Deep-pocketed investors have adopted a bullish approach towards Royal Caribbean Gr (NYSE:RCL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RCL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Royal Caribbean Gr. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 62% leaning bullish and 37% bearish. Among these notable options, 3 are puts, totaling $119,870, and 5 are calls, amounting to $226,604.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $190.0 for Royal Caribbean Gr during the past quarter.

Volume & Open Interest Trends

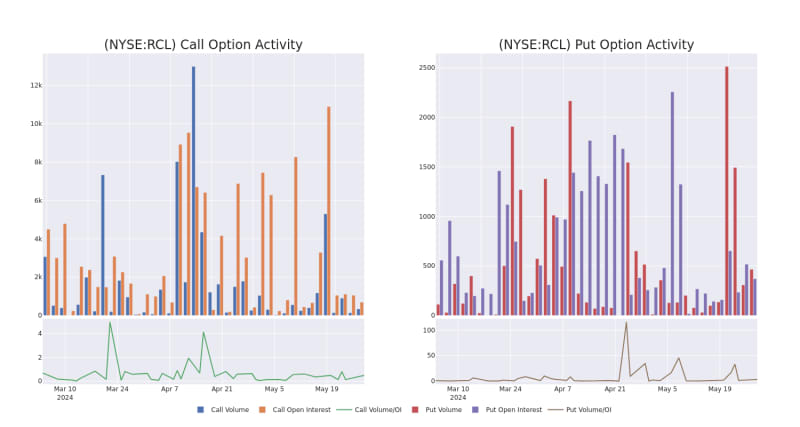

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Royal Caribbean Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Royal Caribbean Gr's substantial trades, within a strike price spectrum from $130.0 to $190.0 over the preceding 30 days.

Royal Caribbean Gr Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

About Royal Caribbean Gr

Royal Caribbean is the world's second-largest cruise company, operating 65 ships across five global and partner brands in the cruise vacation industry, with eight more ships on order. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in the first quarter of 2021.

Following our analysis of the options activities associated with Royal Caribbean Gr, we pivot to a closer look at the company's own performance.

Current Position of Royal Caribbean Gr

- Currently trading with a volume of 844,324, the RCL's price is down by -1.27%, now at $148.22.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 57 days.

What The Experts Say On Royal Caribbean Gr

In the last month, 5 experts released ratings on this stock with an average target price of $165.0.

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Royal Caribbean Gr with a target price of $168.

- Consistent in their evaluation, an analyst from Argus Research keeps a Buy rating on Royal Caribbean Gr with a target price of $172.

- An analyst from B of A Securities has decided to maintain their Neutral rating on Royal Caribbean Gr, which currently sits at a price target of $145.

- An analyst from Truist Securities persists with their Buy rating on Royal Caribbean Gr, maintaining a target price of $175.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Royal Caribbean Gr, targeting a price of $165.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Royal Caribbean Gr, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.