Financial giants have made a conspicuous bearish move on Kohl's. Our analysis of options history for Kohl's (NYSE:KSS) revealed 10 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $179,703, and 5 were calls, valued at $161,485.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $22.5 to $30.0 for Kohl's over the last 3 months.

Analyzing Volume & Open Interest

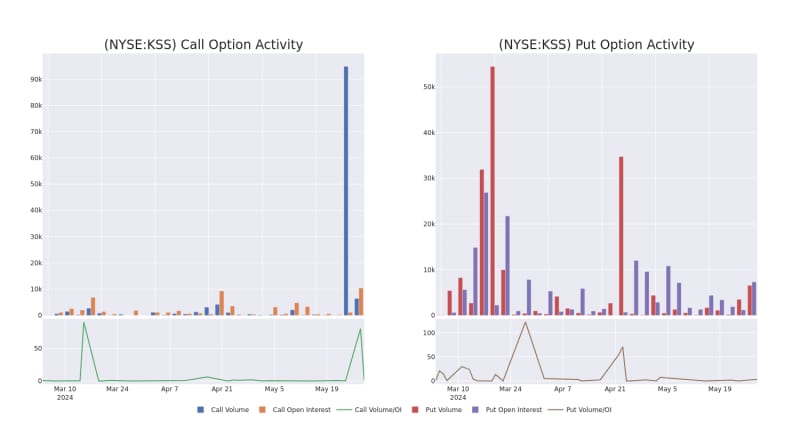

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Kohl's's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Kohl's's significant trades, within a strike price range of $22.5 to $30.0, over the past month.

Kohl's Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

About Kohl's

Kohl's operates about 1,174 department stores in 49 states that sell moderately priced private-label and national brand clothing, shoes, accessories, cosmetics, and home furnishings. Most of these stores are in strip centers. Kohl's also operates a large digital sales business. Women's apparel is Kohl's largest category, having generated 26% of its 2023 sales. The retailer, headquartered in Menomonee Falls, Wisconsin, opened its first department store in 1962.

Current Position of Kohl's

- With a volume of 4,208,720, the price of KSS is up 0.94% at $27.41.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 1 days.

Expert Opinions on Kohl's

In the last month, 2 experts released ratings on this stock with an average target price of $26.5.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on Kohl's with a target price of $25.

- An analyst from Telsey Advisory Group has decided to maintain their Market Perform rating on Kohl's, which currently sits at a price target of $28.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Kohl's options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.