Whales with a lot of money to spend have taken a noticeably bullish stance on Alcoa.

Looking at options history for Alcoa (NYSE:AA) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 57% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $236,500 and 12, calls, for a total amount of $1,484,845.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $45.0 for Alcoa, spanning the last three months.

Insights into Volume & Open Interest

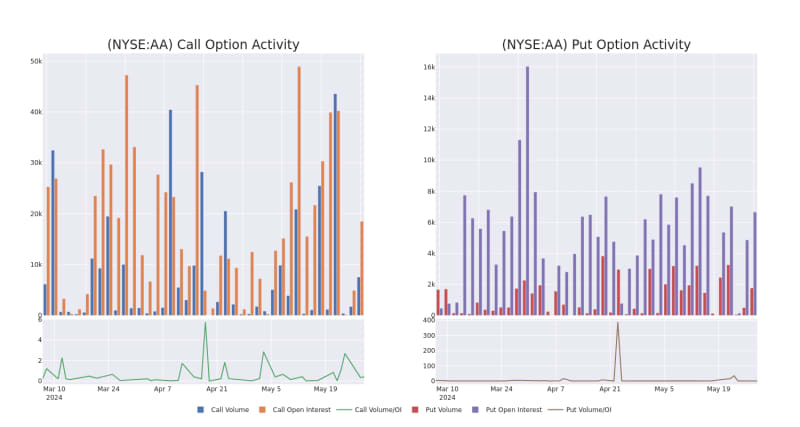

In today's trading context, the average open interest for options of Alcoa stands at 2516.4, with a total volume reaching 9,319.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Alcoa, situated within the strike price corridor from $30.0 to $45.0, throughout the last 30 days.

Alcoa 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

About Alcoa

Alcoa Corp is a vertically integrated aluminum company whose operations include bauxite mining, alumina refining, and the manufacture of primary aluminum. It is a bauxite miner and alumina refiner by production volume, and its profits are closely tied to prevailing commodity prices along the aluminum supply chain. The company segments include Bauxite; Alumina and Aluminum. It generates maximum revenue from the Aluminum segment. Geographically, it derives a majority of its revenue from the United States.

After a thorough review of the options trading surrounding Alcoa, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Alcoa

- With a volume of 3,433,970, the price of AA is up 1.25% at $43.74.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 49 days.

What The Experts Say On Alcoa

In the last month, 1 experts released ratings on this stock with an average target price of $50.0.

- Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Alcoa with a target price of $50.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Alcoa options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.