Deep-pocketed investors have adopted a bullish approach towards Super Micro Computer (NASDAQ:SMCI), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SMCI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 234 extraordinary options activities for Super Micro Computer. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 36% leaning bullish and 35% bearish. Among these notable options, 134 are puts, totaling $7,739,809, and 100 are calls, amounting to $6,635,645.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $500.0 to $1220.0 for Super Micro Computer over the recent three months.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Super Micro Computer options trades today is 263.79 with a total volume of 369,184.00.

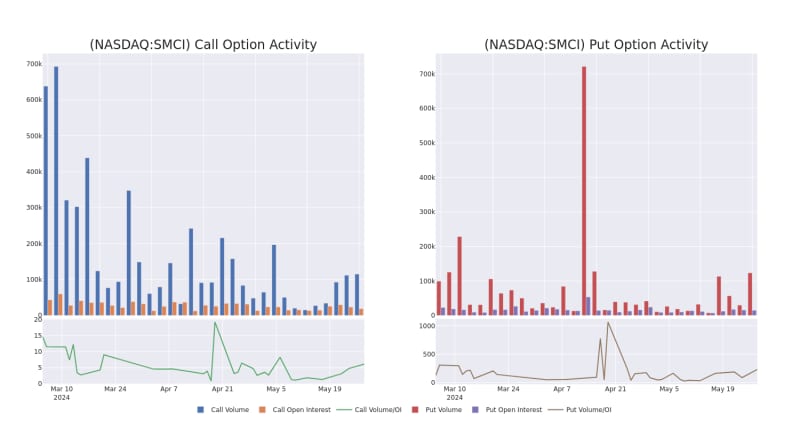

In the following chart, we are able to follow the development of volume and open interest of call and put options for Super Micro Computer's big money trades within a strike price range of $500.0 to $1220.0 over the last 30 days.

Super Micro Computer Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and "Internet of Things" embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

Following our analysis of the options activities associated with Super Micro Computer, we pivot to a closer look at the company's own performance.

Present Market Standing of Super Micro Computer

- With a trading volume of 4,548,630, the price of SMCI is down by -3.73%, reaching $842.07.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 69 days from now.

Expert Opinions on Super Micro Computer

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $947.5.

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Super Micro Computer, targeting a price of $1300.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Neutral rating on Super Micro Computer with a target price of $800.

- An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on Super Micro Computer, which currently sits at a price target of $890.

- Maintaining their stance, an analyst from Wedbush continues to hold a Neutral rating for Super Micro Computer, targeting a price of $800.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Super Micro Computer, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.