This shows the incredible investor bullish sentiment in NVDA stock, given the high price of the calls.

NVDA stock is trading for $1,138.01 per share in midday trading on Wednesday, May 29. That is up almost 20% since its fiscal Q1 2025 earnings were released a week ago on May 22, trading at $949.50.

The large tranche of call options traded today at the $1,050 strike price (i.e., $105.00 post-split) for expiration on Sept. 20, 2024, which is almost 4 months away or 114 days. This can be seen in today's Barchart Unusual Stock Options Activity Report.

Over 29,000 contracts traded today at that strike price at an average price of $173.50 (i.e., $17.35 post-split). This represents over 21 times the prior outstanding number of contracts at that strike price before today's call option volume.

Calls Will Get Cheaper After June 7

Note that after the split goes into effect on June 7, the strike price will be lowered by 10x to $105.00 and the options premium will fall to $17.35 in the midprice. That could effectively make these calls considerably easier to buy and could push their price higher.

For example, to buy 1 call contract now requires spending $173.50 x 100, or $17,350. Post-split, it will only require an investor to spend $1,735.00. In effect, anyone can get the upside on 100 shares for a 10x cheaper price starting on June 7.

Keep in mind, though, that this implies that the intrinsic value of the call options does not go into effect until NVDA stock rises to $105.00+$17.35, or $122.35 per share. That is over 10% higher than today's price of $113.80 (post-split).

However, investors may be thinking that the effect of the stock split could bring in significant interest in these call options. They may not have to actually wait until expiration. They can sell the calls after the stock rises, they presume.

Why NVDA Could Keep Rising

And there is good reason to believe that this could happen. For example, I discussed the upside in NVDA stock in my recent Barchart article on May 24: “Nvidia's Massive FCF Margins Could Make it Worth 45% More at $150 P/Sh Post Split.”

I discussed in that article how NVDA stock could be worth almost $150 per share over the next year (actually $149.52). That is still 31.4% over today's price and would also be 22.2% higher than the $122.35 breakeven price for the calls mentioned above.

I based my target price on a forecast of an average of 53.5% free cash flow (FCF) margin on a next 12-month (NTM) revenue forecast of $137.69 billion. That results in a NTM FCF estimate of $73.66 billion.

Using a 2.00% FCF yield metric results in a market cap estimate for Nvidia of $3,683 billion (i.e., $3.688 trillion). That is 30.7% higher than today's market cap of $2.817 trillion.

In other words, NVDA stock could still be worth almost 31% more, or $149 per share post-split.

Analysts Have Higher Price Targets

Analysts tend to agree with me. For example, AnaChart, a new sell-side analyst tracking service, reports that the average price target of 39 analysts is $1,255.04 (i.e., $125.50 post-split). That is still 10% higher than today's price.

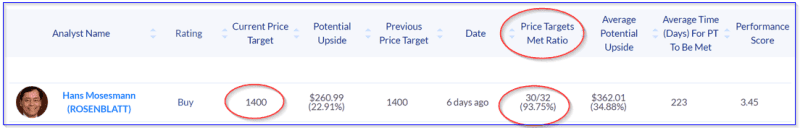

Moreover, one analyst, Hans Mosesmann of Rosenblatt, has a $1,400 ($140 post-split) Buy target price. He has met his price targets 93.75% of the time according to AnaChart, giving him a very high performance score compared to other analysts.

In other words, he believes that there is a good chance that NVDA stock rise from here. Based on his recommendation NVDA stock could reach the $122.35 breakeven price for today's unusual call options trades at the $105.00 strike price for expiration on Sept. 20.

This shows that there is considerable enthusiasm still for NVDA call options trading, especially post-split.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.